2025 PUMP Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: PUMP's Market Position and Investment Value

Pumpfun (PUMP), as the official utility coin of the Pump.Fun Protocols, has established itself as a significant player in the memecoin and AMM protocol space since its inception. As of 2025, PUMP's market capitalization has reached $2.08 billion, with a circulating supply of approximately 590 billion coins, and a price hovering around $0.003532. This asset, often referred to as the "Pump.Fun utility token", is playing an increasingly crucial role in promotional activities and brand synergy within the Pump.Fun ecosystem.

This article will provide a comprehensive analysis of PUMP's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PUMP Price History Review and Current Market Status

PUMP Historical Price Evolution

- 2025: PUMP reached its all-time high of $0.008978 on September 14th

- 2025: The token hit its all-time low of $0.0005 on July 14th

- 2025: PUMP experienced significant volatility, with price fluctuating between its ATH and ATL within a few months

PUMP Current Market Situation

As of November 14, 2025, PUMP is trading at $0.003532. The token has seen a decline of 8.41% in the last 24 hours, with the price ranging between a high of $0.003965 and a low of $0.003439. The current price represents a 60.66% decrease from its all-time high and a 606.4% increase from its all-time low.

PUMP's market capitalization stands at $2,083,880,000, ranking it 55th in the overall cryptocurrency market. The token has a circulating supply of 590 billion PUMP, which is 59% of its total supply of 1 trillion tokens. The fully diluted market cap is $3,532,000,000.

Trading volume in the past 24 hours has reached $14,043,976.69, indicating significant market activity. The token's price has shown mixed performance across different timeframes, with a 1.37% increase in the last hour, but declines of 4.02% over the past week, 10.65% over the last month, and a substantial 43.88% drop over the past year.

Click to view the current PUMP market price

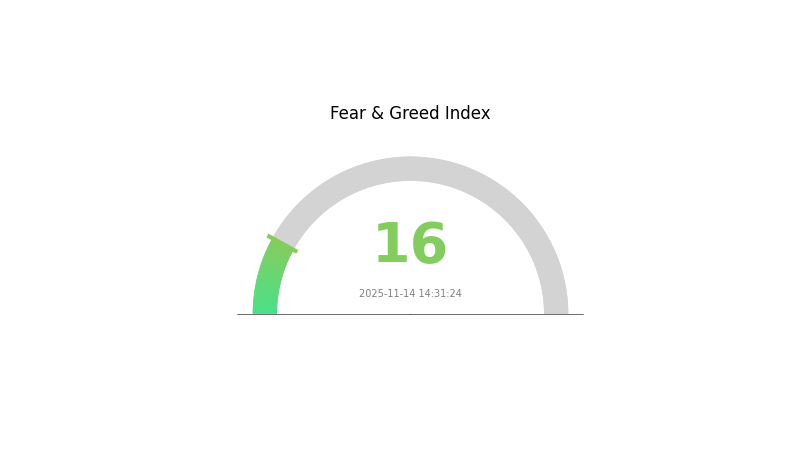

PUMP Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 16. This heightened level of anxiety often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can shift rapidly. Traders should closely monitor key support levels and potential catalysts that could trigger a trend reversal. As always, thorough research and risk management are crucial in navigating these turbulent market conditions.

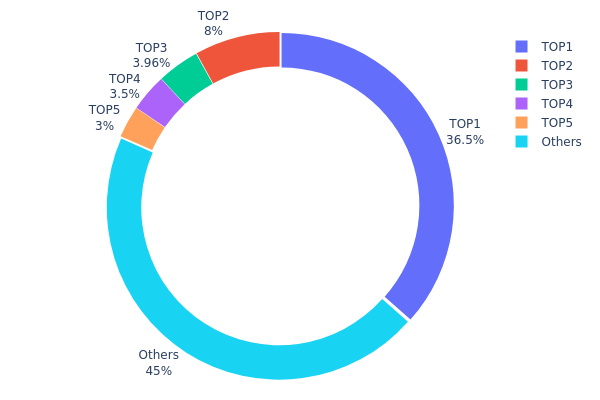

PUMP Holdings Distribution

The address holdings distribution data reveals a significant concentration of PUMP tokens. The top address holds 36.54% of the total supply, while the top 5 addresses collectively control 54.99% of PUMP tokens. This high concentration raises concerns about potential market manipulation and price volatility.

Such a centralized distribution structure could lead to increased market instability. Large holders, often referred to as "whales," have the power to significantly impact token prices through their trading activities. The concentration also suggests a lower degree of decentralization, which may be contrary to the principles of many blockchain projects.

However, it's worth noting that 45.01% of tokens are distributed among other addresses, indicating some level of wider distribution. This fractional dispersion could provide a counterbalance to the top holders' influence, potentially mitigating some risks associated with high concentration.

Click to view the current PUMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Cfq1ts...ShbgZt | 365461857.13K | 36.54% |

| 2 | 8UhbNo...zuTogC | 80000000.01K | 8.00% |

| 3 | G8CcfR...L4kqjm | 39571541.33K | 3.95% |

| 4 | 9pkFKC...DAcXzv | 35000000.01K | 3.50% |

| 5 | 85WTuj...MD5ERS | 29999946.43K | 3.00% |

| - | Others | 449955982.59K | 45.01% |

II. Key Factors Affecting PUMP's Future Price

Supply Mechanism

- Deflationary Model: PUMP implements a deflationary supply model, which reduces the total supply over time.

