USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

CryptoDaily·4h ago

Circle Drives USDC Expansion as Enterprise Platforms Shift From Trading to Real-World Usage

Circle Internet Financial is scaling USDC by embedding the dollar-backed stablecoin into real-world payments, treasury, and software platforms worldwide, accelerating enterprise adoption and positioning digital dollars as core financial infrastructure.

Circle Expands USDC Through Global

Coinpedia·15h ago

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

CryptoDaily·12-19 18:05

Are virtual currencies and stablecoins in Taiwan taxable? Finance Minister: We'll wait for the Financial Supervisory Commission's classification before commenting.

The controversy over whether virtual currencies and stablecoins in Taiwan should be taxed resurfaced on December 17 at the Legislative Yuan. Minister of Finance Chuang Cui-yun responded to legislator Lai Shih-bao's inquiry, stating that the Financial Supervisory Commission's regulations related to virtual assets are currently under review. We must wait for the relevant laws to be enacted to determine whether virtual currencies are classified as payment tools or securities, which will then determine the appropriate taxation method. Lai Shih-bao stated that virtual currency trading volume is significant, and the Ministry of Finance should actively consider taxation.

MarketWhisper·12-19 06:56

Intuit partners with Circle to bring USDC into TurboTax and QuickBooks

Intuit has partnered with Circle to integrate USDC stablecoin across its product ecosystem, enhancing financial services like tax payments. This collaboration aims to provide faster, cost-effective transactions but details about the blockchain implementation will be revealed in 2026.

TapChiBitcoin·12-19 00:33

Intuit to Integrate USDC Stablecoin Across TurboTax, QuickBooks

Intuit has partnered with Circle for a multi-year agreement to integrate USDC into its products, enhancing tax refunds and payments. The blockchain for USDC settlement is not yet disclosed.

Decrypt·12-18 19:03

How USDC and USDT Affect Crypto Casino Bankroll Stability

If you’ve ever opened your wallet before a casino session and thought, “Wait, why is my bankroll up or down already?”, you’re not alone. That little moment of confusion usually isn’t about your gameplay at all, it’s about your coin.

Stablecoins are becoming the antidote to that noise, and the

CryptoNinjas·12-18 15:42

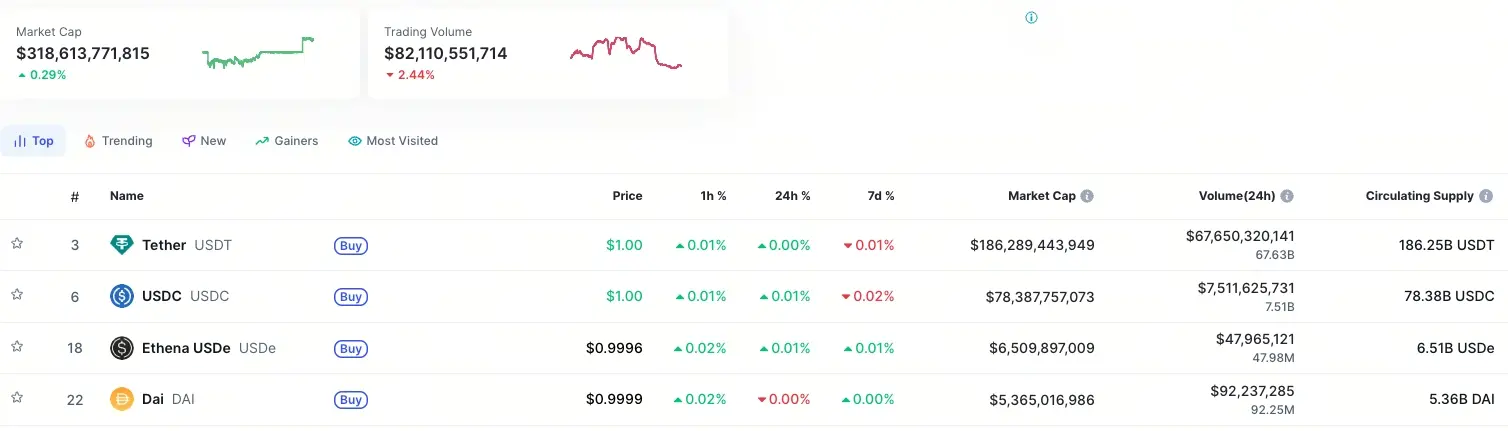

Visa partners with Circle and Solana to provide USDC settlement services to US banks

Global payments giant Visa announced on Tuesday the official launch of stablecoin settlement services in the United States, symbolizing that traditional financial institutions' interest in blockchain payment channels has shifted from "wait-and-see" to "practical application."

