2025 DAOLITY Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

Introduction: Market Position and Investment Value of DAOLITY

DAOLITY (DAOLITY) is a no-code Web3 development platform that empowers users to build, test, and deploy decentralized applications (dApps) with ease. Designed for teams and businesses, the platform simplifies Web3 integration through an intuitive, click-based interface. As of December 23, 2025, DAOLITY has achieved a market capitalization of $5,602,100, with a circulating supply of 26.5 billion tokens currently priced at $0.0002114. The token represents a bridge between innovation and execution in the decentralized internet, offering plug-and-play functionality and rapid deployment tools for DeFi tools, DAOs, and NFT utilities.

This comprehensive analysis examines DAOLITY's price trajectory and market dynamics, incorporating historical performance patterns, market supply and demand factors, ecosystem development, and broader macroeconomic conditions. The analysis provides professional price forecasts and practical investment strategies for investors seeking to understand this emerging Web3 development platform token.

DAOLITY Market Analysis Report

I. DAOLITY Price History Review and Current Market Status

DAOLITY Historical Price Evolution

Based on available market data, DAOLITY has demonstrated significant price volatility since its listing:

- May 17, 2025: DAOLITY reached its all-time high (ATH) of $0.0075481, marking the peak of investor enthusiasm during this period.

- December 5, 2025: The token declined to its all-time low (ATL) of $0.0000537, representing a sharp correction from historical peaks.

- Current Period (December 23, 2025): Recovery phase with the token trading at $0.0002114, showing a 15.31% gain over the past 24 hours.

DAOLITY Current Market Status

As of December 23, 2025, DAOLITY exhibits the following market characteristics:

Price Performance:

- Current price: $0.0002114

- 24-hour change: +15.31% (price change of +$0.000028068112045790)

- 7-day performance: +50.47%, indicating strong recent momentum

- 30-day performance: -17.03%, reflecting recent volatility

- 1-hour movement: +0.20%

Market Capitalization and Valuation:

- Market capitalization: $5,602,100

- Fully diluted valuation: $21,140,000

- Market dominance: 0.00066%

- Current ranking: #1463 by market cap

Supply Metrics:

- Circulating supply: 26,500,000,000 DAOLITY

- Total supply: 100,000,000,000 DAOLITY

- Maximum supply: 100,000,000,000 DAOLITY

- Circulation ratio: 26.5%

- Token holders: 15,224

Trading Activity:

- 24-hour trading volume: $12,187.15

- 24-hour high: $0.00022736

- 24-hour low: $0.00017889

- Listed on 1 exchange

Network Information:

- Blockchain: BSC (Binance Smart Chain)

- Contract address: 0x6123c1bee174cbf500ab6c02cee47ec348fe871f

The current market sentiment reflects extreme fear conditions (VIX: 24), which has created both selling pressure and potential buying opportunities for risk-tolerant investors. The recent 50.47% gain over seven days suggests emerging buying interest despite broader market pessimism.

View current DAOLITY market price on Gate.com

DAOLITY Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index at 24, signaling heightened market anxiety and pessimism. During such periods, investors typically exhibit risk-averse behavior, leading to increased selling pressure and potential price volatility. However, extreme fear historically presents opportunities for contrarian investors to accumulate assets at lower valuations. Market participants should remain cautious while monitoring for reversal signals. Stay informed on market dynamics and consider your risk tolerance before making investment decisions on Gate.com.

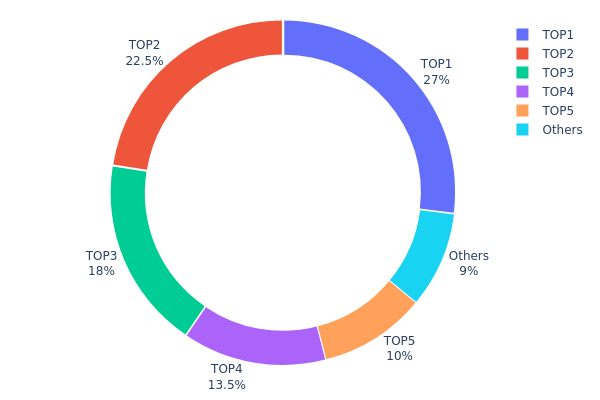

DAOLITY Holdings Distribution

The address holdings distribution chart illustrates the concentration of DAOLITY tokens across the blockchain network, mapping the percentage allocation among top holders and remaining addresses. This metric serves as a critical indicator for assessing token decentralization, market structure stability, and potential concentration risks that could influence price dynamics and market manipulation vulnerabilities.

