2025 SNIFT Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: SNIFT's Market Position and Investment Value

StarryNift (SNIFT) is a premier AI-powered co-creation platform that transforms virtual experiences through AI SDK infrastructure. Since its launch in September 2024, SNIFT has established itself as an innovative player in the virtual experience ecosystem. As of January 2026, SNIFT maintains a market capitalization of approximately $51,521.23, with a circulating supply of 127,812,520 tokens trading at around $0.0004031 per token. This emerging asset is increasingly playing a key role in enabling users to play games, create content, engage in social interactions, develop decentralized identities (DIDs), and earn rewards immersively.

This article will comprehensively analyze SNIFT's price trajectory through 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

StarryNift (SNIFT) Market Analysis Report

I. SNIFT Price History Review and Current Market Status

SNIFT Historical Price Evolution

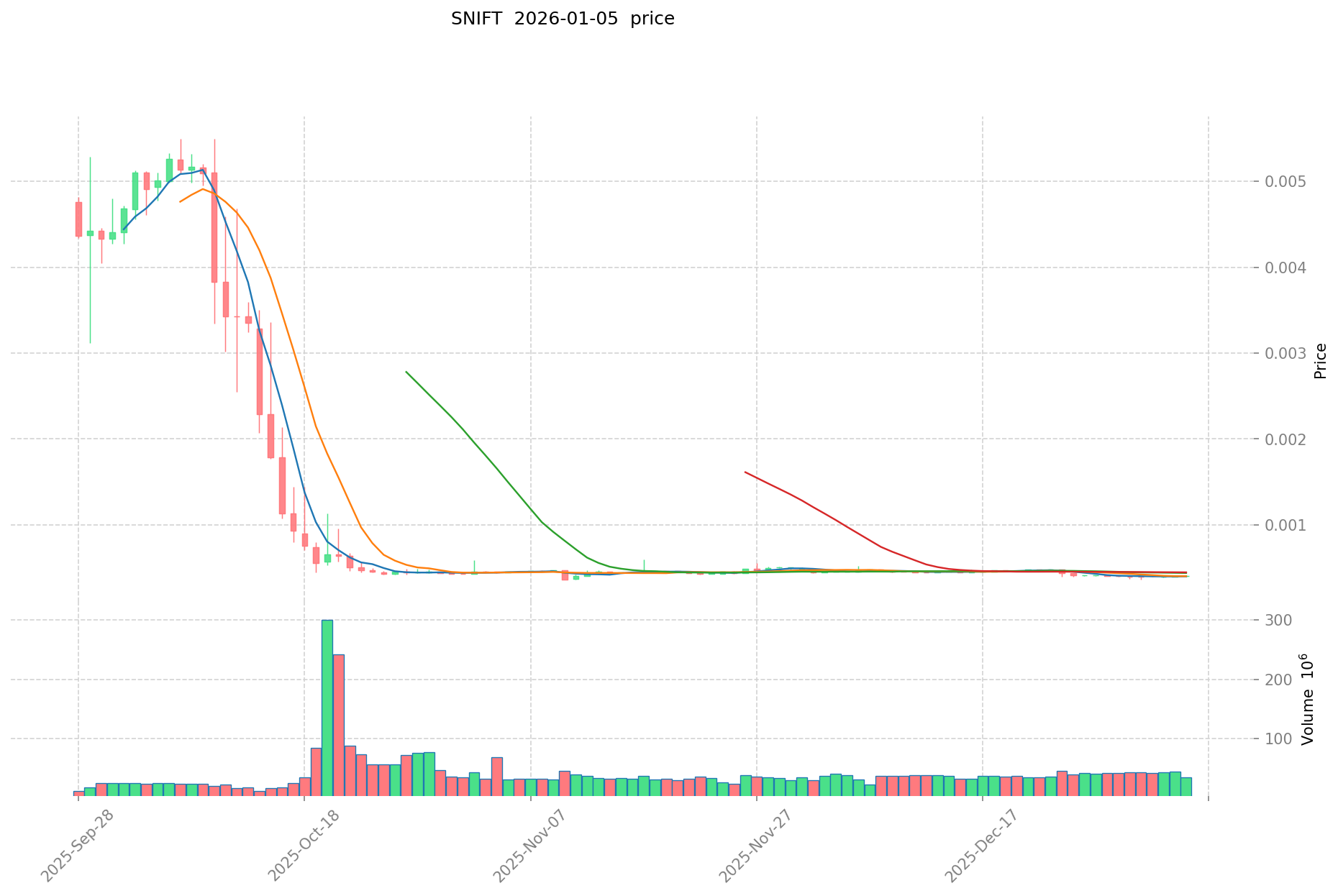

- September 2024: Project launch and market introduction, SNIFT reached its all-time high of $0.13 on September 26, 2024

