2025 THQ Price Prediction: Analyzing Market Trends and Future Valuation Prospects for THQ Inc.

Introduction: Market Position and Investment Value of THQ

Theoriq (THQ) is an AI-native ecosystem designed to coordinate autonomous AI agents in managing onchain capital. Since its launch in December 2025, the project has quickly established itself in the crypto market. As of December 23, 2025, THQ has achieved a market capitalization of approximately $7.1 million with a circulating supply of 128.85 million tokens, currently trading at $0.05509. This innovative asset, recognized for its advanced agent protocol and modular vault architecture, is playing an increasingly important role in decentralized finance through complex onchain use cases such as liquidity provisioning, yield optimization, and autonomous trading.

This article will provide a comprehensive analysis of THQ's price trends and market dynamics, incorporating historical performance patterns, market supply and demand factors, and ecosystem development. By examining the asset's recent volatility—including its all-time high of $0.16 reached on December 16, 2025, and subsequent price corrections—we will offer investors professional price forecasts and actionable investment strategies for the period ahead. Whether you are a seasoned trader or considering your first position in AI-powered DeFi assets, this guide will equip you with the insights needed to make informed decisions in the rapidly evolving cryptocurrency market.

Theoriq (THQ) Market Analysis Report

I. THQ Price History Review and Market Status

THQ Historical Price Evolution

Based on available data, Theoriq (THQ) demonstrates significant volatility in its recent trading history:

- December 16, 2025: All-time high (ATH) of $0.16 reached, marking the peak valuation period for THQ

- December 19, 2025: All-time low (ATL) of $0.03572 recorded, representing a sharp correction of approximately 77.67% from the ATH within a 3-day period

- December 23, 2025: Price recovery to $0.05509, showing a rebound phase following the initial market correction

THQ Current Market Situation

As of December 23, 2025, Theoriq is trading at $0.05509 with a 24-hour trading volume of $1,894,629.71. The token exhibits strong recent momentum with a 24-hour price increase of 15.25%, though longer-term performance shows significant weakness, with 7-day, 30-day, and 1-year changes all at -69.93%.

Key Market Metrics:

- Market Cap: $7,098,556.28

- Fully Diluted Valuation (FDV): $55,090,000

- Circulating Supply: 128,853,808 THQ (12.89% of total supply)

- Total Supply: 1,000,000,000 THQ

- Market Dominance: 0.0017%

- 24-Hour High/Low: $0.062 / $0.0441

- 1-Hour Price Change: +6.72%

- Active Holders: 9,374

The token is deployed on the BASE network (BASE EVM) with contract address 0x0b2558bdbc7ffec0f327fb3579c23dabd1699706. Trading is currently available on Gate.com with limited exchange presence (1 exchange listing reported).

Click to view current THQ market price

THQ Market Sentiment Indicator

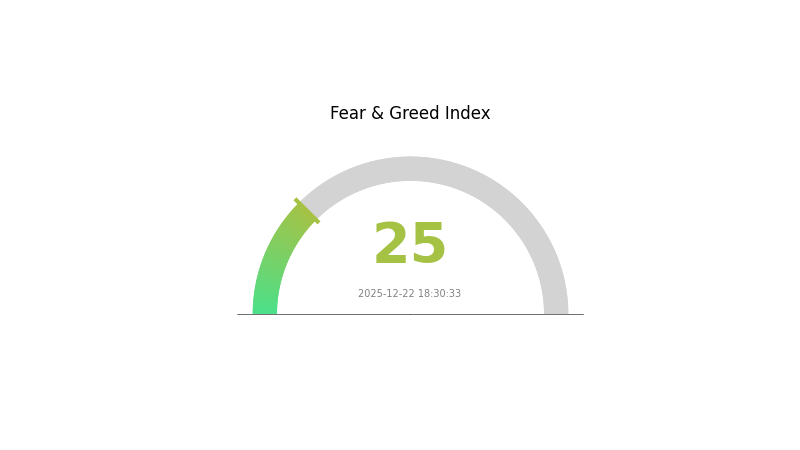

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index dropping to 25. This indicates strong bearish sentiment among investors, characterized by significant selling pressure and risk aversion. When fear reaches such extreme levels, it often creates contrarian opportunities for long-term investors. Market volatility is heightened as participants rush to secure positions. Monitoring this indicator on Gate.com can help traders make informed decisions during such turbulent periods. Despite the current pessimism, historical data suggests extreme fear often precedes market recovery phases.

