2025 NSDX Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: Market Position and Investment Value of NSDX

NASDEX (NSDX) is a decentralized synthetic asset exchange that enables users to mint tokenized stocks through an overcollateralization mechanism, mapping real-world stock prices for on-chain trading and liquidity mining. Since its launch in September 2021, NSDX has established itself as a unique player in the digital assets ecosystem. As of January 2026, NSDX maintains a market capitalization of approximately $97,621.58, with a circulating supply of around 18,985,137 tokens, currently trading at $0.005142 per token. This innovative platform represents a bridge between traditional financial markets and blockchain technology, playing an increasingly important role in decentralized finance applications.

This article will provide a comprehensive analysis of NSDX's price movements through 2026-2031, integrating historical trends, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors considering exposure to this synthetic asset trading platform.

NSDX Market Analysis Report

I. NSDX Price History Review and Current Market Status

NSDX Historical Price Evolution

-

2021: Project launch on October 10th at an initial price of $0.25016. The token rapidly appreciated, reaching its all-time high of $0.908581 on October 10, 2021, representing a 262% gain from launch price.

-

2021-2025: Extended bear market phase. The token experienced significant depreciation throughout this period, declining from its peak as market conditions deteriorated and the broader cryptocurrency market contracted.

-

2025-2026: Continued downward pressure. The token reached its all-time low of $0.00452616 on January 1, 2026, marking a 99.50% decline from the all-time high, reflecting sustained selling pressure and market headwinds.

NSDX Current Market Status

As of January 3, 2026, NSDX is trading at $0.005142, with a 24-hour trading volume of $11,890.88. The token demonstrates weak short-term momentum, declining 0.22% in the past hour and 0.23% over the last 24 hours. Over a longer timeframe, the token has declined 7.77% in the past 7 days, 11.31% over the past 30 days, and 74.86% over the past year.

The fully diluted market capitalization stands at $401,364.35, with a circulating supply of 18,985,137.41 tokens out of a maximum supply of 100,000,000 tokens. The circulating supply currently represents approximately 18.99% of the maximum supply. The token maintains a market dominance of 0.000012%, indicating minimal impact on the broader cryptocurrency market. With 6,154 unique holders, the token has a concentrated holder base.

NSDX operates on the Polygon (MATIC) blockchain, with the contract address 0xe8d17b127ba8b9899a160d9a07b69bca8e08bfc6. The current market sentiment reflects fear, consistent with broader market conditions. The token is available for trading on Gate.com, providing liquidity for interested participants.

Click to view current NSDX market price

NSDX Market Sentiment Index

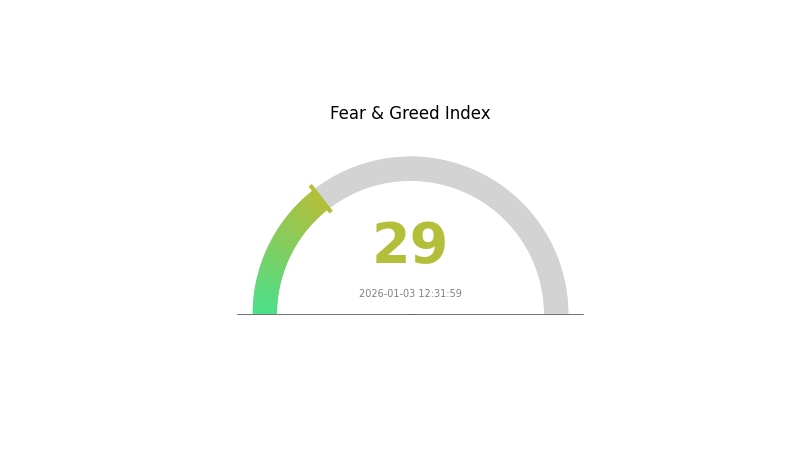

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing a fear sentiment, with the index reading at 29. This indicates increased market anxiety and cautious investor behavior. During periods of fear, market volatility tends to rise as traders adopt defensive strategies. Risk-averse investors may consider reducing exposure, while contrarian traders might view this as a potential accumulation opportunity. Monitor key support levels and market developments closely, as extreme fear readings often precede significant market reversals or corrections.

