2025 NFP Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: NFP's Market Position and Investment Value

NFPrompt (NFP) is an AI-driven UGC platform designed for the new generation of Web3 creators, offering an all-in-one ecosystem that combines AI-creation, social community, and commercialization. Since its launch in December 2023, NFP has established itself as an emerging player in the creator economy space. As of December 21, 2025, NFP has achieved a market capitalization of $12,014,307.51 with a circulating supply of approximately 534.92 million tokens, currently trading at $0.02246 per token.

This platform represents a unique convergence of artificial intelligence and Web3 innovation, playing an increasingly pivotal role in enabling digital creators to monetize their work within decentralized ecosystems.

This article will provide a comprehensive analysis of NFP's price trajectory from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for participants in the digital asset market.

NFPrompt (NFP) Market Analysis Report

I. NFP Price History Review and Market Status

NFP Historical Price Evolution

- December 27, 2023: NFP reached its all-time high (ATH) of $1.28501, marking a significant peak in the project's trading history.

- December 18, 2025: NFP hit its all-time low (ATL) of $0.02082, representing a substantial decline from historical highs.

- Current Period (2025): The token has experienced severe downward pressure, declining approximately 91.75% over the past year.

NFP Current Market Dynamics

As of December 21, 2025, NFPrompt (NFP) is trading at $0.02246, with a 24-hour trading volume of $15,535.82. The token demonstrates continued weakness in the near term, declining 0.27% over the past hour and 1% over the past 24 hours. The broader 7-day and 30-day performance indicators show more pronounced declines of -11.95% and -25.95% respectively, reflecting sustained selling pressure.

The market capitalization stands at $12,014,307.51, with a fully diluted valuation (FDV) of $22,460,000. The circulating supply comprises 534,920,191.78 NFP tokens out of a total supply of 1,000,000,000, representing 53.49% circulation. The token maintains a presence across 18 different exchanges and has attracted 11,595 token holders.

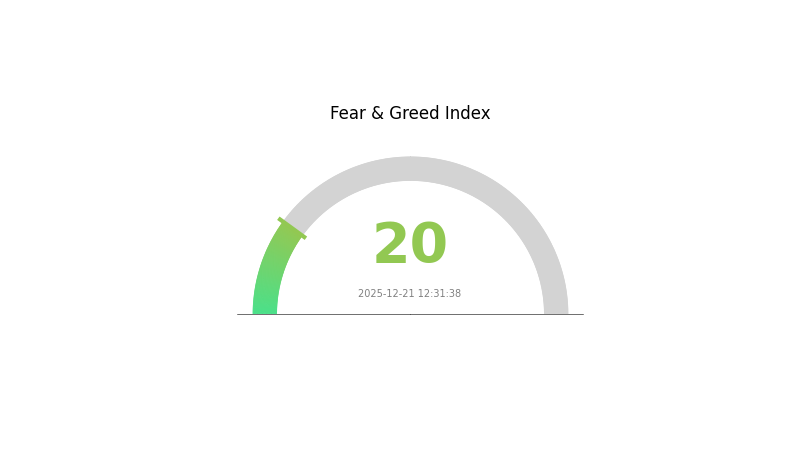

Current market sentiment is characterized by extreme fear (VIX rating of 20), which may be contributing to the broader risk-off environment affecting NFP and similar tokens. The 24-hour trading range shows modest volatility, with the token fluctuating between a low of $0.02245 and a high of $0.02326.

Check the current NFP market price

NFP Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting 20. This indicates widespread panic and pessimism among investors. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors. Market participants should exercise caution while considering that excessive fear sometimes precedes significant recoveries. Monitor market developments closely and ensure proper risk management during this volatile period. Trading on Gate.com allows you to capitalize on market movements with advanced tools and real-time data.