- September 2024 to January 2026: Extended downtrend period, price declined from the peak of $0.13 to current levels, representing a significant correction phase

- November 2025: All-time low recorded at $0.0003608, marking the lowest price point in the token's trading history

SNIFT Current Market Status

As of January 5, 2026, SNIFT is trading at $0.0004031 with a 24-hour trading volume of $14,069.68. The token demonstrates short-term resilience with a 1.44% gain over the past 24 hours and a 0.97% increase in the last hour. However, the broader performance picture reflects challenges, with the token down 11.79% over the past 30 days and experiencing a severe 99.09% decline over the past year from its launch price of $0.08.

The current market capitalization stands at approximately $51,521, with a fully diluted valuation of $403,100. With 127.81 million tokens circulating out of a total supply of 1 billion, the circulating supply ratio is 12.78%. The token maintains a presence across 4 exchanges and has accumulated 82,177 token holders, indicating a modest but distributed holder base.

Market sentiment remains cautious, with current conditions reflecting fear in the broader cryptocurrency market environment.

Click to view current SNIFT market price

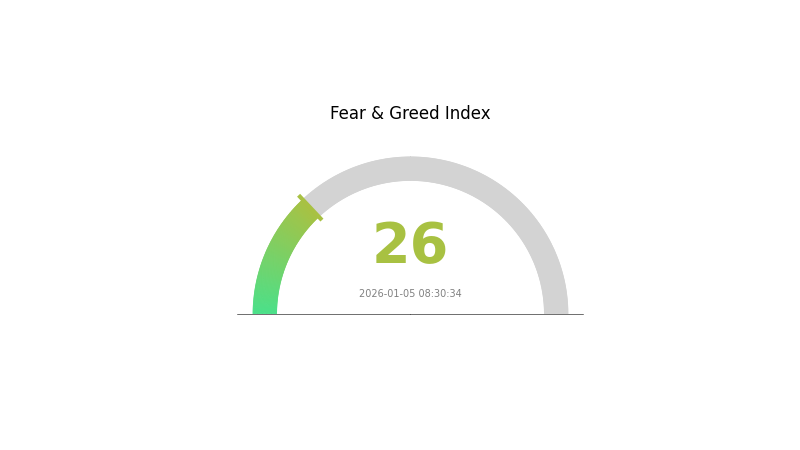

SNIFT Market Sentiment Index

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 26. This low score indicates heightened market anxiety and risk aversion among investors. When the Fear and Greed Index falls into the fear zone, it often signals potential buying opportunities for contrarian traders, as extreme fear can lead to oversold conditions. However, investors should exercise caution and conduct thorough research before making investment decisions. Market sentiment can shift rapidly, and it's crucial to maintain a balanced portfolio strategy during periods of market volatility and uncertainty.

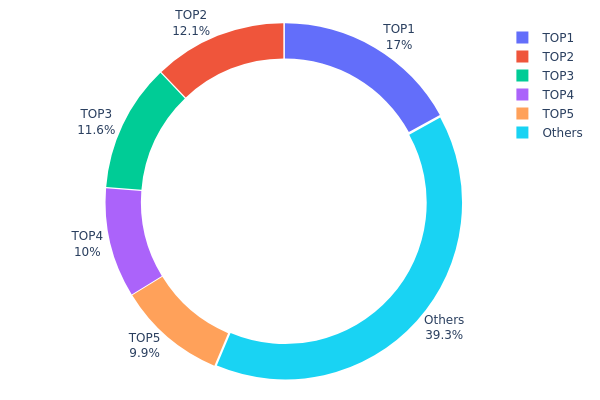

SNIFT Holdings Distribution

The holdings distribution chart illustrates the concentration of SNIFT tokens across individual addresses, providing critical insights into the token's decentralization profile and potential risks associated with whale activities. By analyzing the top holders and their respective share of total supply, we can assess the vulnerability of the token to price manipulation and evaluate the overall health of its market structure.