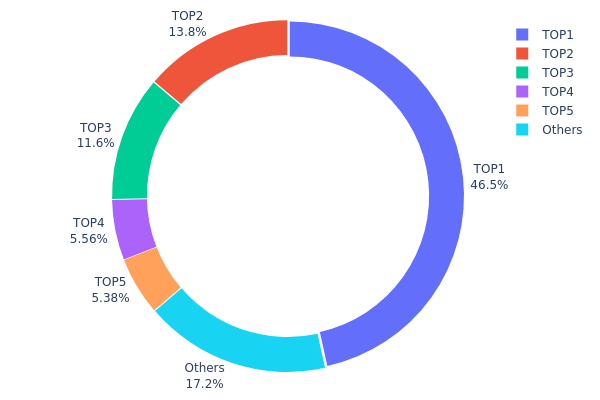

NSDX Holding Distribution

The address holding distribution map reveals the concentration pattern of NSDX tokens across the blockchain network. It visualizes the top holders and their proportional stake in the total token supply, serving as a critical indicator of the project's decentralization status and potential governance risks. By analyzing how tokens are distributed among addresses, market participants can assess the liquidity landscape, identify major stakeholders, and evaluate the token's vulnerability to coordinated actions by concentrated holders.

NSDX demonstrates a notably concentrated holding structure, with the top five addresses controlling approximately 82.78% of the total token supply. The leading address alone accounts for 46.53% of all circulating tokens, representing a significant concentration point that substantially exceeds healthy decentralization thresholds. The second and third largest holders contribute an additional 13.78% and 11.55% respectively, further compounding the concentration effect. Only 17.22% of tokens remain distributed among all other addresses, indicating a fragmented retail holder base relative to the dominant institutional or whale positions. This distribution pattern suggests limited token decentralization and raises concerns about governance stability.

The pronounced concentration observed in NSDX's holding structure creates material implications for market dynamics and price stability. With fewer than five entities controlling approximately four-fifths of the token supply, the potential for significant price volatility exists, as coordinated selling or strategic accumulation by major holders could substantially impact market sentiment and trading volumes. Furthermore, this concentration may amplify governance centralization risks, where key decisions affecting the protocol could be influenced by a limited number of stakeholders, thereby compromising the decentralized ethos typically sought in blockchain projects. The current distribution reflects a market structure characterized by early-stage concentration typical of projects in development phases, though sustained concentration at these levels may hinder organic market maturation and community participation expansion.

Click to view current NSDX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcc04...9b2319 | 36281.32K | 46.53% |

| 2 | 0x35ca...414f95 | 10747.60K | 13.78% |

| 3 | 0x0d07...b492fe | 9005.69K | 11.55% |

| 4 | 0xe43e...64e6a9 | 4333.33K | 5.55% |

| 5 | 0x48f6...bf073b | 4192.00K | 5.37% |

| - | Others | 13401.29K | 17.22% |

II. Core Factors Affecting NSDX's Future Price

Market Sentiment and Investor Confidence

-

Market Sentiment Impact: Investor emotions and confidence directly influence NSDX/USD price movements. Positive market sentiment regarding widespread NSDX adoption or major technological breakthroughs can drive price appreciation.

-

Historical Performance: Historical price trends and market demand serve as key indicators for future price direction.

-

Adoption Catalysts: Price volatility is significantly affected by news related to NSDX's broader adoption and substantial technological innovations in the ecosystem.