According to Visa's statement, this service allows U.S. financial institutions to use the USD stablecoin USDC issued by Circle for backend cash flow and clearing operations on the Solana blockchain. The initial participating banks include Cross River Bank, known for its fintech services, and Lead Bank, which has received investment from well-known venture capital firm a16z.

Visa also announced that this service will continue to expand in scale through 2026. Rubail Birwadker, Head of Global Growth Products and Strategic Partnerships at Visa, stated:

> The reason Visa is expanding its stablecoin settlement business is because

SOL-0.67%

区块客·12-18 05:54

Visa Launches USDC Settlement on Solana for U.S. Banks – Bridging Traditional Finance and Blockchain

Visa announced the rollout of a new service enabling select U.S. banks to settle VisaNet payments directly in USDC stablecoin on the Solana blockchain.

CryptopulseElite·12-18 05:45

Visa Opens USDC Stablecoin Settlement: Traditional Payment Giants Embrace the New Era of the U.S. "Digital Dollar"

Global payments giant Visa announced on December 17th that it will open its network’s stablecoin settlement capabilities to US financial institutions, allowing transactions and settlements using USDC issued by Circle via the Solana blockchain. This move marks the first time stablecoins have achieved full commercial application within the mainstream banking system in the United States, representing a key market breakthrough following the signing of the federal stablecoin framework by the Trump administration in July 2025, which provided a clear regulatory pathway. Cross River Bank and Lead Bank have become the first institutions to adopt this service. Although Visa’s network annualized stablecoin settlement volume has exceeded $3.5 billion, compared to the $17 trillion in total transactions processed last year, this emerging business line has enormous potential, indicating that the integration of traditional finance and crypto assets is accelerating rapidly.

MarketWhisper·12-18 03:16

A Brief Discussion on Visa Supporting Stablecoin Settlement

Visa recently announced support for the stablecoin USDC for settlement, meaning that card issuers and merchants can directly settle payments using stablecoins. This change marks an acceleration in the trend of stablecoins being accepted as real currency, although it is currently only available to some partners.

金色财经_·12-18 02:45

Visa partners with U.S. banks to enable USDC settlement! A seven-day window revolutionizes traditional payments

Visa announces that US banks issuing cards and acquiring banks can now settle VisaNet debts using Circle's USDC stablecoin, marking the first time this functionality has been implemented in the United States. Cross River Bank and Lead Bank become the first US banks to settle with Visa using USDC via the Solana blockchain. This service extends the traditional five-business-day settlement cycle to a seven-day window.

MarketWhisper·12-18 01:40

The on-chain game of the payment giants: The battle for the $40 trillion settlement layer

The payments industry may seem "old," but it has always been the earliest and most easily restructured part of the financial system through technology.

While the market is still debating whether "cryptocurrency is an asset," two major payment giants—Visa and Mastercard—have reached a consensus on a more fundamental engineering issue: Is there a more efficient settlement layer that can be embedded into the existing payment system instead of starting from scratch?

The answer is stablecoins.

Recently, Visa announced the opening of USDC settlement to banks in the United States via Solana; previously, Mastercard partnered with Ripple to test RLUSD-based transaction settlement on XRPL.

This is not just a short-term pilot but a clear signal that the global payment infrastructure is beginning to migrate toward a new generation of settlement layers.

Visa: Making stablecoins into a "settlement"

金色财经_·12-17 13:57

The Bank of Canada drops a bombshell! Stablecoin reserves must be 100% backed by government bonds to pass the test

Bank of Canada Governor Tiff Macklem throws a bombshell at the Montreal Chamber of Commerce: any stablecoin in circulation in Canada must be pegged 1:1 to the central bank's currency, fully backed by high-quality liquid assets such as treasury bills and government bonds, and must offer a zero-fee, instant redemption mechanism. This standard far exceeds the practical operations of current mainstream stablecoins like USDT and USDC, indicating that Canada is building the world's most stringent stablecoin firewall.

MarketWhisper·12-17 06:47

Visa launches USDC stablecoin settlement in the United States, with two banks cooperating to break the weekend vacuum.

Under the protection of the GENIUS Act, Visa has officially introduced USDC settlement into the US banking system, breaking the weekend liquidity gap. Stablecoin settlements worth $3.5 billion annually can now directly run on Solana.