The current distribution data reveals moderate concentration concerns within the SNIFT ecosystem. The top five addresses collectively hold 60.66% of the total supply, with the largest holder commanding 17.00% of all tokens. While this level of concentration does not constitute extreme centralization, it does suggest that a relatively small number of stakeholders possess significant influence over the asset's price dynamics and governance outcomes. Notably, address 0x0000...00dead, which ranks fourth with 10.00% of holdings, likely represents burned or locked tokens, effectively reducing the actively tradable supply and slightly amplifying the concentration risk among operational addresses.

The distribution pattern indicates that 39.34% of SNIFT tokens are dispersed among other addresses, demonstrating a degree of decentralization in the mid-to-lower tier of holders. However, the substantial holdings concentrated in the top four addresses suggest that major token movements initiated by these entities could trigger significant price volatility. This concentration level warrants continuous monitoring, particularly regarding the trading activities and intentions of principal holders, as coordinated or strategic liquidation events could exert considerable downward pressure on market valuations. The current structure reflects a typical profile for emerging digital assets, balancing between early investor accumulation and progressive decentralization as the ecosystem matures.

Click to view current SNIFT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4982...6e89cb | 170085.66K | 17.00% |

| 2 | 0x710b...7abe33 | 121222.00K | 12.12% |

| 3 | 0xeabb...388281 | 116462.50K | 11.64% |

| 4 | 0x0000...00dead | 100000.01K | 10.00% |

| 5 | 0x798e...a97b68 | 99000.00K | 9.90% |

| - | Others | 393229.83K | 39.34% |

Core Factors Affecting SNIFT's Future Price Movement

Macroeconomic Environment

Monetary Policy Impact

Central bank policies and interest rate trajectories significantly influence cryptocurrency valuations. The performance of stablecoins and digital assets is closely tied to global monetary conditions and capital market dynamics.

- Current interest rate environment: Cryptocurrency prices are sensitive to shifts in monetary policy. When central banks maintain higher interest rates, traditional investment vehicles become more attractive, potentially redirecting capital away from digital assets.

- Liquidity conditions: Global liquidity trends directly impact market sentiment toward cryptocurrencies. Expanded monetary stimulus typically correlates with increased risk asset demand, while tightening cycles can trigger price corrections.

Inflation Hedge Characteristics

Cryptocurrencies serve as potential inflation hedges in high-inflation environments, particularly in emerging economies where currency instability drives adoption of alternative value stores.

- Currency devaluation scenarios: In regions experiencing high inflation and unstable local currencies, stablecoins and cryptocurrencies like SNIFT can serve as value preservation mechanisms, driving demand in emerging markets.

- Real asset protection: Digital assets may attract investors seeking protection against purchasing power erosion, especially in economies with elevated inflation rates.

Geopolitical Factors

- International sanctions impact: Cryptocurrencies provide alternative payment channels in regions facing cross-border payment restrictions, enhancing adoption in geopolitically sensitive areas.

- Trade dynamics: Global trade tensions and currency competition influence the attractiveness of decentralized digital assets as neutral value transfer mechanisms.

Market Sentiment and Adoption Dynamics

Sentiment Analysis

- Optimistic sentiment phases: When market sentiment turns bullish and "greed" prevails, cryptocurrencies experience upward price pressure. Conversely, fear sentiment and negative news catalysts can trigger bearish outlooks.

- News-driven volatility: Market sentiment analysis combined with on-chain metrics provides insights into potential price direction. Regulatory announcements, technological upgrades, and adoption milestones significantly influence investor perception.

Regulatory Developments

- Stablecoin regulatory framework: Recent legislative progress including the U.S. STABLE Act (2025) and the GENIUS Act (2025) establishes comprehensive stablecoin regulatory frameworks, enhancing institutional confidence and market legitimacy.

- Hong Kong regulations: Hong Kong's Stablecoins Ordinance (May 2025) represents the first comprehensive regulatory framework for fiat-backed stablecoins, signaling regional support for digital asset development.

Technological Development and Ecosystem Growth

Blockchain Infrastructure Evolution

- Distributed ledger technology adoption: Blockchain technology continues advancing as the backbone for digital asset custody and settlement, enabling faster transaction processing and reduced intermediaries.

- Cross-chain interoperability: Development of seamless cross-chain protocols enhances ecosystem utility and network effects.

Digital Asset Market Expansion

- Stablecoin ecosystem growth: The global stablecoin market has expanded from approximately $50 billion in 2020 to over $2.5 trillion by mid-2025, with a year-over-year compound growth rate exceeding 100%. This expansion demonstrates accelerating mainstream adoption of digital currencies.