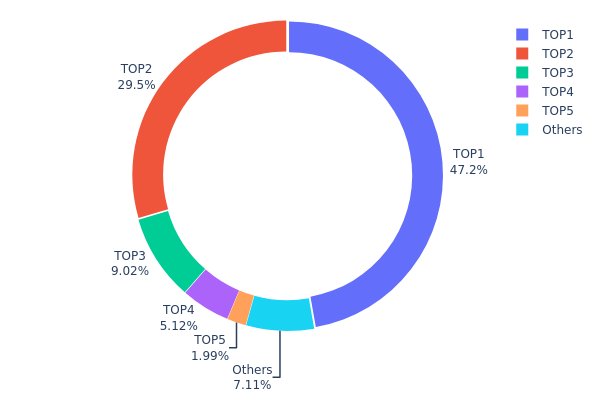

NFP Holding Distribution

The address holding distribution chart illustrates the concentration of token ownership across the blockchain network, revealing the distribution patterns among major stakeholders and their relative proportion of total token supply. This metric is instrumental in assessing the degree of decentralization, identifying potential concentration risks, and evaluating the structural stability of the ecosystem.

NFP demonstrates significant holding concentration, with the top two addresses commanding 76.75% of the total supply. The largest holder (0x3ebc...f7c6e7) accounts for 47.21%, while the second-largest (0xf977...41acec) holds 29.54%, collectively representing over three-quarters of circulating tokens. The third and fourth addresses contribute an additional 14.13%, further consolidating supply concentration in a limited number of entities. This distribution pattern indicates pronounced centralization characteristics within the token ecosystem.

Such elevated concentration levels present material implications for market dynamics and structural vulnerability. The concentration in top addresses raises considerations regarding potential price volatility risks, as large holders possess substantial influence over supply and market movements. Additionally, the burn address (0x0000...00dead) holding 1.98% indicates ongoing token deflation mechanisms. The remaining 7.14% distributed among other addresses reflects limited retail participation and suggests that genuine decentralization remains constrained. This holding structure underscores the necessity for continued monitoring of major stakeholder activities and their potential impact on market equilibrium and long-term ecosystem development.

Click to view current NFP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ebc...f7c6e7 | 465079.81K | 47.21% |

| 2 | 0xf977...41acec | 291007.68K | 29.54% |

| 3 | 0xff97...8d739a | 88845.87K | 9.01% |

| 4 | 0x87a7...054039 | 50446.08K | 5.12% |

| 5 | 0x0000...00dead | 19601.11K | 1.98% |

| - | Others | 70019.45K | 7.14% |

II. Core Factors Affecting NFP Future Price

Macroeconomic Environment

-

Supply and Demand Dynamics: NFP price movements are primarily driven by supply and demand relationships. Changes in market supply levels directly impact price direction and volatility.

-

Economic Data Impact: Economic indicators play a crucial role in determining price trends. Strong economic data can drive price appreciation, while weak data may lead to price declines.

-

Market Sentiment: Market psychology and investor sentiment significantly influence short-term price fluctuations. Positive sentiment can accelerate price gains, while negative sentiment may trigger corrections.

-

Geopolitical Factors: International geopolitical tensions and uncertainties can trigger market volatility and cause substantial price swings in the NFP market.

Note: The provided source material contains limited specific information about NFP's supply mechanisms, institutional holdings, technological developments, or ecosystem applications. Additional detailed research would be required to populate the remaining template sections with verified information.

Three、2025-2030 NFP Price Forecast

2025 Outlook

- Conservative Forecast: $0.02097 - $0.02255

- Neutral Forecast: $0.02255 - $0.03315

- Optimistic Forecast: $0.03315 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing adoption and market maturation, transitioning from consolidation to growth trajectory.

- Price Range Forecast:

- 2026: $0.02618 - $0.03314 (23% potential upside)

- 2027: $0.02958 - $0.04239 (35% potential upside)

- 2028: $0.02259 - $0.04081 (62% potential upside)

- Key Catalysts: Increased institutional interest, ecosystem expansion, technological upgrades, and growing utility adoption across platforms like Gate.com and other major trading venues.

2029-2030 Long-term Outlook

- Base Case: $0.03863 - $0.04095 by 2029 (71% appreciation potential, assuming steady market conditions and normal adoption rates)

- Optimistic Case: $0.03979 - $0.04377 by 2030 (77% appreciation potential, assuming accelerated adoption and positive regulatory environment)

- Transformative Case: Potential for higher valuations contingent upon breakthrough innovations, significant mainstream adoption, and major partnership announcements.