(Background: a16z's major crypto report: 2025, the Year of Institutional Explosion, Stablecoin Trading Volume Rivaling Visa, Saying Goodbye to Adolescence and Entering Adulthood)

(Additional context: What will the world look like when Visa and Mastercard fully adopt stablecoin payments?)

Table of Contents

On-chain settlement breaks weekend vacuum

From payment network to validator

The next step for banks

Payment giant Visa announced yesterday that USDC stablecoin settlement services are now officially live in the US. The first partner bank is Cross River

動區BlockTempo·12-17 03:45

RedotPay raises another $107 million in Series B funding, bringing a "giant" player to the stablecoin payment track

Hong Kong-based fintech company RedotPay recently announced the completion of a $107 million Series B funding round, led by Goodwater Capital, with top institutions such as Pantera Capital, Blockchain Capital, and Circle Ventures participating. This massive investment, just three months after its previous $47 million funding round, highlights strong investor confidence in the prospects of stablecoin payment solutions. The company disclosed that its annualized payment processing volume has exceeded $10 billion, with over 6 million global users, and it has already achieved profitability, accelerating its move towards global payment infrastructure.

MarketWhisper·12-17 01:36

RedotPay raises $107 million in funding! Annualized trading of $10 billion in stablecoin payments explodes

Hong Kong-based fintech company RedotPay has completed a $107 million Series B funding round led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, and others. RedotPay reports an annualized payment volume exceeding $10 billion, annualized revenue surpassing $150 million, and profitable operations.

MarketWhisper·12-17 01:01

Visa Begins US Stablecoin Settlement via USDC on Solana

In brief

Visa will allow partnered issuers and acquirers in the U.S. to settle with stablecoins, starting with USDC on Solana.

The expansion follows its global pilots that began rolling out in 2023.

Its monthly stablecoin volumes have eclipsed a $3.5 billion annual run rate.

Decrypt's

Decrypt·12-16 16:15

Visa Taps Circle’s USDC to Offer Stablecoin Settlement to US Banks

Visa has expanded its stablecoin settlement to the United States, allowing banks and fintechs to transact using the USDC token.

The card payment giant announced Tuesday that issuers and acquirer partners can now leverage stablecoins to settle transactions using Circle’s stablecoin USDC. The move co

