2025 PHTR Price Prediction: Analyst Forecasts and Market Outlook for Palantir Technologies Stock

Introduction: Market Position and Investment Value of PHTR

Phuture (PHTR) is a decentralized protocol that creates and invests in token-based passive investment strategies in the Web3 environment. Since its inception in 2021, PHTR has introduced an open design concept for building passive investment strategies, providing users with tools to create new indexes or invest in existing community indexes. As of January 2026, PHTR maintains a market capitalization of approximately $98,620.65, with a circulating supply of around 62.32 million tokens, trading at approximately $0.0015825 per token. This innovative asset is playing an increasingly important role in the decentralized finance and index protocol ecosystem.

This article will conduct a comprehensive analysis of PHTR's price movements from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Phuture (PHTR) Market Analysis Report

I. PHTR Price History Review and Market Status

PHTR Historical Price Evolution

- June 2021: Project launch with an initial price of $0.8386, marking the beginning of PHTR's market journey.

- June 4, 2021: All-time high (ATH) of $0.994097 reached, representing peak market optimism during the early stage of the protocol.

- June 29, 2021: All-time low (ATL) of $0.00019863 recorded, reflecting significant market correction following the initial peak.

PHTR Current Market Status

As of January 3, 2026, PHTR is trading at $0.0015825, representing a decline of approximately 26.05% over the past year. The token demonstrates limited trading activity with a 24-hour volume of $11,928.39 and a market capitalization of $98,620.65.

Price Performance Metrics:

- 24-hour change: +0.08%

- 7-day change: +0.76%

- 30-day change: -1.09%

- 1-hour change: -0.069%

- 24-hour trading range: $0.0014974 - $0.0017

With a circulating supply of 62,319,525.70 PHTR tokens out of a total supply of 100,000,000 tokens (62.32% circulation ratio), the project maintains a fully diluted valuation of $158,250. The token currently ranks 4923 by market capitalization, with 869 token holders recorded on-chain.

Click to view current PHTR market price

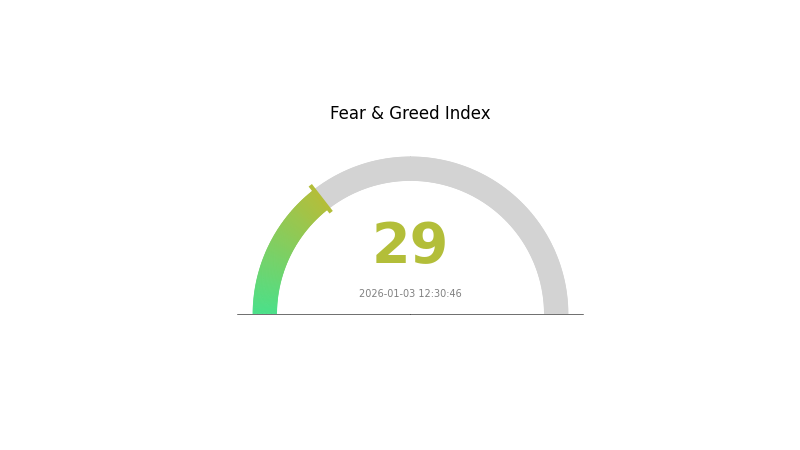

Cryptocurrency Market Sentiment Index

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing significant fear sentiment with an index reading of 29. This fear phase indicates heightened market anxiety and investor caution, often presenting potential opportunities for strategic investors. When fear dominates, market volatility tends to increase, creating entry points for those with conviction. Experienced traders often view extreme fear as a contrarian signal, suggesting oversold conditions may lead to recovery. However, caution remains essential during such periods. Monitor key support levels and market developments closely before making investment decisions. Consider dollar-cost averaging strategies to mitigate timing risks during uncertain market conditions.

