Mr.Block58

Which school of thought do you belong to

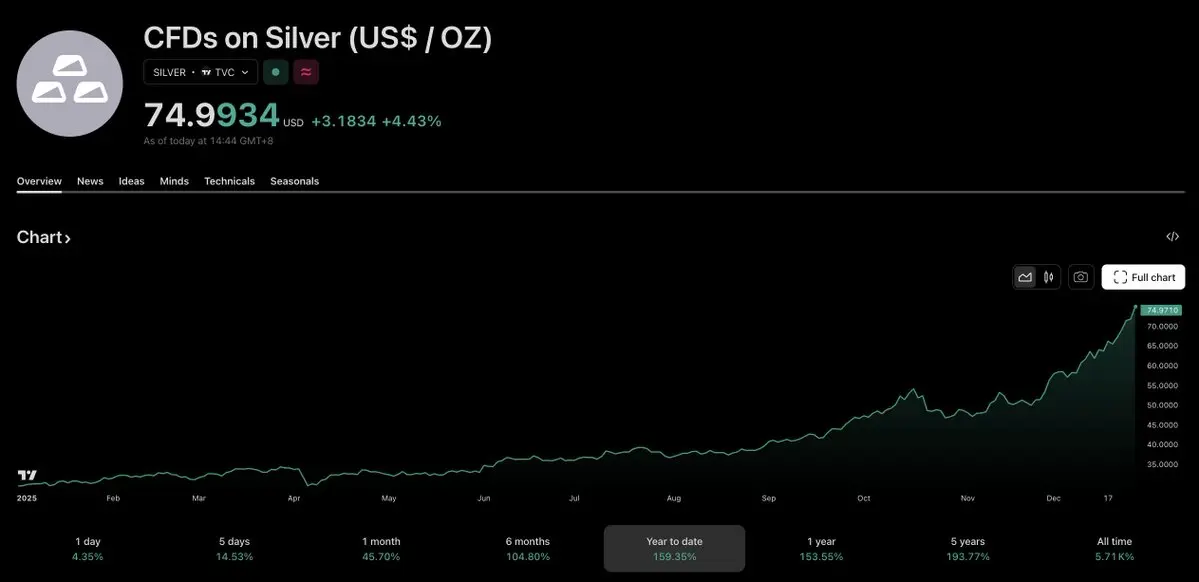

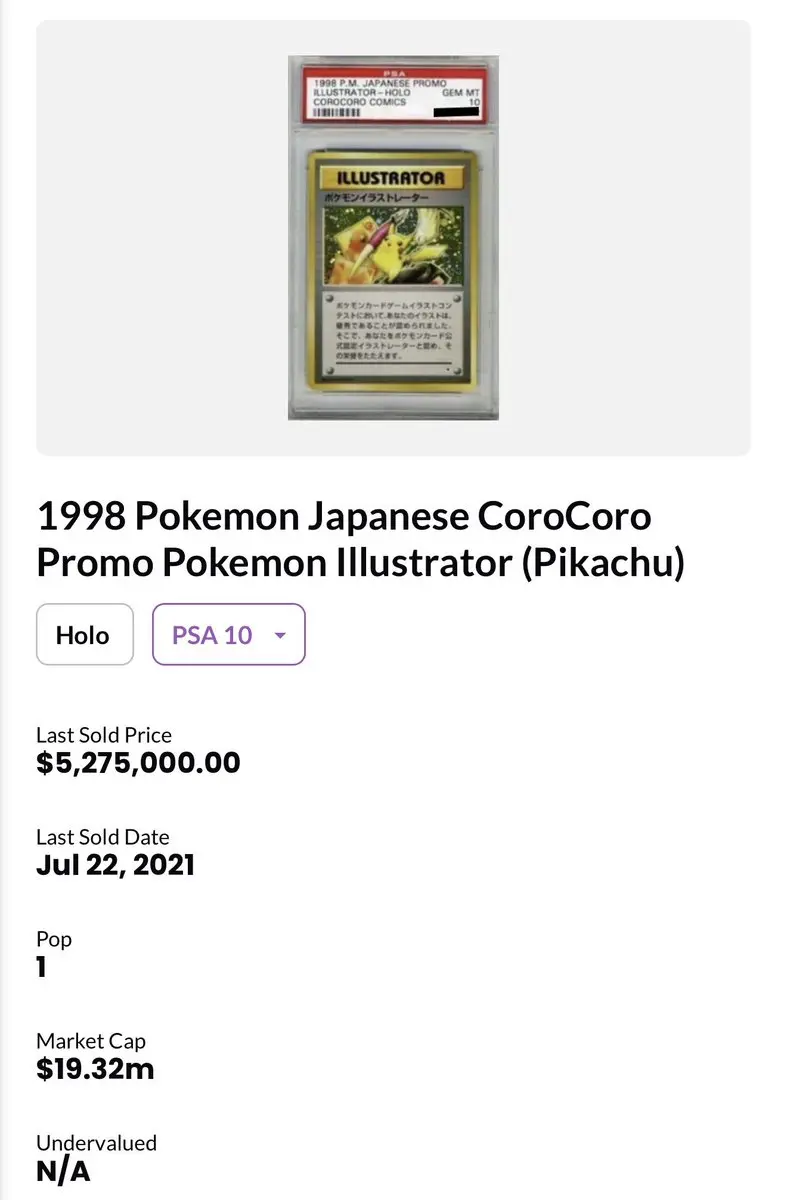

• Some rely on long-term narratives and fundamentals

• Some rely on cycles and macroeconomics

• Some rely on technical analysis and trading discipline

• Some rely on information asymmetry and primary markets

• Some rely on liquidity, farming, points, and airdrops

• Some rely on VC/angel investments

• Some keep launching new projects

• Others only engage in high-risk gambling and emotional trading

Additionally,

Sometimes the biggest losses come from "confusion of schools of thought"

The most common mistake is not misjudging the market,

but:

- Using long-

View Original• Some rely on long-term narratives and fundamentals

• Some rely on cycles and macroeconomics

• Some rely on technical analysis and trading discipline

• Some rely on information asymmetry and primary markets

• Some rely on liquidity, farming, points, and airdrops

• Some rely on VC/angel investments

• Some keep launching new projects

• Others only engage in high-risk gambling and emotional trading

Additionally,

Sometimes the biggest losses come from "confusion of schools of thought"

The most common mistake is not misjudging the market,

but:

- Using long-