- December 21, 2025: NFP trading at $0.02255 (current market entry point following 2025 consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03315 | 0.02255 | 0.02097 | 0 |

| 2026 | 0.03314 | 0.02785 | 0.02618 | 23 |

| 2027 | 0.04239 | 0.03049 | 0.02958 | 35 |

| 2028 | 0.04081 | 0.03644 | 0.02259 | 62 |

| 2029 | 0.04095 | 0.03863 | 0.02472 | 71 |

| 2030 | 0.04377 | 0.03979 | 0.02029 | 77 |

NFPrompt (NFP) Professional Investment Strategy and Risk Management Report

IV. NFP Professional Investment Strategy and Risk Management

NFP Investment Methodology

(1) Long-Term Holding Strategy

-

Target Audience: Web3 creators, content creators seeking passive income, long-term believers in AI-driven UGC platforms

-

Operational Recommendations:

- Accumulate NFP tokens during market downturns, as the current price of $0.02246 represents approximately 98.25% decline from its all-time high of $1.28501 (December 27, 2023), potentially offering entry opportunities for risk-tolerant investors

- Dollar-cost averaging (DCA) approach: Regular purchases at fixed intervals to reduce timing risk and average entry costs

- Monitor platform development milestones and community engagement metrics as key indicators for long-term value realization

-

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure custody of NFP tokens on BSC (Binance Smart Chain)

- Enable multi-layer security protocols including transaction whitelisting and spending limits

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Price Action Analysis: Monitor 1-hour, 4-hour, and daily timeframes to identify support and resistance levels around the current support zone of $0.02245 (24-hour low)

- Volume Profile: Track 24-hour trading volume of $15,535.82 to identify breakout patterns; declining volume during downtrends may signal consolidation before recovery

-

Wave Trading Considerations:

- Current market structure: The 91.75% decline over the past year indicates extreme bearish sentiment; watch for capitulation patterns suggesting potential reversal zones

- Resistance levels: Historical resistance exists at previous support levels; traders should establish clear exit targets given the high volatility and risk profile

NFP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total crypto portfolio allocation (given the highly volatile nature and current bearish price action)

- Aggressive Investors: 2-5% of total crypto portfolio allocation (acceptable only for investors with high risk tolerance and belief in platform fundamentals)

- Professional Investors: 3-10% of total crypto portfolio allocation with hedging strategies and disciplined position sizing

(2) Risk Hedging Approaches

- Diversification Strategy: Balance NFP holdings with established Layer-1 or Layer-2 blockchain tokens to reduce concentrated risk exposure

- Stablecoin Allocation: Maintain 30-50% of intended investment capital in stablecoins, deploying capital systematically during significant price declines (>15% weekly drops)

(3) Secure Storage Solution

- Hardware Wallet Alternative: If self-custody preferred, use non-custodial options with strong security practices; however, Gate.com Web3 Wallet provides convenient and reasonably secure access for active traders

- Self-Custody Best Practices: For large holdings, utilize non-custodial wallets with multi-signature capabilities and hardware wallet backing

- Security Considerations: Never share private keys or seed phrases; enable withdrawal whitelist addresses; use VPNs when accessing wallets on public networks; verify contract addresses before transactions (BSC contract: 0x551897f8203bd131b350601d3ac0679ba0fc0136)

V. NFP Potential Risks and Challenges

NFP Market Risk

- Severe Price Volatility: NFP has declined 91.75% year-over-year and 25.95% over the past 30 days, indicating extreme market instability and potential for further downside; speculative nature of early-stage AI/UGC projects amplifies risk

- Low Trading Liquidity: 24-hour trading volume of only $15,535.82 represents minimal liquidity; large position entries/exits may cause significant price slippage

- Market Capitalization Risk: Current market cap of $22.46 million is extremely small, making the token highly susceptible to market manipulation and sudden price swings; minimal exchange listing (18 exchanges) limits accessibility

NFP Regulatory Risk

- Regulatory Uncertainty for UGC/AI Platforms: Evolving global regulations regarding AI-generated content, copyright protection, and creator compensation mechanisms create undefined legal frameworks that could impact platform operations and token utility

- Geographic Compliance: Restrictions in certain jurisdictions (US, EU) regarding unregistered token sales and trading could limit the platform's addressable market and create compliance costs

NFP Technology Risk

- Platform Execution Risk: As a development-stage project, NFPrompt faces execution challenges in delivering its promised AI creation, social community, and commercialization features; delays or feature inadequacies could erode investor confidence

- Smart Contract Vulnerability: BEP-20 token on BSC carries risks of potential smart contract exploits or vulnerabilities; no mention of formal audits in available materials indicates potential security concerns