TheCryptoBasic·12-16 14:22

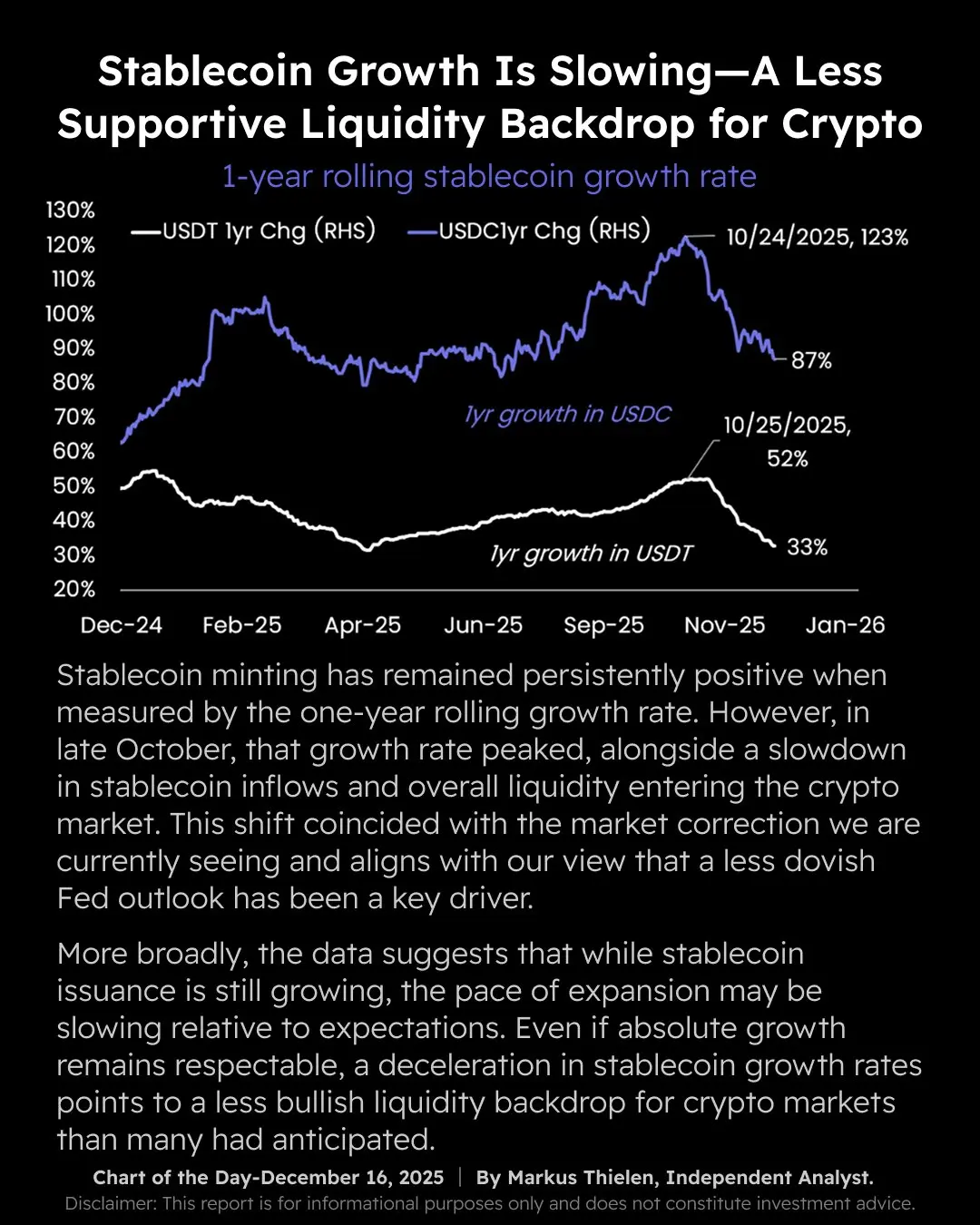

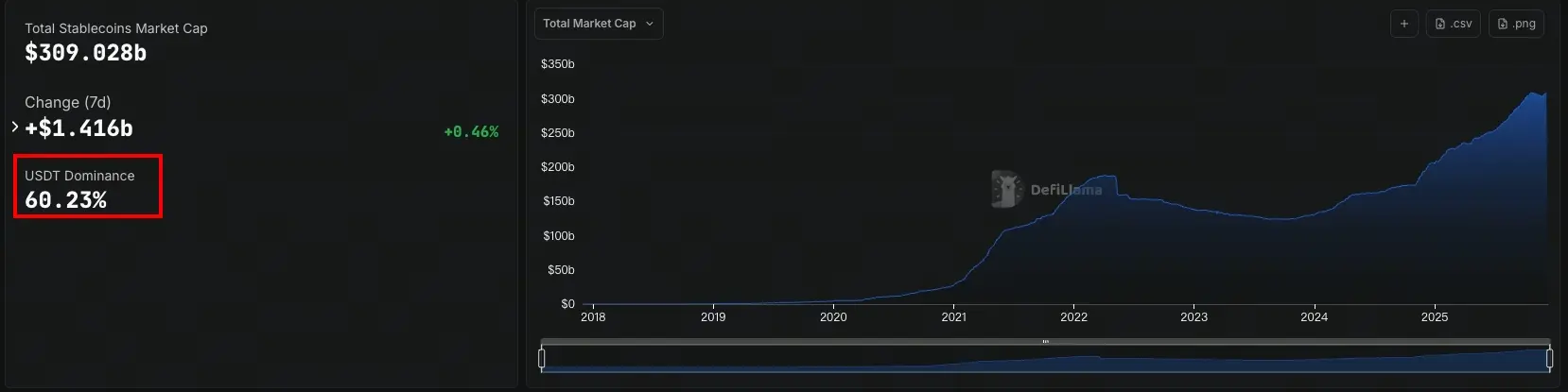

Matrixport: $260 Billion Stablecoins Turn Dead Water, Crypto Liquidity Exhausted

Matrixport's latest report reveals a fatal paradox in the crypto market: the total supply of stablecoins has surpassed $260 billion, reaching a record high. However, the inflow of new funds has peaked and slowed down, causing Bitcoin to lose a key moving average and drop below $86,000. The core issue lies in the Federal Reserve's cautious stance on interest rate cuts, which suppresses risk appetite, turning the massive stablecoin reserves into "dead weight" rather than market-driving fuel.

