PEPE To Rally Higher In Q1? This Emerging Bullish Fractal Setup Suggest So!

**Date: **Sat, Jan 03, 2026 | 11:25 AM GMT

As 2026 kicks off, the broader cryptocurrency market is beginning to show renewed stability. Ethereum (ETH) reclaiming the $3,100 level has improved overall market sentiment, and major memecoin picks are once again picking up momentum. Among them, Pepe (PEPE) is starting to stand out.

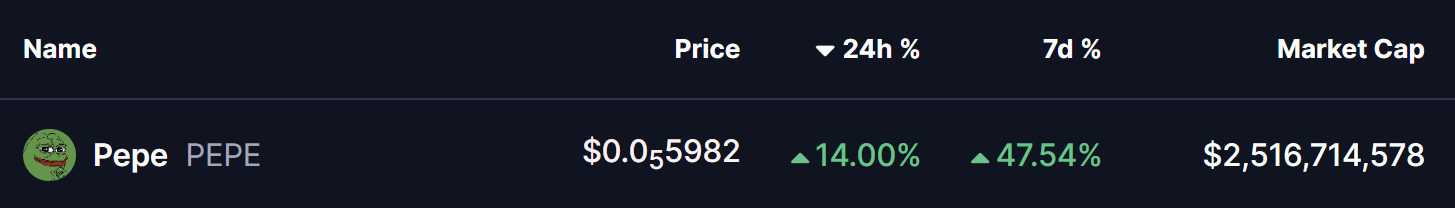

PEPE has surged 14% intraday, extending its weekly gains to around 4%. While the short-term price action is encouraging, the bigger story appears to be unfolding on the charts. A familiar bullish fractal structure is now forming—one that previously preceded a sharp upside move.

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Q1

On the 4-hour timeframe, PEPE’s current price action closely resembles a structure seen in late October 2025, highlighted in the chart comparison. Back then, PEPE spent weeks consolidating in a tight range, building a rounded base below resistance before finally breaking out.

Once that resistance was cleared, price exploded higher, delivering a 127% rally in a relatively short period.

PEPE Fractal Chart/Coinsprobe (Source: Tradingview)

Fast forward to the present, and a similar pattern appears to be playing out again. PEPE recently rebounded from its range lows, pushed back above its short-term support zone, and is now consolidating just below a key horizontal resistance area (marked in yellow on the chart). This consolidation phase mirrors the pre-breakout behavior seen in October, suggesting accumulation rather than distribution.

The fractal alignment between the two periods—structure, consolidation length, and breakout positioning—adds weight to the bullish thesis heading into Q1.

What’s Next for PEPE?

If this bullish fractal continues to play out, PEPE may first see continued consolidation below the $0.0000063 resistance zone. This area has acted as a supply cap in recent sessions, and a clean break above it will be critical for confirming upside continuation.

A successful breakout and hold above $0.0000063 could open the door for a fractal-based rally toward the $0.000014 region, representing a potential 127% upside from the breakout base—similar to the previous October move.

That said, fractal patterns are not guarantees. Market conditions, liquidity, and broader sentiment can always influence outcomes. While the similarities are compelling, traders should closely monitor price behavior, volume expansion, and follow-through above resistance before expecting a full replay of the prior rally.

Final Thoughts

PEPE is entering Q1 with improving momentum, supportive market conditions, and a technically interesting setup. The emerging bullish fractal on the 4-hour chart suggests that the memecoin could be gearing up for another strong move—provided key resistance levels are cleared convincingly.

For now, the $0.0000063 zone remains the level to watch. How PEPE reacts around this area will likely determine whether this fractal evolves into a full-fledged Q1 rally or remains a failed repetition.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

PEPE Price Ready to Rebound: These Critical Levels Decide the Next Move

5 Altcoins Poised for 1000x Gains in ALTSEASON 2026 — Are You Ready to Take the Risk?

PEPE Holds Near $0.054 as Market Cap Stays Steady Around $1.72B

PEPE Holds $0.0549 Support as Price Grinds Higher Within Tight $0.0551 Range

PEPE crashes 66% bottom signal! RSI drops below 30, is it time to buy the dip in meme coins?