- Payment infrastructure development: Stablecoins increasingly facilitate remittances and cross-border payments with costs under 1% of transaction value—significantly lower than traditional SWIFT transfers averaging 6.7%. This cost advantage drives adoption in high-frequency, small-value international payment scenarios.

- Real-world application expansion: Stablecoins serve as core infrastructure for decentralized finance (DeFi), non-fungible token (NFT) trading, and on-chain gaming economies, creating diverse use cases that support sustained demand growth.

Market Risk Considerations: Cryptocurrency prices remain highly sensitive to multiple factors including market sentiment, macroeconomic conditions, news events, and regulatory changes. Even projects with strong fundamentals may experience significant price volatility. Investors should conduct thorough due diligence and understand their risk tolerance before investing in digital assets.

III. 2026-2031 SNIFT Price Forecast

2026 Outlook

- Conservative Forecast: $0.00031 - $0.00042

- Neutral Forecast: $0.00041

- Optimistic Forecast: $0.00042 (requires sustained market stability and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth trajectory, characterized by modest price appreciation and market maturation

- Price Range Forecast:

- 2027: $0.00025 - $0.00043

- 2028: $0.00024 - $0.00049

- 2029: $0.00042 - $0.00051

- Key Catalysts: Ecosystem expansion, increased liquidity on major platforms like Gate.com, growing institutional interest, and technological improvements to the underlying protocol

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00033 - $0.00064 (sustained network growth and moderate adoption across DeFi applications)

- Optimistic Scenario: $0.00041 - $0.00063 (accelerated ecosystem development and strengthened market positioning)

- Transformational Scenario: $0.00056 - $0.00064 (significant breakthrough in utility, mainstream adoption, and substantial increase in transaction volume)

- 2031-12-31: SNIFT reaches $0.00056-$0.00063 range (38% cumulative growth from 2026 baseline, reflecting strong mid to long-term market confidence)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00042 | 0.00041 | 0.00031 | 0 |

| 2027 | 0.00043 | 0.00041 | 0.00025 | 2 |

| 2028 | 0.00049 | 0.00042 | 0.00024 | 5 |

| 2029 | 0.00051 | 0.00046 | 0.00042 | 12 |

| 2030 | 0.00064 | 0.00048 | 0.00033 | 19 |

| 2031 | 0.00063 | 0.00056 | 0.00041 | 38 |

StarryNift (SNIFT) Professional Investment Analysis Report

IV. SNIFT Professional Investment Strategy and Risk Management

SNIFT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Risk-averse investors, content creators, and gaming enthusiasts interested in AI-powered platforms

- Operational Recommendations:

- Accumulate SNIFT tokens during market downturns, as the token has experienced significant volatility with a 1-year decline of -99.09%

- Hold tokens for minimum 12-24 months to capture potential platform adoption growth

- Participate in platform activities (gaming, content creation, social interactions) to earn additional rewards while holding

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price volatility: The token shows 24-hour price range of $0.0003956 to $0.0004144, suggesting active short-term trading opportunities

- Volume analysis: Current 24-hour trading volume of $14,069.68 indicates moderate liquidity

- Wave Trading Key Points:

- Monitor the $0.0004031 support level (current price) for entry opportunities

- Historical all-time high of $0.13 (September 26, 2024) provides resistance reference for target pricing

- Watch for significant deviations from the 7-day performance indicator (0.67% gain)

SNIFT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation (with hedge strategies)

(2) Risk Hedging Solutions

- Diversification Strategy: Balance SNIFT holdings with established cryptocurrencies to mitigate project-specific risks

- Position Sizing: Implement strict position limits to prevent overexposure to this highly volatile token

(3) Secure Storage Solutions

- Hardware Security: Store significant holdings in hardware wallets with backup seed phrases stored securely offline

- Exchange Holdings: Maintain active trading portions on Gate.com with two-factor authentication enabled

- Security Considerations: Never share private keys or seed phrases; use official contract address verification before transactions

V. SNIFT Potential Risks and Challenges

SNIFT Market Risks

- Extreme Price Volatility: The token has declined 99.09% over one year and 11.79% in the past month, indicating severe market instability

- Liquidity Risk: With only 4 trading venues and moderate daily volume, potential difficulty in executing large orders without significant price slippage