MarketWhisper·12-16 08:06

What Is Circle's Acquisition of Interop Labs? Boosting Cross-Chain Interoperability for USDC and Arc in 2026

Circle—the issuer of the USDC stablecoin—announced a signed agreement to acquire the team and proprietary intellectual property of Interop Labs, a key contributor to the Axelar cross-chain protocol.

CryptopulseElite·12-16 06:44

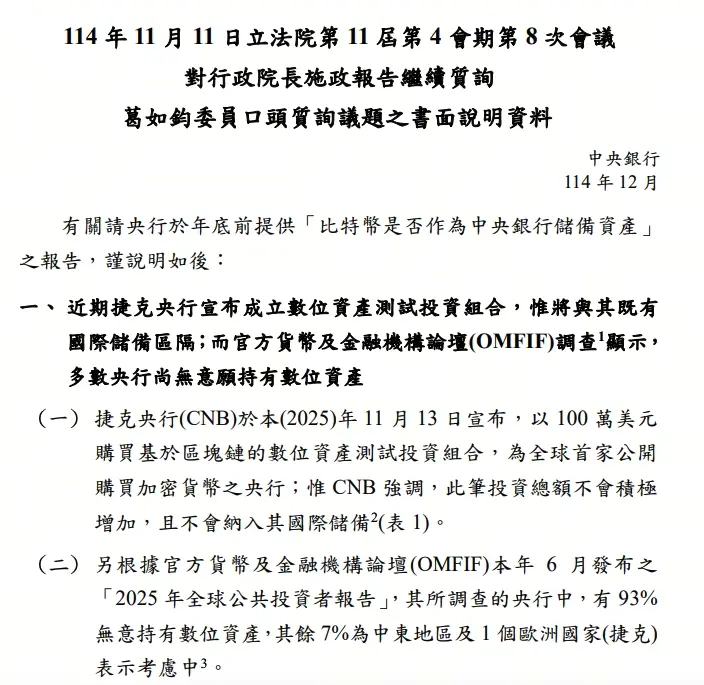

Will Taiwan include Bitcoin in its strategic reserve assets? The central bank provides the final answer......

Taiwan's Central Bank responded to legislator Ge Rujun's inquiry about whether Bitcoin should be used as a central bank reserve asset by officially submitting a written assessment document. The conclusion is clear: Bitcoin is not suitable as a central bank reserve asset. The Taiwan Central Bank pointed out four core risks associated with Bitcoin: extreme price volatility, liquidity risk, cybersecurity custody risk, and an immature regulatory framework. These risks do not meet the three main principles of reserve assets: "safety, liquidity, and profitability."

MarketWhisper·12-16 06:15

Nasdaq applies to the SEC for the 5×23 trading new system; the fastest "no closing" US stock market to be implemented in the second half of 2026

Nasdaq applies to the SEC for a 5×23 trading plan. If approved, US stocks could trade 23 hours daily as early as the second half of 2026.

(Background: Interactive Brokers opens "stablecoin deposits," allowing USDC to be deposited into brokerage accounts)

(Additional context: Interactive Brokers plans to issue a US dollar stablecoin: the technical foundation is ready, and a revolution in brokerage settlement is coming?)

Nasdaq submitted the 5×23 plan to the U.S. Securities and Exchange Commission (SEC) on the 15th, requesting a review of the "5×23" system. If approved, starting from the second half of 2026, US stocks will be tradable for 23 hours a day, only during the day

動區BlockTempo·12-16 02:15

Interactive Brokers connects "Stablecoin Deposit": Why is the Wall Street giant breaking down the "Payment Berlin Wall" at this time?

Author: BlockWeeks

Between the crypto market and traditional financial markets (TradFi), there has long been an invisible wall: the friction costs of fiat channels.

Recently, the globally renowned electronic broker Interactive Brokers (IBKR) announced a milestone update: officially supporting clients to deposit funds using stablecoins (mainly USDC) for trading stocks, futures, and forex, among other traditional assets.

If not examined carefully, this might seem like a simple payment feature update. But in the eyes of observers well-versed in financial infrastructure transformation, this is a substantial acknowledgment by Wall Street’s top broker of the “on-chain settlement network.” When the US Dollar becomes USDC, and SWIFT becomes the

ETH-0.3%

PANews·12-16 02:08

Yen stablecoin 2026 is here! SBI Holdings is rushing into the trillion-yen cross-border settlement market

Japanese financial group SBI Holdings and Web3 infrastructure company Startale Group have signed a memorandum of understanding, planning to issue a regulated Japanese yen stablecoin through Shinsei Trust, with the goal of launching in Q2 2026. SBI Holdings CEO Yoshitaka Kitao stated that this move will lay the foundation for Japan's transition to a token economy.

