Manus founder Xiao Hong is also a Bitcoin holder. God Fish: Once interned at Yibit.

Cobo founder Shen Yu posted this morning that Manus founder Xiao Hong, who was just acquired by Meta, once served as an intern in the Bit1 team led by him and is also a Bitcoin Hodler.

(Background: The AI unicorn Manus suddenly emptied its community and laid off 70%, what is the truth behind its escape to China?)

(Additional background: The popular Chinese AI agency “Manus” received a $75 million investment from Silicon Valley’s Benchmark, with a valuation exceeding $500 million.)

M

eta announced last week the acquisition of generative AI company Manus and invited founder Xiao Hong to serve as the group’s Vice President. Recently, many articles have been discussing how Manus succeeded. This morning, a post from Cobo founder Shen Yu further reveals Xiao Hong’s past experience.

From early Bitcoin intern to Meta executive

Shen Yu revealed that Xiao Hong was an intern in the “Bit1” team led by him while studying at Huazhong University of Science and Technology. At that time, Bit1, along with Barbit and Bitcoin Home, was known as one of the three major portals in China’s Bitcoin industry and was one of the early important sources of cryptocurrency news in the Chinese-speaking world.

He also specifically noted Xiao Hong’s social media account, where he claims to be a BTC Hodler. Additionally, Shen Yu added:

Over ten years, from Bitcoin to AI Agents, times have changed, and the boundaries of companies are blurring: rather than “hiring employees,” it’s more like “recognition vectors”—finding people with ideas, strong execution, and rapid growth, establishing early connections.

Recently, we are preparing to recruit a new batch of talented interns, looking forward to meeting the future “vectors.”

Manus founder Xiao Hong is a BTC Holder, which is not surprising—back in 2013, he was one of the interns we recruited at Huazhong University of Science and Technology, working together on Bit1.

Over ten years, from Bitcoin to AI Agents, times have changed, and the boundaries of companies are blurring: rather than “hiring employees,” it’s more like “recognition vectors”—finding people with ideas, strong execution, and rapid growth, establishing early connections. … pic.twitter.com/QE6HWkFmc6

— DiscusFish (@bitfish) January 7, 2026

Xiao Hong’s Bitcoin address has been uncovered

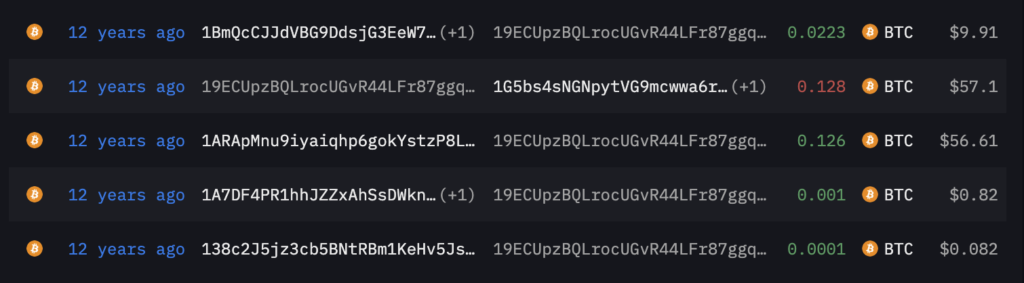

Interestingly, according to Arkham monitoring, they seem to have found Xiao Hong’s Bitcoin address, which currently holds 0.0223 BTC, worth about $2,068.

This address only made 5 transactions 12 years ago, receiving 0.15 BTC (worth $66.5 at the time) and sending out 0.128 BTC. If this is truly all his crypto assets, it shows he has fully committed to the AI field.

Related Articles

Yesterday, the US Bitcoin ETF saw a net inflow of 417 BTC, and the Ethereum ETF experienced a net inflow of 10,536 ETH.

Rising Stablecoin Inflows Hint at Early Accumulation Despite Bitcoin Decline

Data: In the past 24 hours, the total liquidation across the network was $266 million, with long positions liquidated at $143 million and short positions at $123 million.