- Market Cap Concentration: Total market capitalization of only $51,521 suggests limited market depth and susceptibility to whale manipulation

SNIFT Regulatory Risks

- AI Platform Regulatory Uncertainty: Evolving global regulations on AI-powered platforms and NFT/gaming integrations could impact platform operations

- Jurisdictional Compliance: DID (Decentralized Identity) development may face regulatory scrutiny in certain jurisdictions

- Token Classification: Regulatory bodies may reclassify SNIFT's utility and compliance requirements

SNIFT Technology Risks

- Platform Development Risk: Dependence on successful execution of AI SDK infrastructure rollout and feature delivery

- Smart Contract Risk: BEP-20 token operates on BSC chain; potential vulnerabilities in smart contracts or network failures

- Adoption Risk: Uncertainty regarding user adoption rates for gaming, content creation, and DID features on the platform

VI. Conclusion and Action Recommendations

SNIFT Investment Value Assessment

StarryNift presents a speculative investment opportunity in the AI-powered metaverse and gaming space. The platform's vision of integrating AI, gaming, content creation, and decentralized identity is innovative, but execution risk remains extremely high. The token's 99% one-year decline reflects significant market skepticism and challenges in the emerging AI-gaming intersection. While the fully diluted valuation of $403,100 appears modest, the circulating supply represents only 12.78% of total tokens, creating potential dilution concerns. Investors should approach this as a high-risk, high-reward opportunity suitable only for experienced participants with substantial risk tolerance.

SNIFT Investment Recommendations

✅ Beginners: Consider starting with a minimal allocation (0.1-0.5% of crypto portfolio) after thorough research; use only capital you can afford to lose entirely

✅ Experienced Investors: Deploy 2-5% allocation with disciplined entry points during significant dips; maintain strict stop-loss orders at -30% to -50% levels; actively monitor platform development progress

✅ Institutional Investors: Conduct comprehensive due diligence on team credentials and technology; consider small allocation (1-3%) with vesting schedules; establish regular portfolio rebalancing protocols

SNIFT Trading Participation Methods

- Direct Token Purchase: Trade SNIFT pairs on Gate.com with real-time market data and secure transaction processing

- Platform Engagement: Earn SNIFT rewards by participating in gaming, content creation, and social activities on the StarryNift platform

- DCA Strategy: Implement Dollar-Cost Averaging by purchasing fixed amounts weekly or monthly to reduce timing risk

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is SNIFT? What are its uses and value proposition?

SNIFT is a Web3 utility token designed for decentralized prediction and community governance. Its value proposition centers on enabling users to participate in price prediction markets, earn rewards through staking, and influence protocol decisions via DAO mechanisms. SNIFT powers an ecosystem where accurate predictions drive token appreciation.

What are the main factors affecting SNIFT price?

SNIFT price is primarily influenced by market sentiment, on-chain activity, and supply-demand dynamics. Investor confidence, trading volume, and market trends also play crucial roles in price fluctuations.

How to conduct SNIFT price prediction? What are the analysis methods?

SNIFT price prediction employs technical analysis methods such as RSI and Stoch RSI indicators, combined with market trend analysis. Analysis suggests SNIFT may reach $0.009681 by 2032, with potential 461.52% growth over five years.

What is SNIFT's historical price performance and what trends exist?

SNIFT has demonstrated volatile price movements with a notable upward trend in recent periods. The token shows strong market momentum, with increasing trading volume and growing community interest indicating bullish sentiment for future growth potential.

What are the risks of investing in SNIFT? What should I pay attention to?

SNIFT investment carries market volatility and regulatory risks. Price fluctuations are driven by market sentiment and adoption trends. Monitor news updates and market movements closely. Conduct thorough research before investing to manage exposure effectively.

SNIFT与其他类似代币相比有什么优势或劣势?

SNIFT offers lower transaction fees and faster cross-border payments compared to traditional channels. However, it faces regulatory uncertainty in different jurisdictions and competes with established stablecoins like USDT and USDC, which dominate over 85% market share.

2025 NRN Price Prediction: Expert Analysis and Market Outlook for Neuron Token's Future Performance

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

Bitcoin Minetrix

Is Cryptocurrency Legal in Moldova?

Texas Buys Bitcoin for Strategic Reserve

Thanh Luu: Co-Founder and Architect of Cryptocurrency Exchange Standards

Popular English-Language Telegram Groups and Channels for Finance and Cryptocurrency