III. 2026-2031 NSDX Price Forecast

2026 Outlook

- Conservative Forecast: $0.00381 - $0.00515

- Neutral Forecast: $0.00515 - $0.00752

- Bullish Forecast: $0.00752 (requiring sustained market momentum and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with increasing adoption potential

- Price Range Forecast:

- 2027: $0.0052 - $0.00837 (23% upside potential)

- 2028: $0.00449 - $0.01022 (43% upside potential)

- 2029: $0.00518 - $0.01142 (70% upside potential)

- Key Catalysts: Technology upgrades, partnership announcements, increased institutional interest, and broader market recovery

2030-2031 Long-term Outlook

- Base Case: $0.00829 - $0.01496 (96% upside potential by 2030, assuming stable market conditions and consistent protocol development)

- Bullish Case: $0.01078 - $0.01366 (143% upside potential by 2031, assuming accelerated adoption and positive regulatory environment)

- Transformative Case: $0.01496+ (requiring breakthrough network utility, mainstream adoption, and favorable macroeconomic conditions)

- January 3, 2026: NSDX trading near support levels with recovery potential over the forecast period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00752 | 0.00515 | 0.00381 | 0 |

| 2027 | 0.00837 | 0.00634 | 0.0052 | 23 |

| 2028 | 0.01022 | 0.00735 | 0.00449 | 43 |

| 2029 | 0.01142 | 0.00879 | 0.00518 | 70 |

| 2030 | 0.01496 | 0.01011 | 0.00829 | 96 |

| 2031 | 0.01366 | 0.01253 | 0.01078 | 143 |

NASDEX (NSDX) Professional Investment Report

IV. NSDX Professional Investment Strategy and Risk Management

NSDX Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Those seeking exposure to decentralized synthetic asset trading infrastructure with moderate to high risk tolerance

- Operational recommendations:

- Accumulate during market downturns when NSDX trades below key support levels, taking advantage of the current -74.86% year-over-year decline

- Maintain a disciplined Dollar-Cost Averaging (DCA) approach to reduce timing risk given the project's volatility

- Set realistic profit-taking targets at 50-100% gains, considering the token's historical volatility range

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Monitor the current price level of $0.005142 against historical highs ($0.908581 in October 2021) and recent lows ($0.00452616 in January 2026)

- 24-Hour Volume Analysis: Track the daily trading volume of $11,890.88 to identify liquidity patterns and potential breakout opportunities

- Wave trading key points:

- Observe the -0.23% 24-hour price change and -7.77% 7-day decline to identify potential reversal patterns

- Execute positions during high-volume sessions to ensure optimal entry and exit execution

NSDX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio allocation

- Active investors: 2-5% of portfolio allocation

- Professional investors: 5-10% of portfolio allocation with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine NSDX holdings with stablecoins and other established cryptocurrencies to mitigate concentrated risk exposure

- Position Sizing: Limit individual NSDX positions to maintain strict stop-loss orders at 15-20% below entry price given the token's high volatility

(3) Secure Storage Solutions

- Hot Wallet Usage: Gate Web3 Wallet for frequent trading and active position management on the Polygon network

- Hardware Wallet Strategy: For long-term holdings, transfer NSDX to secure offline storage solutions after acquisition

- Security considerations: Always verify contract addresses on PolygonScan before transactions; never share private keys or recovery phrases; enable multi-signature authorization for large holdings

V. NSDX Potential Risks and Challenges

NSDX Market Risks

- Extreme Price Volatility: NSDX has experienced a catastrophic -74.86% decline over the past year, with historical volatility ranging from $0.908581 to current levels, indicating severe market instability

- Liquidity Constraints: With only $11,890.88 in 24-hour trading volume and a market capitalization of $97,621.58, the token faces significant liquidity challenges that could amplify slippage during large transactions

- Market Sentiment Deterioration: The token currently trades at only 0.57% of its all-time high, suggesting diminished investor confidence and reduced institutional interest

NSDX Regulatory Risks

- Synthetic Asset Compliance: Regulatory authorities worldwide are increasingly scrutinizing decentralized finance protocols dealing with real-world asset tokenization, which could impact NSDX's operational framework

- Securities Classification: Jurisdictions may classify tokenized stocks as securities, subjecting the protocol to stricter regulatory requirements and potential operational restrictions

- Cross-Border Trading Limitations: Future regulatory actions could restrict retail access to synthetic asset platforms in specific jurisdictions, reducing the addressable market