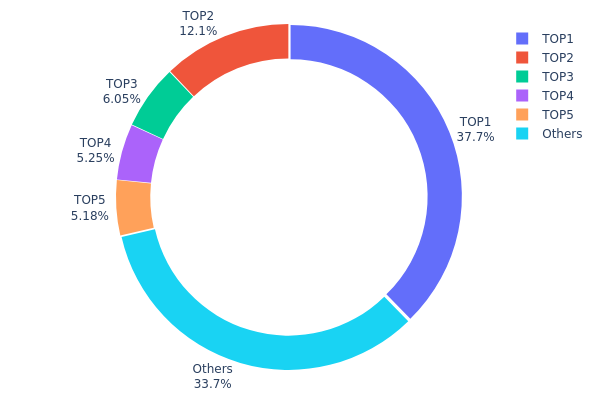

PHTR Holdings Distribution

The address holdings distribution chart illustrates the concentration of PHTR tokens across blockchain addresses, revealing how token supply is allocated among different holders. This metric serves as a critical indicator for assessing the degree of decentralization and potential market concentration risks within the PHTR ecosystem.

Current data demonstrates significant concentration among top holders. The leading address (0x6575...3574ec) commands 37.68% of total holdings, representing the largest single position in the network. When combined with the second and third largest addresses, these three entities collectively control 55.82% of all circulating PHTR tokens. This level of concentration indicates a relatively centralized token distribution structure. The top five addresses alone account for 66.25% of holdings, while the remaining 33.75% is distributed across numerous other addresses, further emphasizing the asymmetrical nature of token allocation.

This pronounced concentration pattern presents notable implications for market dynamics. The substantial holdings by top addresses create potential for significant price volatility, as large token movements from these positions could trigger substantial market shifts. Furthermore, the concentration raises questions regarding market integrity, as coordinated actions by major holders could influence price discovery mechanisms. However, the presence of a meaningful dispersed holder base (33.75% of tokens) provides some counterbalance to extreme centralization, suggesting that while whale activity remains influential, a secondary layer of distributed ownership does exist. The distribution pattern reflects the nascent stage of PHTR's market maturation, wherein institutional or early investor positioning has not yet evolved into a more equitable distribution typical of mature token ecosystems.

Click to view current PHTR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6575...3574ec | 37680.47K | 37.68% |

| 2 | 0x3b98...b799f5 | 12108.63K | 12.10% |

| 3 | 0x5505...359e81 | 6048.57K | 6.04% |

| 4 | 0x281a...67acc4 | 5250.00K | 5.25% |

| 5 | 0x1f13...ba7b35 | 5182.29K | 5.18% |

| - | Others | 33730.04K | 33.75% |

II. Core Factors Influencing PHTR Future Price

Macroeconomic Environment

-

Market Demand and Investor Sentiment: PHTR's future price is influenced by overall market demand, macroeconomic trends, and investor sentiment. The cryptocurrency market operates 24/7 with continuous price fluctuations driven by broader economic conditions.

-

High Volatility Characteristics: PHTR exhibits high volatility due to speculative trading activity and limited market presence. This volatility creates both opportunities and risks for investors navigating the cryptocurrency landscape.

-

Historical Price Performance: PHTR reached its all-time high (ATH) of $1.00 USD on June 3, 2021, representing a 99.83% decline from that peak to the current price of $0.001687 USD as of January 3, 2026. The token hit its all-time low (ATL) of $0.0008677 USD on December 5, 2025, and has since recovered 94.37% from that level, indicating significant price volatility and market cycles.

III. PHTR Price Forecast 2026-2031

2026 Outlook

- Conservative Prediction: $0.00133–$0.00158

- Neutral Prediction: $0.00158–$0.00180

- Optimistic Prediction: $0.00207 (requires sustained market momentum and positive fundamental developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental price appreciation driven by ecosystem expansion and adoption growth

- Price Range Forecast:

- 2027: $0.00144–$0.00238 (15% upside potential)

- 2028: $0.00193–$0.00294 (32% upside potential)

- 2029: $0.00242–$0.00290 (59% upside potential)

- Key Catalysts: Technological upgrades, increased institutional interest, broader market cycle recovery, and enhanced utility adoption within the crypto ecosystem

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00252–$0.00380 (assumes steady institutional adoption and supportive regulatory environment)

- Optimistic Scenario: $0.00325–$0.00380 (sustained bull market conditions with significant ecosystem partnerships)

- Transformative Scenario: $0.00355–$0.00380 (extreme favorable conditions including major protocol innovations and mainstream adoption breakthrough)

