#ETHTrendWatch #ETHTrendWatch | Ethereum in 2026: From Smart Contracts to Global Financial Infrastructure

As we move deeper into 2026, Ethereum is no longer just a blockchain — it is evolving into a foundational layer of the digital economy.

What once powered simple smart contracts now supports decentralized finance, tokenized real-world assets, AI-driven protocols, and institutional-grade settlement systems. ETH is quietly transforming from a speculative asset into core financial infrastructure.

And markets are beginning to price that reality.

🌐 Ethereum’s Structural Shift in 2026

Ethereum today sits at the center of Web3 innovation.

Key trends shaping ETH’s future include:

• Rapid growth of Layer-2 ecosystems reducing transaction costs and increasing throughput

• Expansion of tokenized assets (bonds, equities, commodities, real estate) on Ethereum rails

• Institutional adoption through ETFs, custody platforms, and compliant DeFi gateways

• Rising staking participation, tightening liquid supply

• Increasing demand from AI, gaming, and on-chain identity applications

Together, these forces are redefining ETH from a “crypto asset” into a productive digital commodity.

🔥 Supply Dynamics: The Quiet Bullish Engine

Ethereum’s post-merge economics continue to mature.

With EIP-1559 burning transaction fees and staking locking up large portions of circulating ETH, supply pressure is gradually tightening. During periods of high network activity, Ethereum effectively becomes deflationary — a powerful long-term tailwind.

Looking ahead, analysts expect:

Reduced exchange balances

Growing validator participation

Increased ETH held in DeFi protocols

Long-term accumulation by institutions

This creates a structural scarcity narrative unlike anything seen in previous cycles.

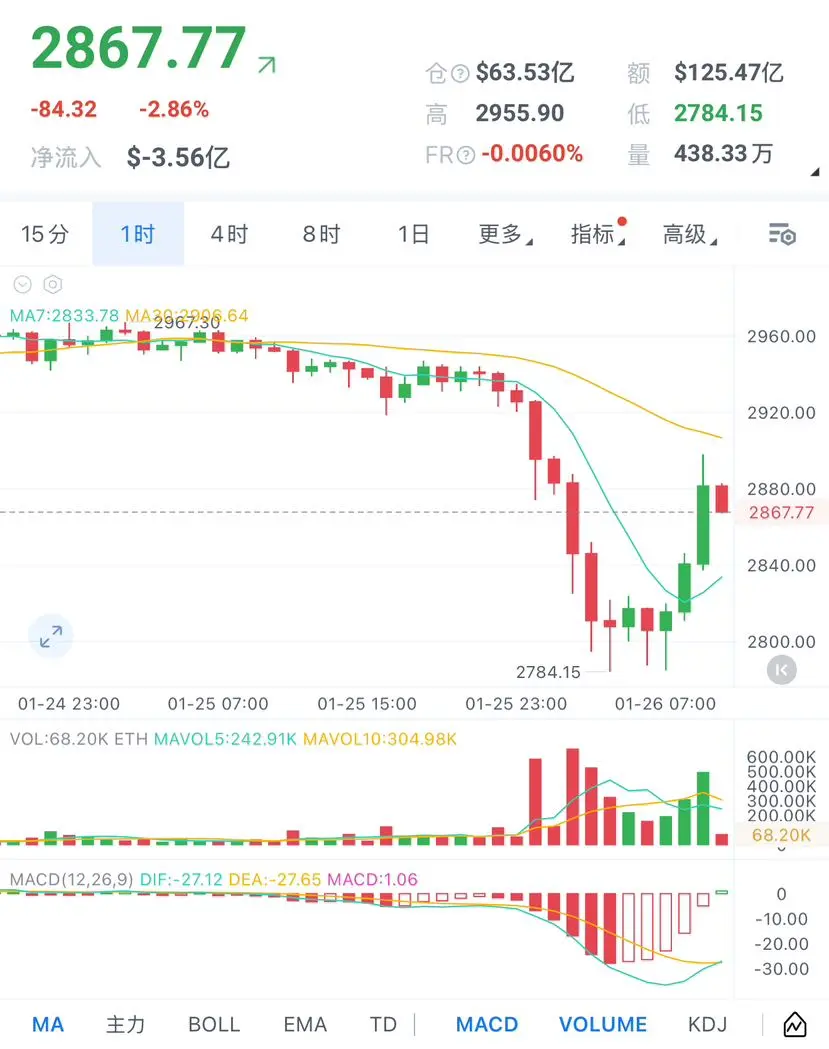

📈 Market Positioning: ETH Meets Macro

Ethereum is no longer isolated from global markets.

In 2026, ETH trades alongside:

• Fed policy expectations

• Liquidity cycles

• Tech equity sentiment

• ETF inflows

• Risk-on / risk-off dynamics

As traditional capital enters crypto through regulated products, ETH increasingly behaves like a hybrid asset — part technology, part commodity, part monetary network.

This integration changes volatility patterns and strengthens Ethereum’s role in diversified portfolios.

🏦 Institutional Momentum Builds

Wall Street’s relationship with Ethereum is deepening.

Banks are experimenting with on-chain settlement. Asset managers are allocating to ETH-based products. Corporations are exploring Ethereum for treasury management and tokenized finance.

This institutional layer brings:

• Higher liquidity

• Greater regulatory clarity

• Longer holding horizons

• Reduced dependency on retail speculation

Ethereum is becoming a serious macro asset.

🧠 Beyond Price: The Ethereum Economy

Price action tells only part of the story.

Ethereum’s real growth is happening beneath the surface:

• DeFi protocols managing billions in value

• NFTs evolving into digital IP and licensing tools

• DAOs governing real capital

• Layer-2s onboarding millions of users

• Developers building composable financial products

This is an economy not just a network.