THQ Holdings Distribution

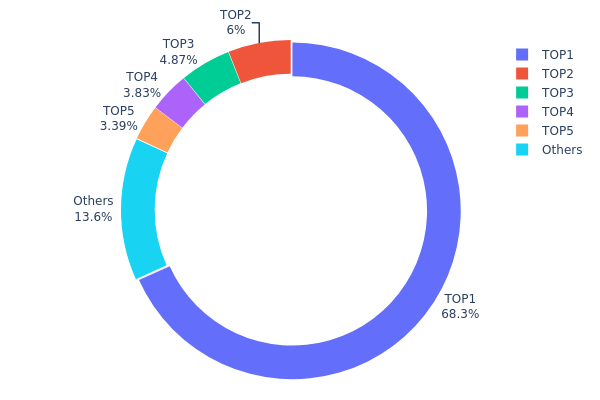

The address holdings distribution map illustrates the concentration of token ownership across different wallet addresses on the blockchain. It provides critical insight into how THQ tokens are distributed among holders, serving as a key indicator of market structure health and potential centralization risks. By analyzing the top holders and their respective percentages, investors and analysts can assess the degree of decentralization and evaluate the stability of the token's on-chain ecosystem.

THQ demonstrates significant concentration risk within its holder base. The top address controls 68.25% of total supply, representing an exceptionally high degree of centralization. The top five addresses collectively hold 86.33% of all THQ tokens, leaving only 13.67% distributed among remaining holders. This extreme concentration in the hands of a limited number of addresses raises substantial concerns regarding market manipulation potential and price volatility. Such distribution patterns typically indicate either early-stage projects with concentrated founder holdings or tokens with limited decentralization progress.

The current address distribution reflects a market structure with pronounced centralization characteristics. The dominant position of the leading address suggests potential control over significant price movements and market direction. While large holders do not necessarily pose immediate risks if aligned with long-term project development, the limited diversity among top holders constrains the token's decentralization narrative. This concentration pattern warrants careful monitoring, as any coordinated action or liquidation from major addresses could substantially impact market stability and token valuation. The distribution indicates that THQ remains in a phase where wealth concentration substantially outweighs distributed holdings.

View the current THQ holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2f7f...25b219 | 227339.29K | 68.25% |

| 2 | 0x73d8...4946db | 19983.78K | 6.00% |

| 3 | 0x4985...652b2b | 16222.28K | 4.87% |

| 4 | 0x97b9...b68689 | 12763.10K | 3.83% |

| 5 | 0x00d4...8c0b83 | 11282.25K | 3.38% |

| - | Others | 45460.23K | 13.67% |

II. Core Factors Affecting THQ's Future Price

Supply Mechanism

- Token Unlock Schedule: A major unlock of 17.94% is scheduled for December 2026, creating significant future selling pressure on the token's price.

- Circulating Supply Imbalance: Currently, only 13.76% of the total supply is in circulation, indicating substantial dilution risk as more tokens enter the market over time.

Institutional and Whale Dynamics

- Institutional Investment: Theoriq has received backing from renowned institutions.

- Token Concentration Risk: The top two addresses control 68% of the token supply, indicating severe centralization risk and potential for coordinated selling pressure.

Token Economics

- Staking Rewards Mechanism: THQ features a staking rewards mechanism that incentivizes token holders to lock up their assets, which may help reduce selling pressure.

- Unlock Schedule Transparency Issues: The token unlock schedule lacks sufficient transparency, raising concerns about future supply releases and their impact on price stability.

Three、2025-2030 THQ Price Forecast

2025 Outlook

- Conservative Forecast: $0.03809 - $0.0552

- Neutral Forecast: $0.0552

- Optimistic Forecast: $0.08114 (requiring sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with strengthening fundamentals and increasing institutional adoption

- Price Range Predictions:

- 2026: $0.03545 - $0.0968 (25% upside potential)

- 2027: $0.07176 - $0.11961 (51% upside potential)

- 2028: $0.09499 - $0.1061 (86% upside potential)

- Key Catalysts: Enhanced protocol functionality, expanded partnership ecosystems, growing market liquidity on platforms like Gate.com, and broader cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.05362 - $0.10513 (assuming steady ecosystem adoption and moderate market growth)

- Optimistic Scenario: $0.10668 - $0.15559 (assuming accelerated mainstream adoption and network effects materialization by 2030)

- Transformative Scenario: $0.15559+ (assuming breakthrough technological innovations, major institutional backing, and THQ establishing itself as a leading protocol solution)

