2025 GEL Price Prediction: Will the Georgian Lari Strengthen Against Major Currencies?

Introduction: GEL's Market Position and Investment Value

Gelato (GEL), as a personal Ethereum robot for automated transactions, has been executing and automating trades according to user-specified instructions and allowances since its inception. As of 2025, Gelato's market capitalization has reached $5,419,907, with a circulating supply of approximately 265,812,021 tokens, and a price hovering around $0.02039. This asset, known as the "decentralized automation protocol," is playing an increasingly crucial role in the field of smart contract automation on the Ethereum network.

This article will comprehensively analyze Gelato's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. GEL Price History Review and Current Market Status

GEL Historical Price Evolution

- 2021: GEL reached its all-time high of $4.21 on November 30, marking a significant milestone for the project

- 2023-2024: The cryptocurrency market entered a bearish phase, affecting GEL's price performance

- 2025: GEL hit its all-time low of $0.01980527 on November 21, reflecting a severe market downturn

GEL Current Market Situation

As of November 22, 2025, GEL is trading at $0.02039, with a 24-hour trading volume of $23,422.76. The token has experienced a 1.74% decrease in the last 24 hours. GEL's market capitalization stands at $5,419,907, ranking it at 1508th position in the global cryptocurrency market. The current price represents a substantial 99.52% decrease from its all-time high and a slight 2.95% increase from its all-time low. The token's circulating supply is 265,812,021.04 GEL, which is 63.18% of its total supply of 420,690,000 GEL. Over the past week, GEL has seen a significant drop of 25.06%, while its monthly and yearly performances show declines of 52.87% and 90.67%, respectively.

Click to view the current GEL market price

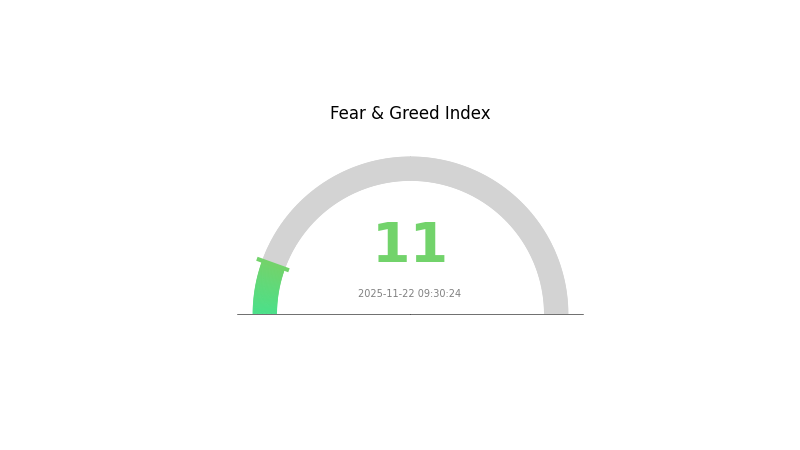

GEL Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 11. This stark reading suggests investors are exceedingly cautious, potentially creating oversold conditions. While such extreme fear often precedes market bottoms, it's crucial to approach with caution. Savvy traders might see this as an opportunity to "be greedy when others are fearful," but always remember to conduct thorough research and manage risks wisely in this volatile market environment.

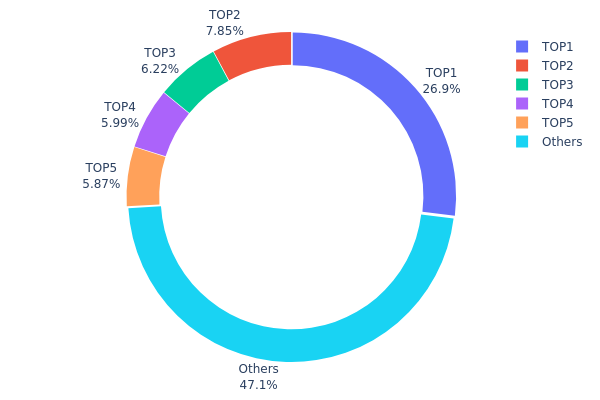

GEL Holdings Distribution

The address holdings distribution for GEL reveals a significant concentration of tokens among a few top addresses. The largest holder possesses 26.94% of the total supply, while the top 5 addresses collectively control 52.85% of GEL tokens. This concentration level indicates a relatively centralized distribution, which may raise concerns about potential market manipulation and price volatility.

The substantial holdings of the top addresses could potentially impact market dynamics, as any significant movement of tokens from these wallets might cause noticeable price fluctuations. However, it's worth noting that 47.15% of the tokens are distributed among other addresses, suggesting some level of wider distribution beyond the top holders.