- Blockchain Dependency: Reliance on BSC network means exposure to BSC ecosystem risks, including network congestion, security incidents, or protocol changes that could affect token functionality

VI. Conclusion and Action Recommendations

NFP Investment Value Assessment

NFPrompt presents a highly speculative investment opportunity targeting the intersection of AI, UGC, and Web3 creator economy. While the platform addresses a potentially significant market opportunity (creator monetization and AI-assisted content creation), the token has experienced catastrophic value destruction (91.75% decline YoY from $1.28501 to $0.02246). The extremely low market cap ($22.46M), minimal liquidity ($15.5K daily volume), and limited exchange presence suggest this is an extremely high-risk, early-stage asset. Investment should be considered exclusively by risk-capital allocations, not core portfolio holdings. Success depends entirely on platform execution, creator adoption, and regulatory clarity around AI-generated content and tokenomics utility. The current price may reflect genuine fundamental challenges rather than simply a cyclical market opportunity.

NFP Investment Recommendations

✅ Beginners: Avoid this asset entirely until the project demonstrates significant platform traction, sustainable user growth metrics, and clear regulatory compliance frameworks. If interested, allocate only 0.1-0.5% of crypto portfolio as speculative research position; prioritize education on project fundamentals before investing capital.

✅ Experienced Investors: Consider small speculative positions (1-3% of crypto allocation) only if personally convinced of platform-market-fit and team execution capability. Implement strict stop-loss discipline at 20-30% below entry price. Monitor project development milestones and community activity metrics as leading indicators for continued engagement.

✅ Institutional Investors: Generally unsuitable given illiquidity, low market cap, and execution risks; would require significant improvement in trading volume, exchange listings, and platform metrics before institutional consideration. If pursued, limit to sub-1% allocations with 12+ month lockup commitment and direct management engagement.

NFP Trading Participation Methods

- Gate.com Platform Trading: Direct trading of NFP on Gate.com provides access to spot trading with competitive fees; suitable for active traders monitoring technical levels and capitalizing on volatility

- Dollar-Cost Averaging (DCA): Systematic accumulation through regular automated purchases on Gate.com reduces timing risk and provides disciplined exposure to long-term platform development

- Limit Orders Strategy: Given high volatility, utilize limit orders at psychological support levels (current range: $0.022-$0.024) rather than market orders to minimize slippage and improve entry pricing

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance, financial circumstances, and investment objectives. Consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely. NFP's extreme price volatility, minimal market liquidity, and development-stage status classify this as high-risk speculative venture capital, not traditional investments.

FAQ

What is NFP crypto?

NFP is the native cryptocurrency of the Non-Fungible People project, designed to support a community-driven platform. It enables transactions and governance within the NFP ecosystem.

How much is nfp crypto?

NFP crypto is currently priced at $0.02226385, down 1.62418% in the last 24 hours as of December 21, 2025. The token maintains steady market activity with consistent trading volume across major platforms.

How much will cryptocurrency be worth in 2025?

Bitcoin is projected to reach $200,000 by 2025 according to Standard Chartered. Predictions vary widely based on market conditions, adoption rates, and macroeconomic factors. Actual values depend on multiple variables.

What factors affect NFP price prediction?

NFP price prediction is influenced by employment data strength, US Dollar movement, market sentiment, Federal Reserve policy expectations, and global economic outlook. Strong job reports typically strengthen the dollar and crypto valuations, while weak data may increase risk appetite toward alternative assets.

Is NFP a good investment for 2025?

NFP shows moderate investment potential for 2025, with projected maximum price of $0.026 and average trading price around $0.0253, offering potential ROI of 7.4% by December 2025.

2025 EPT Price Prediction: Bullish Outlook as Adoption Soars and Market Matures

Is HyperGPT (HGPT) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors in 2024

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

What is AITECH: Exploring the Cutting-Edge Technology Revolutionizing Artificial Intelligence Applications

How to Analyze On-Chain Data: Active Address Count, Transaction Volume, Whale Distribution, and Fee Trends in 2026

Will Stellar (XLM) Price Reach $1?

What is Tokenomics and Why Is It Important?

What is tokenomics: token distribution mechanisms, inflation design, and governance rights explained

What are the core technical innovations and ecosystem challenges of Internet Computer (ICP) in 2026?