MarketWhisper·12-16 01:34

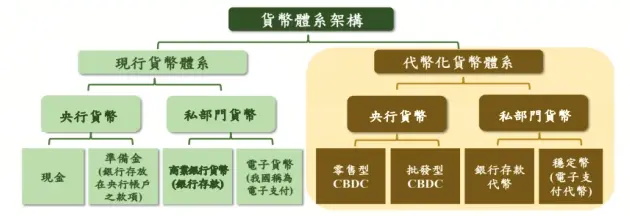

New Taiwan Dollar Stablecoin to Launch in 2026! Financial Experts Warn of Currency Sovereignty Defense Battle

Taiwan FinTech Association Director Wen Hongjun warns that USDT and USDC stablecoins account for about 99% of the global market share. If Taiwan does not issue a new Taiwan dollar stablecoin soon, it could be marginalized in emerging digital financial infrastructure. This is not just a payment issue, but a competition surrounding monetary sovereignty and control over financial ledgers. The Financial Supervisory Commission states that if virtual asset legislation and related regulations are passed quickly, Taiwan's issued stablecoin could be launched as early as the second half of 2026.

MarketWhisper·12-15 07:27

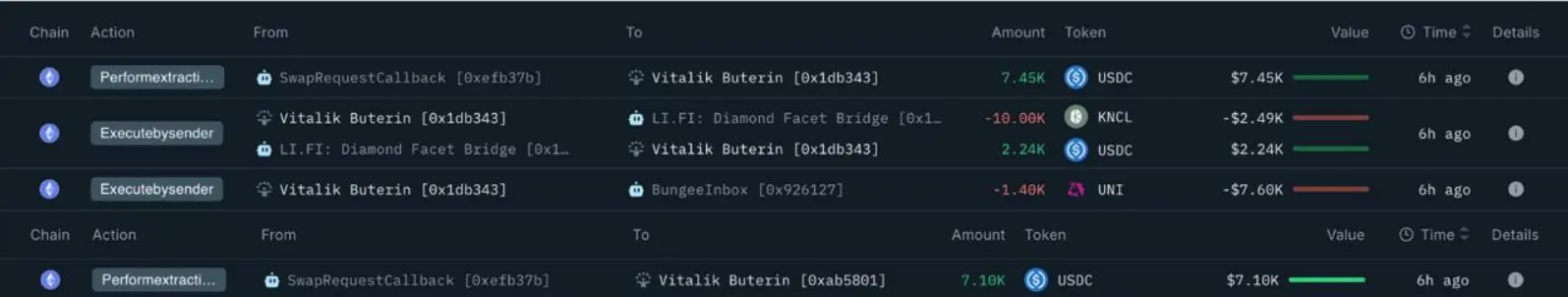

Vitalik Buterin sells UNI, KNC, and DINU, earns nearly 17,000 USDC

Vitalik Buterin, co-founder of Ethereum, recently sold various digital assets, including 1,400 UNI and 40 trillion DINU tokens, totaling 16,796 USDC. Despite their modest value, these transactions drew attention due to Buterin's influence in the crypto market, highlighting portfolio rebalancing rather than market trend signals.

TapChiBitcoin·12-15 04:51

Interactive Brokers officially launches "stablecoin deposits," allowing USDC to be instantly credited to stock accounts

Major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins. Funds can arrive in the account within seconds, enabling 24/7 real-time deposits.

(Background: YouTube has enabled stablecoin payments, allowing US creators to receive PYUSD as revenue)

(Additional context: Interactive Brokers plans to issue a US dollar stablecoin: the technical foundation is ready, is the broker's settlement revolution coming?)

According to Bloomberg today (12), the major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins, with funds arriving within minutes.

PYUSD0.11%

動區BlockTempo·12-12 16:00

The most commonly used overseas brokerage for Taiwanese investors in US stocks: Interactive Brokers (Interactive Brokers) now accepts stablecoin deposits

Interactive Brokers, the most frequently used US stock overseas broker by Taiwanese people, has recently opened the door for retail investors to deposit using stablecoins. According to a video released by the service provider, deposits can be made via USDC on three blockchains: Base, Solana, and Ethereum, reducing deposit costs, offering 24/7 service year-round, and enabling instant fund transfers. However, currently only US investors are allowed to use stablecoins, with Interactive Brokers stating that access will be gradually expanded.