- Historical Pattern: Previous supply reductions have generally led to price increases due to increased scarcity.

- Current Impact: The ongoing deflationary mechanism is expected to continue supporting price growth as the circulating supply decreases.

Institutional and Whale Dynamics

- Institutional Holdings: Several crypto investment firms have been accumulating PUMP, indicating growing institutional interest.

- Corporate Adoption: A number of fintech startups have begun integrating PUMP into their payment systems.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' potential shift towards tighter monetary policies could affect risk assets like PUMP.

- Inflation Hedging Properties: PUMP has shown some correlation with inflation rates, potentially serving as a hedge against currency devaluation.

Technological Development and Ecosystem Building

- Layer 2 Integration: PUMP is working on implementing Layer 2 solutions to improve scalability and reduce transaction costs.

- Cross-chain Interoperability: Developments in cross-chain bridges are enhancing PUMP's utility across different blockchain networks.

- Ecosystem Applications: Several DeFi protocols and NFT marketplaces are being built on the PUMP network, expanding its ecosystem.

III. PUMP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00222 - $0.00353

- Neutral prediction: $0.00353 - $0.00422

- Optimistic prediction: $0.00422 - $0.0049 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00352 - $0.00772

- 2028: $0.00532 - $0.00797

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00723 - $0.00824 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00824 - $0.01187 (with favorable market conditions and increased utility)

- Transformative scenario: $0.01187+ (with breakthrough use cases and mainstream adoption)

- 2030-12-31: PUMP $0.01187 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0049 | 0.00353 | 0.00222 | 0 |

| 2026 | 0.00628 | 0.00422 | 0.00291 | 19 |

| 2027 | 0.00772 | 0.00525 | 0.00352 | 48 |

| 2028 | 0.00797 | 0.00648 | 0.00532 | 83 |

| 2029 | 0.00925 | 0.00723 | 0.00542 | 104 |

| 2030 | 0.01187 | 0.00824 | 0.00544 | 132 |

IV. PUMP Professional Investment Strategies and Risk Management

PUMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate PUMP tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor Pump.Fun protocol updates and community sentiment

PUMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Use to limit potential losses in volatile markets

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PUMP

PUMP Market Risks

- High volatility: PUMP price may experience significant fluctuations

- Meme coin sentiment: Market perception may shift rapidly

- Competition: Other meme coins may impact PUMP's market share

PUMP Regulatory Risks

- Regulatory uncertainty: Potential changes in crypto regulations

- Platform compliance: Pump.Fun protocols may face regulatory scrutiny

- Cross-border restrictions: International regulations may affect accessibility

PUMP Technical Risks

- Smart contract vulnerabilities: Potential bugs in Pump.Fun protocols

- Network congestion: Solana network issues could affect transactions

- Scalability challenges: Future growth may strain existing infrastructure

VI. Conclusion and Action Recommendations

PUMP Investment Value Assessment

PUMP offers potential for high returns but comes with significant risks due to its meme coin nature and volatile market. Long-term value depends on Pump.Fun protocol adoption and community growth.

PUMP Investment Recommendations

✅ Beginners: Start with small positions, focus on learning Pump.Fun ecosystem ✅ Experienced investors: Consider allocating a portion of high-risk portfolio to PUMP ✅ Institutional investors: Approach with caution, conduct thorough due diligence

PUMP Trading Participation Methods

- Spot trading: Buy and sell PUMP tokens on Gate.com

- Staking: Participate in Pump.Fun protocol staking if available

- DeFi integration: Explore liquidity provision on swap.pump.fun AMM

Cryptocurrency investments are extremely high-risk, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does pump coin have a future?

Yes, pump coin has a promising future. With increasing adoption and technological advancements, it's expected to see significant growth and value appreciation in the coming years.

How high will Pump Fun go in 2025?

Based on market trends and expert predictions, Pump Fun could potentially reach $0.50 to $1 by 2025, driven by increased adoption and platform developments.

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, and Web3 infrastructure have the potential for massive growth. Always research thoroughly before investing.

What is the official Trump coin prediction for 2030?

The official Trump coin prediction for 2030 is $50 per coin, with a potential market cap of $5 billion based on increased adoption and political support.

What Does 'Stonks' Mean ?

Will Crypto Recover in 2025?

Pre-Market Crypto Trading: How to Get Early Access Before Tokens List

why is crypto crashing and will it recover ?

What Does "Stonks" Mean? The Meme That Took Over Trading

Will Crypto Recover ?

How to Buy Bitcoin ETF? A Complete Guide in 2026

What are on-chain data analysis metrics for Monad (MON): active addresses, whale movements, and transaction trends in 2026?

What is a token economics model: allocation mechanisms, inflation design, and governance utility explained

What is altseason, and why is everyone anticipating it?

# How Do Exchange Net Inflows and DOT Holdings Impact Polkadot's Liquidity and Fund Flows in 2025?