2025 DWAIN Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: DWAIN's Market Position and Investment Value

DWAIN (DWAIN), as an AI meme running on the Solana blockchain, has been making waves since its inception. As of 2025, DWAIN's market capitalization has reached $100,519, with a circulating supply of approximately 987,616,534 tokens, and a price hovering around $0.00010178. This asset, often referred to as a "Solana-based AI meme token," is playing an increasingly crucial role in the intersection of artificial intelligence and blockchain technology.

This article will provide a comprehensive analysis of DWAIN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. DWAIN Price History Review and Current Market Status

DWAIN Historical Price Evolution

- 2025 (January): DWAIN reached its all-time high of $0.017821, marking a significant milestone for the project.

- 2025 (October): The token experienced a sharp decline, hitting its all-time low of $0.00009792.

DWAIN Current Market Situation

As of November 2, 2025, DWAIN is trading at $0.00010178. The token has seen a 24-hour decline of 1.24%, with a trading volume of $9,976.56. DWAIN's market capitalization stands at $100,519.61, ranking it at 5071 in the global cryptocurrency market.

The token has shown mixed performance across different timeframes:

- 1-hour change: +0.31%

- 7-day change: -6.18%

- 30-day change: -30.34%

DWAIN's current price is significantly lower than its all-time high, indicating a substantial market correction. The token's circulating supply is 987,616,534 DWAIN, which is very close to its total supply of 987,615,389.43 DWAIN.

Click to view the current DWAIN market price

DWAIN Market Sentiment Indicator

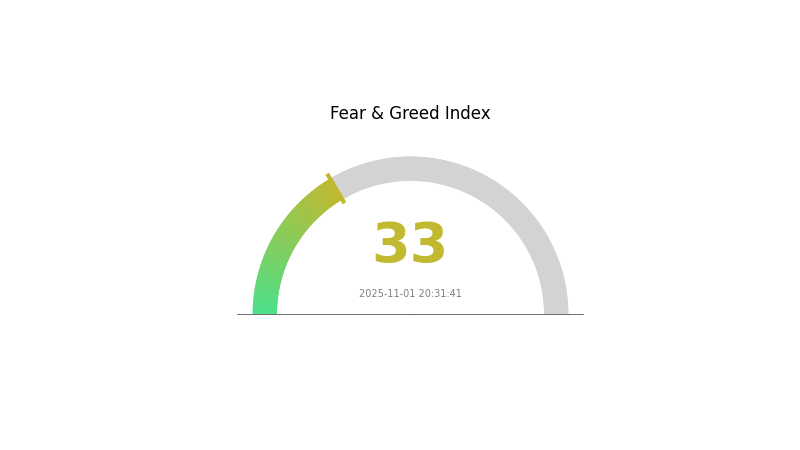

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 33. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a contrarian approach. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider using Gate.com's advanced tools for informed decision-making in these uncertain times.

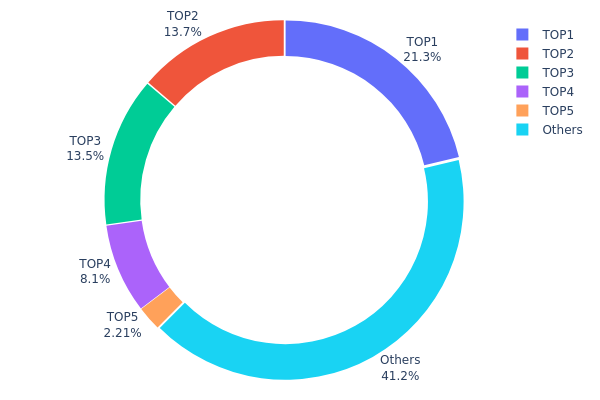

DWAIN Holdings Distribution

The address holdings distribution chart provides insight into the concentration of DWAIN tokens among different wallet addresses. Analysis of the data reveals a significant concentration of tokens among the top holders. The top five addresses collectively control 58.79% of the total DWAIN supply, with the largest holder possessing 21.25% of all tokens.

This level of concentration raises concerns about market centralization and potential price manipulation. The top two addresses alone hold over 35% of the supply, which could lead to increased volatility if large transactions occur. However, it's worth noting that 41.21% of tokens are distributed among other addresses, indicating some degree of broader market participation.

The current distribution structure suggests a moderate level of centralization in DWAIN's on-chain ecosystem. While this concentration may provide stability in some aspects, it also presents risks to market dynamics and could impact the token's ability to achieve true decentralization. Monitoring the movement of tokens from these top addresses will be crucial for understanding future market trends and potential shifts in DWAIN's tokenomics.