Interactive Brokers Opens Stablecoin Deposit for US Retail Investors

Bloomberg reports that giant US broker Interactive Brokers has permitted retail investors to deposit using stablecoins. Interactive Brokers is a platform used by many overseas individuals to trade US stocks. For example, Taiwanese traders usually trade US stocks through overseas brokers or via omnibus accounts. Among overseas brokers, the most prominent are

ChainNewsAbmedia·12-12 15:55

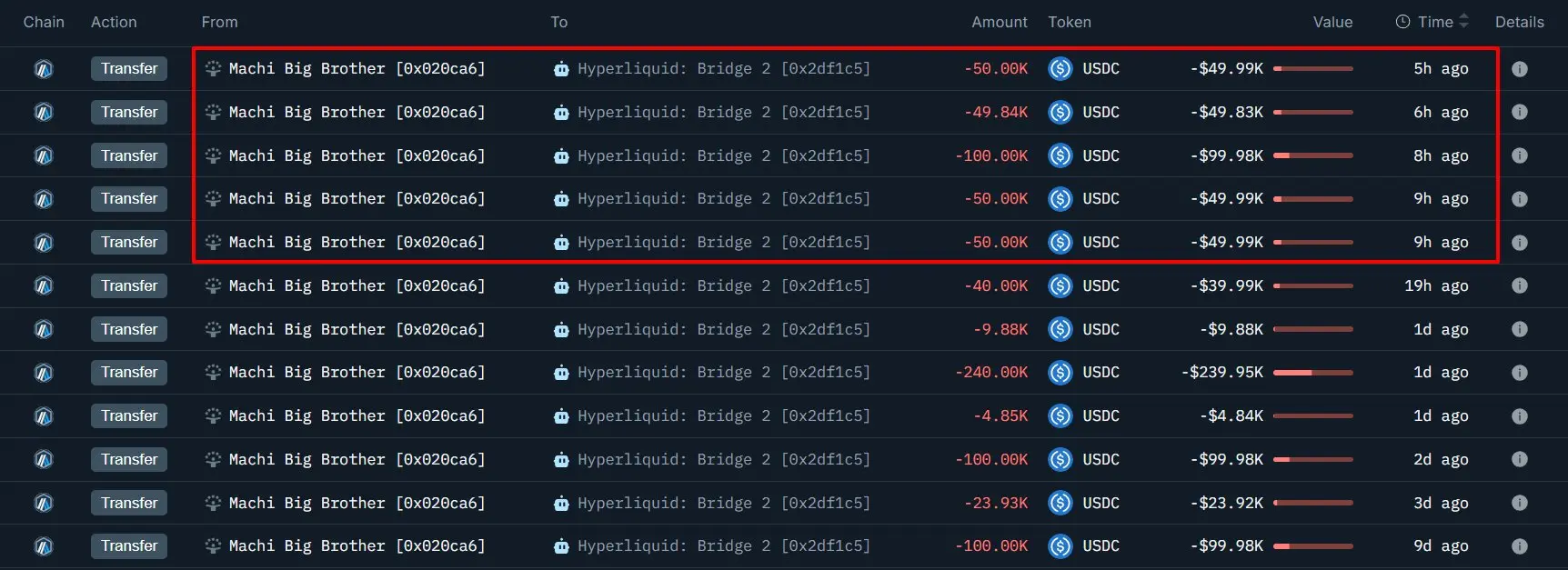

Huang Licheng invests another 300,000 USDC! Brother Maji stubbornly holds onto his ETH long positions, refusing to admit defeat

On December 12th, American-Taiwanese singer and L.A. Boyz member "Brother Ma Ji" Huang Licheng deposited 299,842 USDC into Hyperliquid and increased his ETH 25x leveraged long position. The current position is 6,900 ETH, with an entry average price of $3,240.93, and a liquidation price of $3,130.95, just about $110 away from triggering a liquidation.

ETH-0.3%

MarketWhisper·12-12 01:44

Coinbase Ending USDC Rewards for Free Users, Will Only Be for Paid Members

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Crypto exchange Coinbase will stop paying USDC rewards to non-paying customers next week, confirming to Decrypt on Thursday that only Coinbase One premium subscribers will be eligible to earn 4% on their stablecoin

Decrypt·12-11 14:54

Why is China banning stablecoins? Former Vice President of the Bank of China, Wang Yongli, reveals 4 major deadly reasons

Shenzhen Digital Information Service Group Co-Chairman and former Vice President of the Bank of China, Wang Yongli, recently published an article elaborating on China's firm policy logic to halt stablecoins. He pointed out that China's accelerated development of digital RMB and the clear policy orientation to resolutely curb virtual currencies, including stablecoins, are based on comprehensive considerations of factors such as its global leading position in mobile payments, the sovereignty security of the RMB, and the stability of the monetary and financial system.