- Dec 23, 2025: THQ trading at average price of $0.0552 (market consolidation phase ongoing)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08114 | 0.0552 | 0.03809 | 1 |

| 2026 | 0.0968 | 0.06817 | 0.03545 | 25 |

| 2027 | 0.11961 | 0.08249 | 0.07176 | 51 |

| 2028 | 0.1061 | 0.10105 | 0.09499 | 86 |

| 2029 | 0.10668 | 0.10357 | 0.06318 | 90 |

| 2030 | 0.15559 | 0.10513 | 0.05362 | 93 |

Theoriq (THQ) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Theoriq (THQ) is an AI-native ecosystem designed to coordinate autonomous AI agents in managing onchain capital. Trading at $0.05509 as of December 23, 2025, THQ has experienced significant volatility with a 15.25% gain over the last 24 hours but a 69.93% decline over the past 7 days. With a market cap of $7.1 million and a fully diluted valuation of $55.1 million, THQ remains an emerging project with limited liquidity and high risk characteristics.

II. THQ Market Position Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.05509 |

| 24-Hour High/Low | $0.062 / $0.0441 |

| All-Time High | $0.16 (December 16, 2025) |

| All-Time Low | $0.03572 (December 19, 2025) |

| Market Cap | $7,098,556 |

| Fully Diluted Valuation | $55,090,000 |

| Circulating Supply | 128,853,808 THQ |

| Total Supply | 1,000,000,000 THQ |

| 24-Hour Volume | $1,894,630 |

| Token Holders | 9,374 |

Price Performance Analysis

Short-term Performance:

- 1-Hour Change: +6.72%

- 24-Hour Change: +15.25%

- 7-Day Change: -69.93%

- 30-Day Change: -69.93%

- 1-Year Change: -69.93%

The token exhibits extreme volatility, with sharp price swings reflecting its early-stage market status and low liquidity. The recent 70% decline from launch suggests market correction following initial enthusiasm.

III. THQ Professional Investment Strategy

THQ Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Venture-oriented cryptocurrency investors with high risk tolerance, technology enthusiasts interested in AI-driven onchain solutions, and portfolio diversification seekers

-

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Allocate fixed amounts on a weekly or monthly basis to reduce timing risk and lower average entry price amid market volatility

- Fundamental Monitoring: Continuously track ecosystem development progress, AI agent performance metrics, and adoption of use cases (liquidity provisioning, yield optimization, autonomous trading)

- Portfolio Rebalancing: Review position size quarterly and adjust based on platform development milestones and competitive landscape changes

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA): Use 20-day and 50-day MAs to identify trend directions; short-term traders should watch for MA crossover signals

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to time entry and exit points

- Volume Analysis: Watch trading volume trends on Gate.com; declining volume during rallies may signal weakening momentum

-

Swing Trading Considerations:

- Volatility Exploitation: Given the 70%+ price swings observed, traders should establish clear stop-loss and take-profit levels at 15-25% intervals

- News-Driven Entries: Monitor announcements regarding AI agent cluster launches, new blockchain integrations, or ecosystem partnerships for trading opportunities

IV. THQ Risk Management Framework

Resource Allocation Principles

Given THQ's high-risk profile with limited trading history and market cap, the following allocation guidelines are recommended:

- Conservative Investors: 0.5-1% of total cryptocurrency portfolio

- Moderate Investors: 1-3% of total cryptocurrency portfolio

- Aggressive Investors: 3-5% of total cryptocurrency portfolio

All allocations should represent capital that investors can afford to lose entirely.

Risk Hedging Approaches

- Position Sizing: Limit individual THQ holdings to prevent catastrophic portfolio impact; use smaller position sizes than established projects

- Profit-Taking Strategy: Consider selling 25-50% of gains at key resistance levels to lock in returns and reduce downside exposure

Secure Storage Solutions

- Custodial Exchange Storage: Store THQ on Gate.com for active trading purposes; ensure you enable two-factor authentication (2FA) and withdraw large holdings to cold storage periodically

- Non-Custodial Storage: Transfer THQ to Gate's Web3 wallet for medium-term holdings, allowing self-custody while maintaining security

- Security Considerations:

- Never share private keys or seed phrases

- Verify contract addresses before token transfers (THQ contract on BASE: 0x0b2558bdbc7ffec0f327fb3579c23dabd1699706)

- Use hardware security measures for larger holdings

- Be cautious of phishing attempts targeting new project communities

V. THQ Potential Risks and Challenges

Market Risks

- Extreme Volatility: THQ has experienced 70% declines within weeks of launch, indicating severe price instability and low liquidity that can result in slippage and rapid capital loss