This current distribution pattern reflects a moderate degree of centralization in GEL's on-chain structure. While this concentration may provide some stability in terms of large holders potentially having long-term interests, it also highlights the need for increased decentralization to enhance market resilience and reduce the risk of price manipulation by a few major players.

Click to view the current GEL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4c64...c69b7c | 113348.14K | 26.94% |

| 2 | 0x4a7c...a7ddd6 | 33042.76K | 7.85% |

| 3 | 0x55fa...fa4416 | 26173.14K | 6.22% |

| 4 | 0x706c...d834c4 | 25197.64K | 5.98% |

| 5 | 0xc8e4...163d29 | 24676.85K | 5.86% |

| - | Others | 198251.47K | 47.15% |

II. Key Factors Affecting GEL's Future Price

Supply Mechanism

- Fixed Supply: GEL has a fixed total supply, which can create scarcity and potentially support price stability over time.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions have not yet publicly disclosed significant holdings in GEL, which may impact its market perception and liquidity.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, GEL may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: The GEL ecosystem is still in its early stages, with limited DApps and projects currently utilizing the token.

III. GEL Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01905 - $0.02027

- Neutral forecast: $0.02027 - $0.02179

- Optimistic forecast: $0.02179 - $0.02331 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01917 - $0.02757

- 2028: $0.02530 - $0.03176

- Key catalysts: Expanding use cases and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.02934 - $0.03374 (assuming steady market growth)

- Optimistic scenario: $0.03814 - $0.04791 (assuming strong adoption and favorable market conditions)

- Transformative scenario: Up to $0.04791 (with breakthrough innovations and mass adoption)

- 2030-12-31: GEL $0.03374 (65% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02331 | 0.02027 | 0.01905 | 0 |

| 2026 | 0.03072 | 0.02179 | 0.01155 | 6 |

| 2027 | 0.02757 | 0.02626 | 0.01917 | 28 |

| 2028 | 0.03176 | 0.02691 | 0.0253 | 31 |

| 2029 | 0.03814 | 0.02934 | 0.02728 | 43 |

| 2030 | 0.04791 | 0.03374 | 0.01721 | 65 |

IV. Professional Investment Strategies and Risk Management for GEL

GEL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate GEL tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to manage downside risk

GEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Strategies

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Gelato wallet (if available)

- Security precautions: Use two-factor authentication, store private keys offline

V. Potential Risks and Challenges for GEL

GEL Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

GEL Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory changes

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Adapting to evolving regulatory requirements

GEL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Ethereum network limitations may affect performance

- Technological obsolescence: Risk of being outpaced by newer solutions

VI. Conclusion and Action Recommendations

GEL Investment Value Assessment

Gelato (GEL) presents a high-risk, high-potential investment opportunity within the Ethereum ecosystem. While its automation capabilities offer long-term value, short-term volatility and regulatory uncertainties pose significant risks.

GEL Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the technology ✅ Experienced investors: Allocate a portion of crypto portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider OTC trading

GEL Participation Methods

- Spot trading: Purchase GEL tokens on Gate.com

- Staking: Participate in staking programs if offered by the Gelato network

- DeFi integration: Utilize Gelato's automation features within supported DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is gel stock a good buy?

GEL could be a good buy for investors seeking exposure to the growing Web3 sector. Its innovative blockchain technology and increasing adoption suggest potential for future growth.

What is gels stock prediction for 2025?

Based on current market trends and expert analysis, GEL's price is predicted to reach around $0.15 to $0.20 by 2025, showing potential for moderate growth in the coming years.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or even $1 million per coin in the coming years.

What is the future target price?

The future target price for GEL is projected to reach $0.50 by the end of 2026, based on current market trends and potential growth in the Web3 ecosystem.

Ethereum Founder Vitalik Buterin: Age, Background, and Achievements

2025 ENS Price Prediction: Navigating the Future of Decentralized Domain Names

2Z vs GRT: The Battle for Dominance in the Emerging Tech Market

ENS vs GMX: Which Decentralized Domain Name System Will Dominate Web3?

Unlocking the Potential of DeFi with Blockchain Data Feeds

Yearn Finance's yETH Hack: $3M Sent to Tornado Cash - DeFi Security Analysis

What is Smooth Love Potion?

Why Is XRP's Price Not Going Up After the SEC Lawsuit Win?

What is Conflux (CFX)?

Stoinks Wallet

Externally Owned Account (EOA)