NSDX Technology Risks

- Smart Contract Vulnerabilities: As a DeFi protocol managing user collateral and synthetic assets, NSDX faces inherent smart contract security risks including potential exploits or vulnerabilities in the over-collateralization mechanism

- Blockchain Dependency: The protocol's reliance on the Polygon network means its performance and security are subject to the underlying blockchain's stability and validator network integrity

- Oracle Risk: The accuracy of real-world stock price feeds is critical; any failure or manipulation of price oracles could result in significant protocol-wide consequences and user losses

VI. Conclusion and Action Recommendations

NSDX Investment Value Assessment

NSDX operates within the emerging decentralized synthetic asset space, offering users tokenized exposure to real-world stocks through on-chain mechanisms. However, the token faces substantial challenges: it has depreciated 74.86% year-over-year, maintains minimal trading liquidity, and operates in a nascent market segment with uncertain regulatory clarity. The project's long-term viability depends on achieving meaningful adoption, demonstrating technical security, and navigating evolving regulatory frameworks. Current valuation levels may represent value for risk-tolerant investors, but the project remains highly speculative with significant downside potential.

NSDX Investment Recommendations

✅ Beginners: Exercise extreme caution; consider allocating only 0.5-1% of portfolio if interested in synthetic asset exposure; prioritize learning the protocol mechanics before investing meaningful capital

✅ Experienced Investors: Implement disciplined position sizing with strict risk management; use dollar-cost averaging strategies; maintain active monitoring of technical levels and regulatory developments

✅ Institutional Investors: Conduct comprehensive due diligence on protocol governance, smart contract audits, and regulatory compliance; consider participating only after the project demonstrates sustained adoption metrics and achieves greater liquidity

NSDX Trading Participation Methods

- Direct Token Trading: Purchase NSDX on Gate.com platform supporting the token; ensure wallet compatibility with the Polygon network before transactions

- Liquidity Provision: Participate in yield farming opportunities on the protocol to generate returns from trading fees and liquidity incentives

- Synthetic Asset Creation: Engage directly with the protocol to mint tokenized stocks through the over-collateralization mechanism if you possess technical proficiency and significant capital

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must conduct independent research and consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose entirely. All cryptocurrency markets, particularly those involving synthetic assets, carry substantial risk of total capital loss.

FAQ

What is NSDX and what is its current price?

NSDX (NASDEX) is a cryptocurrency token currently priced at $0.0055 per NSDX. With a circulating supply of approximately 18.99 million tokens, NSDX maintains a market cap of around $105,164. It represents a digital asset within the Web3 ecosystem.

What factors influence NSDX price movements?

NSDX price movements are influenced by supply and scarcity mechanisms, market demand, institutional investment activity, trading volume, broader crypto market trends, and protocol developments affecting the decentralized exchange ecosystem.

What is the price prediction for NSDX in 2024 and 2025?

NSDX price prediction for 2024-2025 is expected to range between $0.005876 and $0.00890029, based on current market trends and technical analysis.

How does NSDX compare to other similar cryptocurrencies or tokens?

NSDX stands out with its focus on Polygon ecosystem integration and decentralized trading capabilities. It offers competitive transaction efficiency and lower fees compared to similar tokens, with strong trading volume and an expanding community-driven ecosystem.

What are the risks and potential returns of investing in NSDX?

NSDX offers a mean return of 0.14% with potential upside of 1.42%. The investment carries moderate risk with a standard deviation of 0.77% and a value at risk of -1.23%.

Where can I buy and trade NSDX, and what is the trading volume?

You can buy and trade NSDX on major cryptocurrency exchanges. The current trading volume is approximately $11,668. Check leading exchange platforms for real-time pricing and volume data.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Dropee Question of the Day and Daily Combo Answers Guide

Ganache Blockchain

How Does BONK Compare to Pump.Fun and Believe in the Solana Meme Coin Market?

What Is Token Economics Model: KAS Distribution, Inflation Mechanism & DAO Governance Explained

How Do Kaspa (KAS) On-Chain Metrics Predict Price Movements in 2026?