- Low Trading Volume: Daily volume of $1.9 million is minimal relative to market cap, making it difficult to execute large trades without significant price impact

- Market Concentration: With only 9,374 token holders, wealth concentration poses risks of coordinated selling or market manipulation

Regulatory Risks

- Unclear Classification: As an AI-focused protocol operating onchain, regulatory treatment remains uncertain across different jurisdictions

- Compliance Evolution: Changes in crypto regulations, particularly regarding autonomous systems and algorithmic trading, could impact Theoriq's operational model

- Jurisdictional Uncertainty: Different regulatory approaches across regions where agents operate may create compliance challenges

Technology Risks

- Protocol Security: As a new AI-native platform, the security of the agent protocol and vault architecture has not been battle-tested across market cycles

- Agent Performance: Real-world performance of autonomous agents in liquidity provision and yield optimization may diverge significantly from theoretical models

- Smart Contract Vulnerabilities: Early-stage smart contracts carry elevated risk of undiscovered bugs or exploits that could result in capital loss

VI. Conclusion and Action Recommendations

THQ Investment Value Assessment

Theoriq represents a speculative bet on the emerging AI-agent-coordinated capital management sector. The project combines compelling technical vision with significant execution risks. With 70% declines from all-time highs, current valuations may reflect realistic risk adjustments, but the extreme volatility and low liquidity indicate this remains a high-risk, early-stage investment unsuitable for risk-averse investors. Long-term value depends heavily on successful deployment of autonomous agents, ecosystem adoption, and sustained demand for AI-driven financial coordination.

THQ Investment Recommendations

✅ For Beginners: Start with minimal allocations (0.5-1% of crypto portfolio) focused on education; use Gate.com for learning order types and risk management without exposing significant capital. Avoid leverage trading.

✅ For Experienced Investors: Deploy DCA strategies over 3-6 months; combine long-term core holdings with selective swing trading around identified support/resistance levels. Monitor development milestones closely.

✅ For Institutional Investors: Conduct thorough technical due diligence on AI agent performance and protocol security; establish position limits and liquidity management protocols to account for low trading volumes; consider allocation only after ecosystem reaches meaningful adoption metrics.

Methods for Trading Participation

- Gate.com Spot Trading: Purchase THQ directly against USDT or other stablecoins; ensure you understand slippage given low liquidity

- Gate Web3 Wallet Integration: Store holdings securely while maintaining access to emerging onchain opportunities within the Theoriq ecosystem

- Community Participation: Engage with the Discord community to monitor development updates, participate in beta testing of AI agents, and stay informed on protocol upgrades

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more capital than you can afford to lose entirely.

FAQ

What is THQ and what factors affect its price?

THQ is TheoriqAI token combining AI and blockchain technology. Price factors include platform adoption rates, AI industry growth, user base expansion, trading volume, and ecosystem development. Increased demand for THQ tokens through transactions and staking typically drives price appreciation.

What is the price forecast for THQ in 2025?

Based on technical analysis, THQ is projected to reach approximately $0.30 by the end of 2025. This forecast considers current market trends and chart patterns as of December 22, 2025.

What are the risks and opportunities for THQ price prediction?

THQ faces selling pressure risks that could limit upside, but healthcare sector growth offers significant opportunities. Current price at $18.64 provides entry potential. Market trends and fund performance drive price movements.

How does THQ compare to similar assets in terms of price performance?

THQ has underperformed comparable assets, declining 15.7% over the past year. Growth potential remains limited due to high interest rates and leverage, though it offers a 0.96% yield for income-focused investors.

What historical price trends can help predict THQ's future performance?

Historical price trends reveal support and resistance levels that guide THQ's future price movements. Past pattern repetitions and trading volume analysis help forecast price directions and identify potential breakout opportunities for investors.

Is Hey Anon (ANON) a Good Investment?: Analyzing the Potential Returns and Risks of This Emerging Cryptocurrency

Is Hive AI (BUZZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 ALCH Price Prediction: Bullish Outlook as DeFi Adoption Surges

2025 GIZA Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

Is Velvet (VELVET) a good investment? : Analyzing the potential and risks of this new cryptocurrency

2025 UNO Price Prediction: Analyzing Market Trends and Potential Growth Factors

What is a cryptocurrency airdrop?

How to Withdraw Money from a Cryptocurrency Exchange

What is HIBS: A Comprehensive Guide to Understanding Hemolytic Immune-mediated Transfusion Reactions

What is IBFK: A Comprehensive Guide to International Bank Fund Keying and Cross-Border Financial Operations

How to Withdraw Cryptocurrency to Your Bank Account