The current DAOLITY holdings data reveals a pronounced concentration pattern, with the top five addresses collectively controlling 91% of the total token supply. The leading address (0xdaa3...d071c0) holds 27% of all tokens, while the second-largest holder (0xe016...dc031f) commands 22.5%, and the third-ranking address (0x112d...7de6b8) maintains an 18% stake. This tiered distribution demonstrates significant centralization, with each of the top three addresses holding substantial individual positions exceeding 18% of the circulating supply. The remaining 9% of tokens distributed across other addresses underscores the highly concentrated nature of the token ecosystem.

Such pronounced concentration introduces material risks to market structure integrity. The top five holders collectively possess sufficient token volumes to exert substantial influence over price discovery mechanisms and market liquidity. A coordinated liquidation event or concentrated selling pressure from these major stakeholders could trigger significant downside volatility, while their buying activity might artificially inflate prices. Furthermore, the minimal participation of smaller token holders (9% collectively) suggests limited retail distribution, potentially constraining organic market participation and reducing the resilience of the token's price stability during stress scenarios.

Click to view current DAOLITY holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdaa3...d071c0 | 27000000.00K | 27.00% |

| 2 | 0xe016...dc031f | 22500000.00K | 22.50% |

| 3 | 0x112d...7de6b8 | 18000000.00K | 18.00% |

| 4 | 0x321b...c4aa84 | 13500000.00K | 13.50% |

| 5 | 0xfff7...f5ea49 | 10000000.00K | 10.00% |

| - | Others | 9000000.00K | 9% |

II. Core Factors Affecting DAOLITY's Future Price

Supply Mechanism

-

Limited Total Supply: DAOLITY has a fixed total issuance with limited quantity, making scarcity its core value proposition. As the circulating supply approaches the maximum limit, the scarcity effect is expected to become a key driver for price appreciation.

-

Current Impact: The approaching circulation limit of the total supply is anticipated to create upward price pressure through increased scarcity dynamics.

Technology Development and Ecosystem Building

- No-Code Web3 Platform: DAOLITY operates as an emerging no-code Web3 platform designed to revolutionize token issuance and ecosystem development, with significant growth potential through its user-friendly infrastructure that lowers barriers to entry for Web3 applications.

Three、2025-2030 DAOLITY Price Forecast

2025 Outlook

- Conservative Forecast: $0.00014 - $0.00020

- Neutral Forecast: $0.00021

- Optimistic Forecast: $0.00026 (requires sustained market sentiment and ecosystem development)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery trajectory, characterized by moderate volatility and incremental adoption growth

- Price Range Forecast:

- 2026: $0.00021 - $0.00025

- 2027: $0.00020 - $0.00035

- Key Catalysts: Protocol upgrades, expanded partnership announcements, growing institutional interest, and improved market liquidity through platforms like Gate.com

2028-2030 Long-term Outlook

- Base Case: $0.00029 - $0.00033 (assuming stable ecosystem fundamentals and moderate market recovery)

- Optimistic Scenario: $0.00034 - $0.00041 (assuming accelerated adoption, successful integration milestones, and positive macroeconomic conditions)

- Transformative Scenario: $0.00041+ (extreme favorable conditions including breakthrough technological developments and mainstream market penetration)

Forecast Summary: DAOLITY demonstrates a projected cumulative appreciation of approximately 58% from 2025 through 2030, with price volatility expected to decline as market maturity increases and liquidity infrastructure strengthens.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00026 | 0.00021 | 0.00014 | 0 |

| 2026 | 0.00025 | 0.00023 | 0.00021 | 10 |

| 2027 | 0.00035 | 0.00024 | 0.0002 | 14 |

| 2028 | 0.00033 | 0.0003 | 0.00029 | 40 |

| 2029 | 0.00036 | 0.00032 | 0.00029 | 49 |

| 2030 | 0.00041 | 0.00034 | 0.00022 | 58 |

DAOLITY Professional Investment Strategy and Risk Management Report

IV. DAOLITY Professional Investment Strategy and Risk Management

DAOLITY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with 6+ month investment horizons seeking exposure to no-code Web3 development platforms

- Operational recommendations:

- Accumulate DAOLITY during market dips, particularly when price drops below $0.00015

- Dollar-cost averaging (DCA) approach: allocate fixed amounts weekly or monthly to mitigate volatility

- Maintain positions through platform adoption cycles and ecosystem expansion phases

(2) Active Trading Strategy

- Technical analysis tools:

- Support/Resistance levels: Monitor key levels at $0.0002114 (current price), $0.00017889 (24h low), and $0.00022736 (24h high)

- Trend indicators: Track the 7-day performance (+50.47%) and 30-day performance (-17.03%) to identify momentum shifts

- Swing trading key points:

- Enter positions during oversold conditions (below 30-day average)

- Exit on confirmation of resistance breakouts above $0.00023

DAOLITY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 2-3% portfolio allocation