MarketWhisper·12-11 05:41

OCC: Nine major US banks ban Crypto, Department of Justice intervenes in investigation

According to a survey by the Office of the Comptroller of the Currency (OCC), from 2020 to 2023, the nine major US banks restricted financial services to politically sensitive industries, with Crypto being the most affected. The OCC stated that these banks, when providing financial services, made inappropriate distinctions based on the customer's legitimate business activities. Measures taken against Crypto include restrictions on "issuers, exchanges, or custodians." The investigation is still ongoing and may result in the findings being submitted to the Department of Justice.

MarketWhisper·12-11 01:54

Circle Just Minted Another $500 Million USDC on Solana

Circle Internet Financial minted $500 million of USD Coin on Solana, contributing to a total of $15.03 billion USDC since October 11. This issuance boosted trading volumes and liquidity on decentralized exchanges, highlighting Solana's growing status for stablecoin use.

CryptoBreaking·12-10 08:00

CFTC Launches Crypto Pilot With BTC, ETH, USDC Driving Margin Heat

A new CFTC pilot program opens the door for regulated tokenized collateral in U.S. derivatives markets, signaling broader acceptance of bitcoin, ether and stablecoins while removing barriers that once constrained digital asset innovation.

CFTC Launches Tokenized Collateral Pilot and Pulls Back

Coinpedia·12-10 00:44

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo Network

Circle is partnering with Aleo to launch USDCx, a privacy-focused and interoperable stablecoin that protects user data while ensuring regulatory compliance. Expected on Aleo's mainnet by January, it enhances usability in various financial applications.

Decrypt·12-09 18:27

CFTC Launches Pilot Allowing BTC, ETH, USDC as Collateral

The CFTC launched a pilot allowing Bitcoin, Ethereum, and USDC as tokenized collateral for U.S. derivatives under strict regulations, enhancing safety and oversight amid evolving digital asset markets.

CryptoFrontNews·12-09 15:32

Stripe opened USDC payments on the 12th, targeting Visa and Mastercard with a 1.5% flat fee.

Payment platform Stripe officially launched USDC payments on the 12th, with a single 1.5% fee directly challenging Visa and Mastercard, making blockchain completely invisible to merchants.

(Prior context: Will Stripe’s dedicated payment chain Tempo threaten the status of ETH and SOL?)

(Supplementary background: Stripe’s settlement blockchain Tempo completed a $500 million Series A funding round, valuing it at $5 billion.)

After Trump’s return to the White House, fintech regulation in the US has noticeably loosened, and Silicon Valley has shifted its focus from SEC penalties back to competing on efficiency. Seizing the opportunity, payment giant Stripe announced on December 12 that it will open stablecoin payment functionality to global merchants, supporting USDC, with initial networks being Ethereum, Polygon, and Coinbase’s...

動區BlockTempo·12-09 08:49

Historic Breakthrough for CFTC! Bitcoin, Ethereum, and USDC Approved as Collateral

The U.S. Commodity Futures Trading Commission (CFTC) has launched a digital asset pilot program, allowing Bitcoin, Ethereum, and USDC, among other payment stablecoins, to be used as collateral in the U.S. derivatives market. The program is only applicable to futures commission merchants (FCMs) that meet specific conditions. These firms can accept BTC, ETH, and USDC as margin collateral for futures and swaps trading, but must comply with strict reporting and custody requirements.

MarketWhisper·12-09 03:41

The US CFTC launches a pilot program, allowing Bitcoin, Ethereum, and USDC to be used as collateral in the derivatives market.

The U.S. Commodity Futures Trading Commission (CFTC) has launched a pilot program allowing Bitcoin, Ethereum, and USDC to be used as collateral in the derivatives market, replacing outdated guidelines and symbolizing the integration of digital assets into the traditional financial system. The new regulations require futures merchants to adhere to strict supervision and pave the way for other tokenized assets, enhancing market efficiency.

ETH-0.3%

ChainNewsAbmedia·12-09 03:06

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28