- 2031-12-31: PHTR at $0.00355 (consolidation phase with 105% cumulative gains from 2026 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00207 | 0.00158 | 0.00133 | 0 |

| 2027 | 0.00238 | 0.00183 | 0.00144 | 15 |

| 2028 | 0.00294 | 0.0021 | 0.00193 | 32 |

| 2029 | 0.0029 | 0.00252 | 0.00242 | 59 |

| 2030 | 0.0038 | 0.00271 | 0.00252 | 71 |

| 2031 | 0.00355 | 0.00325 | 0.00283 | 105 |

Phuture (PHTR) Professional Investment Strategy and Risk Management Report

IV. PHTR Professional Investment Strategy and Risk Management

PHTR Investment Methodology

(1) Long-term Hold Strategy

- Target Investors: Conservative investors seeking passive index exposure in decentralized finance, long-term believers in tokenized index strategies, and investors with moderate risk tolerance

- Operation Guidelines:

- Accumulate PHTR during market downturns when volatility is elevated, as the token has experienced significant depreciation (down 26.05% over one year) creating potential entry opportunities

- Dollar-cost averaging (DCA) approach recommended given the high volatility, investing fixed amounts at regular intervals to reduce timing risk

- Secure storage through Gate.com's Web3 wallet for direct participation in Phuture's ecosystem while maintaining asset security

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price of $0.0015825 operates near the 24-hour low of $0.0014974, indicating strong support; monitor resistance at $0.0017

- Volume Analysis: Current 24-hour trading volume of $11,928.39 provides reference for entry and exit liquidity

- Swing Trading Considerations:

- Monitor the 7-day positive performance (0.76% gain) as potential signal for short-term recovery momentum

- Utilize the wide price range between all-time high ($0.994097) and current levels to identify possible mean reversion opportunities

- Exercise caution given the low market cap ($98,620.65) which may indicate limited liquidity and higher slippage

PHTR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum

- Active Investors: 3-8% portfolio allocation maximum

- Professional Investors: Up to 15% portfolio allocation with structured hedge positions

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance PHTR exposure with more established assets given its stage as a decentralized protocol with limited trading volume

- Position Sizing: Implement strict stop-loss orders at 15-20% below entry prices to protect capital during market downturns

- Rebalancing Protocol: Quarterly portfolio rebalancing to maintain target allocation percentages and lock in gains

(3) Secure Storage Solutions

- Self-Custody Approach: Gate.com's Web3 wallet provides non-custodial storage enabling direct protocol participation while maintaining full control of private keys

- Exchange Storage: Short-term traders may maintain trading positions on Gate.com for execution convenience, though long-term holders should utilize self-custody

- Security Precautions: Enable multi-signature authentication where available, use hardware security keys for Web3 wallet access, never share private keys or recovery phrases, and verify smart contract addresses before token transfers

V. PHTR Potential Risks and Challenges

PHTR Market Risk

- Extreme Price Volatility: PHTR has declined 99.84% from its all-time high of $0.994097 (recorded June 4, 2021) to current levels, demonstrating exceptional vulnerability to market sentiment shifts

- Low Liquidity Environment: With only 869 token holders and minimal trading volume of $11,928.39 in 24 hours, the token faces significant liquidity constraints that may result in high slippage during trading

- Market Capitalization Vulnerability: The fully diluted market cap of only $158,250 places PHTR among the smallest cryptocurrency projects, creating extreme susceptibility to small capital flows

PHTR Regulatory Risk

- Decentralized Protocol Classification Uncertainty: Evolving global regulatory frameworks may impact how passive investment strategies on blockchain platforms are treated, potentially affecting protocol viability

- Securities Compliance Questions: Index-based token offerings may face regulatory scrutiny regarding whether passive investment indices constitute securities in various jurisdictions

- Jurisdictional Variations: Different countries may impose conflicting regulatory requirements on decentralized index protocols, limiting user accessibility in certain markets

PHTR Technical Risk

- Smart Contract Vulnerability: As a decentralized protocol, Phuture relies on complex smart contracts whose bugs or exploits could result in total loss of invested capital

- Ecosystem Adoption Risk: The protocol's value depends on community adoption for index creation and investment; limited adoption suggests weak network effects