Click to view the current DWAIN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 209907.47K | 21.25% |

| 2 | u6PJ8D...ynXq2w | 135702.62K | 13.74% |

| 3 | 2UzYwf...pfdbYq | 133285.71K | 13.49% |

| 4 | DPA3ch...JyeG5T | 79996.91K | 8.10% |

| 5 | 2LydRX...C4J2m6 | 21872.32K | 2.21% |

| - | Others | 406795.42K | 41.21% |

II. Key Factors Influencing DWAIN's Future Price

Institutional and Whale Dynamics

- Enterprise Adoption: Some well-known companies have adopted DWAIN, which could impact its future price trajectory.

Macroeconomic Environment

- Inflation Hedging Properties: DWAIN's performance in inflationary environments may affect its price.

Technological Development and Ecosystem Building

- Ecosystem Applications: Major DApps and ecosystem projects related to DWAIN could influence its value.

III. DWAIN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00006 - $0.00008

- Neutral prediction: $0.00009 - $0.00011

- Optimistic prediction: $0.00012 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00009 - $0.00015

- 2027: $0.00008 - $0.00015

- Key catalysts: Project upgrades, increased adoption, and overall crypto market trends

2028-2030 Long-term Outlook

- Base scenario: $0.00012 - $0.00018 (assuming steady market growth)

- Optimistic scenario: $0.00019 - $0.00022 (assuming strong project performance and favorable market conditions)

- Transformative scenario: Up to $0.00022 (under extremely favorable conditions and widespread adoption)

- 2030-12-31: DWAIN $0.00018 (potential 76% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00012 | 0.0001 | 0.00006 | 0 |

| 2026 | 0.00015 | 0.00011 | 0.00009 | 10 |

| 2027 | 0.00015 | 0.00013 | 0.00008 | 30 |

| 2028 | 0.0002 | 0.00014 | 0.0001 | 38 |

| 2029 | 0.00019 | 0.00017 | 0.00013 | 64 |

| 2030 | 0.00022 | 0.00018 | 0.00012 | 76 |

IV. DWAIN Professional Investment Strategies and Risk Management

DWAIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in AI and meme tokens

- Operational suggestions:

- Accumulate DWAIN during market dips

- Set a long-term price target based on project developments

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem news for potential impacts

- Set stop-loss orders to manage downside risk

DWAIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance DWAIN with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet supporting Solana

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for DWAIN

DWAIN Market Risks

- High volatility: Meme tokens are subject to rapid price swings

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Heavily influenced by social media trends

DWAIN Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on meme tokens

- Platform risk: Dependent on Solana's regulatory compliance

- Cross-border restrictions: Varying legal status in different jurisdictions

DWAIN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Solana network dependencies: Subject to Solana's performance and upgrades

- Limited use case: Primarily speculative, lacking robust utility

VI. Conclusion and Action Recommendations

DWAIN Investment Value Assessment

DWAIN presents a high-risk, high-reward opportunity within the AI meme token space on Solana. While it offers potential for significant returns, it also carries substantial short-term volatility and long-term sustainability concerns.

DWAIN Investment Recommendations

✅ Beginners: Consider small, experimental positions with funds you can afford to lose ✅ Experienced investors: Implement strict risk management and consider as part of a diversified crypto portfolio ✅ Institutional investors: Approach with caution, conduct thorough due diligence on the project's long-term viability

DWAIN Trading Participation Methods

- Spot trading: Available on Gate.com for direct DWAIN/USDT trading

- Limit orders: Use to enter positions at desired price levels

- Dollar-cost averaging: Consider for long-term accumulation strategy

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Dash hit $1000 again?

It's possible, but uncertain. Dash's future price depends on market trends, adoption rates, and overall crypto sentiment. A new bull market could potentially push Dash towards $1000 again.

What is the price prediction for Trump in 2030?

Based on current trends, the price prediction for Trump in 2030 is $10.16. However, this projection may vary.

What is the future of deeper networks?

Deeper networks are poised for significant growth, with projections indicating a potential high of $0.3347 by 2026. Advancements in AI and blockchain technology will likely drive their increased adoption and value.

Which coin will reach 1 rupee prediction?

Shiba Inu (SHIB) is predicted to reach 1 rupee by the end of 2030, based on current market trends and analysis.

What is GOAT: Understanding the Greatest of All Time Concept and Its Impact Across Sports and Culture

What is GORK: Understanding the Revolutionary AI Model Transforming Digital Innovation

What is AIMONICA: A Comprehensive Guide to AI-Powered Business Intelligence and Data Analytics Platform

2025 ELIZA Price Prediction: Expert Analysis and Market Forecast for the Emerging AI Token

What is DWAIN: A Comprehensive Guide to Distributed Web Application Infrastructure Network

2025 DWAIN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

# How Do Exchange Net Inflows and DOT Holdings Impact Polkadot's Liquidity and Fund Flows in 2025?

What is HBAR coin holdings and fund flows: ETF inflows hit $68 million with institutional interest surging

Pi Coin Price Prediction in 2026: Learn Everything About Pi Coin Price

How will regulatory compliance and SEC oversight impact LUNC's future in 2025?

How Does SUI Price Volatility Compare to Bitcoin and Ethereum in 2026?