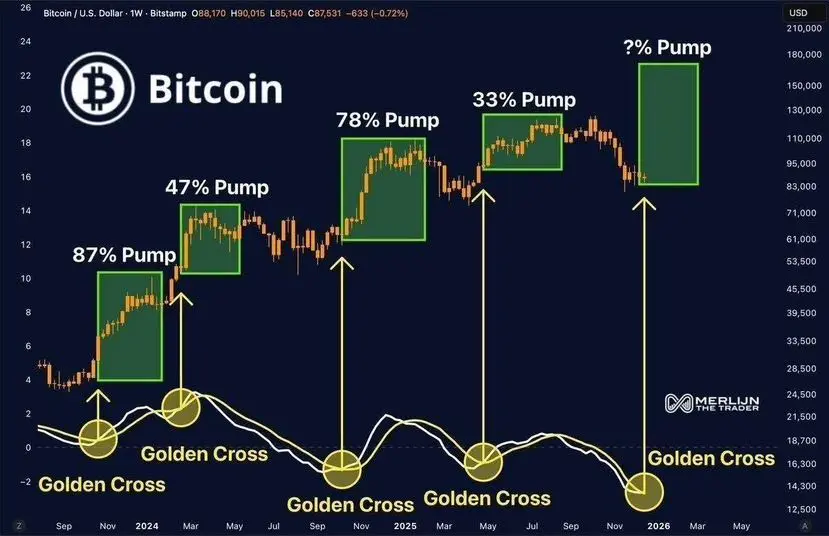

🔮 2026–2027 Outlook

Forward-looking scenarios for ETH include:

• Increased correlation with Nasdaq tech stocks

• Strong performance during liquidity expansions

• Rising dominance in real-world asset tokenization

• Continued Layer-2 adoption driving user growth

• ETH staking yields becoming a core income strategy

If macro conditions stabilize and risk appetite returns, Ethereum could lead the next digital asset expansion phase.

🚀 Final Thought

#ETHTrendWatch is no longer about short-term charts.

It’s about Ethereum’s role in the future of finance.

From programmable money to decentralized infrastructure, ETH is building a parallel financial system one block at a time.

In 2026, Ethereum isn’t chasing relevance.

It’s defining it.

$ETH $BTC

#Ethereum2026

As we move deeper into 2026, Ethereum is no longer just a blockchain — it is evolving into a foundational layer of the digital economy.

What once powered simple smart contracts now supports decentralized finance, tokenized real-world assets, AI-driven protocols, and institutional-grade settlement systems. ETH is quietly transforming from a speculative asset into core financial infrastructure.

And markets are beginning to price that reality.

🌐 Ethereum’s Structural Shift in 2026

Ethereum today sits at the center of Web3 innovation.

Key trends shaping ETH’s future include:

• Rapid growth of Layer-2 ecosystems reducing transaction costs and increasing throughput

• Expansion of tokenized assets (bonds, equities, commodities, real estate) on Ethereum rails

• Institutional adoption through ETFs, custody platforms, and compliant DeFi gateways

• Rising staking participation, tightening liquid supply

• Increasing demand from AI, gaming, and on-chain identity applications

Together, these forces are redefining ETH from a “crypto asset” into a productive digital commodity.

🔥 Supply Dynamics: The Quiet Bullish Engine

Ethereum’s post-merge economics continue to mature.

With EIP-1559 burning transaction fees and staking locking up large portions of circulating ETH, supply pressure is gradually tightening. During periods of high network activity, Ethereum effectively becomes deflationary — a powerful long-term tailwind.

Looking ahead, analysts expect:

Reduced exchange balances

Growing validator participation

Increased ETH held in DeFi protocols

Long-term accumulation by institutions

This creates a structural scarcity narrative unlike anything seen in previous cycles.

📈 Market Positioning: ETH Meets Macro

Ethereum is no longer isolated from global markets.

In 2026, ETH trades alongside:

• Fed policy expectations

• Liquidity cycles

• Tech equity sentiment

• ETF inflows

• Risk-on / risk-off dynamics

As traditional capital enters crypto through regulated products, ETH increasingly behaves like a hybrid asset — part technology, part commodity, part monetary network.

This integration changes volatility patterns and strengthens Ethereum’s role in diversified portfolios.

🏦 Institutional Momentum Builds

Wall Street’s relationship with Ethereum is deepening.

Banks are experimenting with on-chain settlement. Asset managers are allocating to ETH-based products. Corporations are exploring Ethereum for treasury management and tokenized finance.

This institutional layer brings:

• Higher liquidity

• Greater regulatory clarity

• Longer holding horizons

• Reduced dependency on retail speculation

Ethereum is becoming a serious macro asset.

🧠 Beyond Price: The Ethereum Economy

Price action tells only part of the story.

Ethereum’s real growth is happening beneath the surface:

• DeFi protocols managing billions in value

• NFTs evolving into digital IP and licensing tools

• DAOs governing real capital

• Layer-2s onboarding millions of users

• Developers building composable financial products

This is an economy not just a network.

🔮 2026–2027 Outlook

Forward-looking scenarios for ETH include:

• Increased correlation with Nasdaq tech stocks

• Strong performance during liquidity expansions

• Rising dominance in real-world asset tokenization

• Continued Layer-2 adoption driving user growth

• ETH staking yields becoming a core income strategy

If macro conditions stabilize and risk appetite returns, Ethereum could lead the next digital asset expansion phase.

🚀 Final Thought

#ETHTrendWatch is no longer about short-term charts.

It’s about Ethereum’s role in the future of finance.

From programmable money to decentralized infrastructure, ETH is building a parallel financial system one block at a time.

In 2026, Ethereum isn’t chasing relevance.

It’s defining it.

$ETH $BTC

#Ethereum2026