- Token Utility Concerns: With only marginal trading volume and an extremely concentrated holder base, questions exist regarding PHTR's actual utility and demand within the Phuture ecosystem

VI. Conclusion and Action Recommendations

PHTR Investment Value Assessment

Phuture represents a specialized decentralized finance protocol addressing passive index strategy creation in Web3 environments. While the protocol concept introduces innovative tokenized passive investment mechanisms, the investment presents substantial risk parameters. The token's extreme depreciation (99.84% from all-time highs), minimal market capitalization, and low trading volume indicate a project in early or distressed development stages. The small holder base (869 addresses) and concentrated liquidity create additional execution challenges. Investors should recognize PHTR as a highly speculative, early-stage protocol investment rather than an established cryptocurrency asset.

PHTR Investment Recommendations

✅ Beginners: Avoid direct exposure to PHTR; if interested in decentralized index protocols, research established alternatives with greater liquidity and community adoption before considering small speculative positions

✅ Experienced Investors: Consider micro-position allocation (1-3% maximum) only after thorough protocol evaluation; implement strict risk management protocols including stop-loss orders and position sizing discipline

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, protocol governance structure, and development roadmap before any allocation; consider this asset class as venture-stage protocol investment requiring appropriate risk classification

PHTR Trading Participation Methods

- On-Chain Participation: Access the Phuture protocol directly through the Ethereum network (contract address: 0xE1Fc4455f62a6E89476f1072530C20CF1A0622dA) to create or invest in community-generated passive indices

- Exchange Trading: Execute PHTR purchases and sales through Gate.com, which provides platform support for this token; utilize limit orders given low liquidity to minimize slippage

- Liquidity Provision: Advanced users may contribute to PHTR liquidity pools to generate yield, though this strategy carries concentrated exposure and impermanent loss risks

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions aligned with their individual risk tolerance and financial circumstances. Consultation with qualified financial advisors is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

What is the price prediction for PHTR stock in 2024?

PHTR price predictions for 2024 vary among experts with no consensus. Forecasts range from potential declines to gains, with estimates spanning $0.001487 to $0.002518. Market outlook remains uncertain; investors should conduct independent research before making decisions.

What are Palantir Technologies' business model and revenue sources?

Palantir generates revenue primarily through government contracts and enterprise subscriptions. The company provides data analytics and big data solutions to government agencies and commercial clients, with government contracts representing the majority of its revenue stream.

What are the main risk factors of PHTR stock?

PHTR's main risk factors include market volatility, technical risks, and regulatory risks. Its high volatility and small market capitalization significantly increase investment risks and price fluctuation exposure.

What advantages does PHTR have compared to industry competitors such as Databricks and Tableau?

PHTR excels in comprehensive data integration, advanced analytics, and enterprise-grade security. Unlike Databricks' focus on data processing or Tableau's visualization capabilities, PHTR offers an integrated platform combining data management with powerful analytical tools, backed by strong government contracts and proven reliability in handling sensitive information.

分析师对PHTR股票的长期前景如何看?

Analysts view PHTR stock positively long-term, citing strong growth in data analytics and defense sectors. The company shows consistent revenue growth and expanding market share. Most analysts recommend holding or buying for its innovative technology solutions and competitive market position.

Is PHTR stock suitable for long-term holding or short-term trading?

PHTR is better suited for short-term trading due to its high volatility. The token has experienced significant price fluctuations, ranging from historical highs of $1 to lows of $0.0008677. For risk-tolerant traders, short-term opportunities may be more profitable than long-term holding.

Is TrustWallet (TWT) a good investment?: Analyzing the potential and risks of the native token of a popular crypto wallet

Is THORWallet (TITN) a good investment?: A comprehensive analysis of features, tokenomics, and market potential

2025 WALLET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Dropee Question of the Day and Daily Combo Answers Guide

Ganache Blockchain

How Does BONK Compare to Pump.Fun and Believe in the Solana Meme Coin Market?

What Is Token Economics Model: KAS Distribution, Inflation Mechanism & DAO Governance Explained

How Do Kaspa (KAS) On-Chain Metrics Predict Price Movements in 2026?