- Active investors: 5-8% portfolio allocation

- Professional investors: 10-15% portfolio allocation

(2) Risk Hedging Solutions

- Volatility hedging: Diversify DAOLITY holdings with stablecoins to reduce exposure during market downturns

- Position sizing: Never allocate more than 1-2% of total portfolio to a single trade to manage drawdown risks

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for active trading and regular transactions

- Cold storage approach: Transfer long-term holdings to hardware-secured solutions for maximum protection

- Security best practices: Enable two-factor authentication, use strong passwords, verify contract addresses (0x6123c1bee174cbf500ab6c02cee47ec348fe871f on BSC) before transfers, and never share private keys

V. DAOLITY Potential Risks and Challenges

DAOLITY Market Risks

- Market volatility: The token experienced an 87.99% decline from all-time high ($0.0075481 on May 17, 2025) to current levels, indicating extreme price fluctuation

- Liquidity constraints: Daily trading volume of $12,187.15 is relatively low compared to market capitalization, potentially limiting exit opportunities

- Concentration risk: Only 15,224 token holders suggests limited distribution and potential whale manipulation vulnerability

DAOLITY Regulatory Risks

- Emerging regulatory environment: No-code Web3 development platforms face uncertain regulatory treatment across jurisdictions

- Compliance uncertainty: Changes in cryptocurrency and smart contract regulations could impact platform viability and token utility

- Enforcement actions: Regulatory crackdowns on decentralized application platforms could negatively affect adoption and token value

DAOLITY Technical Risks

- Smart contract vulnerabilities: As a blockchain-based platform, Daolity faces potential security exploits in its core smart contracts

- Blockchain dependency: Reliance on BSC infrastructure means platform availability depends on network stability and performance

- Adoption barriers: Success depends on developer adoption of no-code Web3 tools, which remains unproven at scale

VI. Conclusion and Action Recommendations

DAOLITY Investment Value Assessment

Daolity represents a speculative opportunity in the no-code Web3 development space, targeting a market segment focused on democratizing blockchain application development. The project demonstrates clear utility value proposition for non-technical developers and enterprises. However, the significant price decline from ATH (-71.98%), combined with relatively low trading volume and limited token distribution, suggests heightened speculative risk. The platform's success depends critically on developer adoption rates and competitive positioning against other Web3 development solutions. Investment is suitable only for risk-tolerant portfolios with capacity to absorb potential total loss.

DAOLITY Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% portfolio) through Gate.com with dollar-cost averaging strategy; prioritize learning about the Daolity platform and no-code Web3 development before increasing exposure

✅ Experienced investors: Implement tactical positions using 5-8% allocation with defined stop-losses at $0.00015; combine technical analysis with fundamental tracking of platform adoption metrics and developer community growth

✅ Institutional investors: Conduct thorough due diligence on Daolity's development team, tokenomics, and competitive positioning; maintain 10-15% allocation within Web3 infrastructure category with quarterly rebalancing and active governance participation consideration

DAOLITY Trading Participation Methods

- Direct purchase: Acquire DAOLITY tokens on Gate.com by converting BNB or other supported trading pairs

- Staking opportunities: If available through Daolity ecosystem, participate in protocol staking for yield generation

- Community engagement: Join Daolity's Twitter community (@Daolity_Coin) and review whitepaper (https://docs.daolity.com/) to stay informed on platform developments and ecosystem announcements

Cryptocurrency investment carries extreme risk and volatility. This report is for informational purposes only and does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

Is Dao crypto a good investment?

Dao crypto presents strong investment potential with innovative governance models and community-driven returns. Its decentralized structure offers unique opportunities for value appreciation in the growing Web3 ecosystem.

How much will a dot be worth in 2025?

Based on current market analysis, Polkadot (DOT) is projected to trade between $1.77 and $1.82 in 2025, with an average price around $1.80. This forecast reflects ongoing market trends and ecosystem development.

Can dot coin reach $100?

Yes, DOT has potential to reach $100. Based on market trends and growth projections, predictions suggest this milestone could be achieved by 2035, representing significant long-term appreciation.

2025 BAKED Price Prediction: Will This DeFi Token Rise to New Heights or Crumble?

2025 DCK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 PUSH Price Prediction: Expert Analysis and Market Forecast for the Push Protocol Token

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

2025 AR Price Prediction: Analyzing Growth Factors and Market Dynamics in the Arweave Ecosystem

Who is the Founder of This Leading Crypto Exchange?

What is Succinct Prover Network? Complete Guide to PROVE Token and Zero-Knowledge Infrastructure

What is BUSY: A Comprehensive Guide to Understanding Business Process Optimization and Workflow Management Systems

How to Get Started with Token Staking Through Launchpool

What is the Laspeyres Index?