2025 COOK Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: COOK's Market Position and Investment Value

COOK (mETH Protocol) serves as the first fully vertically integrated staking and restaking protocol built by Mantle, combining simplicity and scalability to offer users unmatched opportunities for accruing Ethereum staking yields while enhancing capital efficiency. As of December 2025, COOK has achieved a market capitalization of $19.43 million with approximately 960 million tokens in circulation, trading at $0.003886 per token. This innovative asset is playing an increasingly critical role in the Ethereum staking and liquid staking derivatives ecosystem.

This article will conduct a comprehensive analysis of COOK's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

COOK Price Analysis Report

I. COOK Price History Review and Current Market Status

COOK Historical Price Trajectory

-

November 2024: Launch milestone, COOK reached its all-time high of $0.04584 on November 9, 2024, marking the peak of initial market enthusiasm following the protocol's introduction.

-

November 2024 - December 2025: Extended decline phase, price depreciated from the all-time high of $0.04584 to $0.003738, representing a decline of approximately 91.85% over the year.

COOK Current Market Conditions

As of December 24, 2025, COOK is trading at $0.003886 with a 24-hour trading volume of $12,102.18. The token demonstrates modest positive momentum in the short term, gaining 0.77% over the past 24 hours. However, the broader trend remains bearish, with the token declining 2.90% over the past 7 days and 16.35% over the past 30 days.

COOK maintains a market capitalization of $3,730,560 with a fully diluted valuation of $19,430,000. The circulating supply stands at 960,000,000 tokens out of a total supply of 5,000,000,000 tokens, representing 19.2% circulation ratio. With 194 token holders and trading activity across 4 exchanges, COOK reflects a relatively nascent market with limited liquidity and adoption.

The token's price range over the past 24 hours spans from $0.00382 to $0.003967, indicating moderate volatility. Current market sentiment reflects extreme fear, as evidenced by the broader market VIX index reading of 24.

View current COOK market price

COOK Market Sentiment Indicator

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and heightened investor anxiety. When fear reaches such levels, market participants typically adopt defensive positions. However, historical data suggests extreme fear often precedes market recovery opportunities. Savvy investors may view current conditions as potential entry points for long-term positions. On Gate.com, traders can monitor real-time market sentiment data and adjust their strategies accordingly. Always conduct thorough research and risk management before making investment decisions during volatile market conditions.

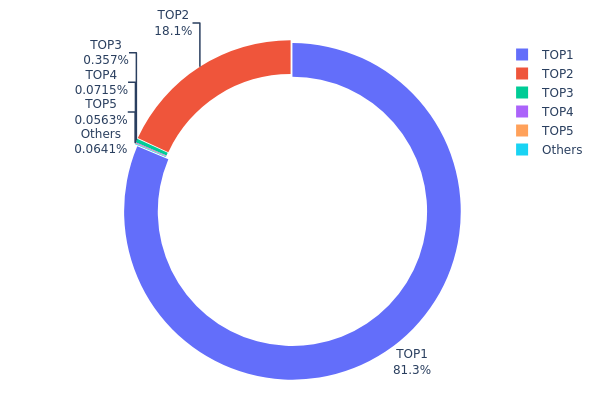

COOK Holdings Distribution

The address holdings distribution chart provides a granular view of token concentration across the blockchain network, revealing how COOK tokens are distributed among different wallet addresses. This metric serves as a critical indicator of decentralization level, market structure stability, and potential concentration risks within the ecosystem.

COOK exhibits significant concentration characteristics, with the top address holding 81.33% of total supply, indicating a highly centralized distribution pattern. The second-largest address commands an additional 18.11%, meaning just two addresses control 99.44% of all COOK tokens in circulation. This extreme concentration level raises material concerns regarding decentralization and governance autonomy. The remaining top three addresses (positions 3-5) collectively hold only 0.47% of the token supply, while other addresses account for a negligible 0.090% share, further underscoring the severe disparity in token allocation.

Such pronounced concentration creates considerable structural vulnerabilities for the COOK ecosystem. The dominant position of the top two addresses presents elevated risks for potential price manipulation, coordinated selling pressure, and sudden market disruption. Large holders possess disproportionate influence over token supply dynamics and could theoretically impact price discovery mechanisms through concentrated transactions. Additionally, this distribution pattern suggests limited liquidity diversity and raises questions about token release mechanisms and vesting schedules. The extreme concentration also indicates that COOK's current on-chain structure lacks robust decentralization characteristics, with governance and market stability heavily dependent on the actions of a minimal number of stakeholders.

View current COOK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc144...0bdca9 | 4066820.89K | 81.33% |

| 2 | 0x0035...20cb6a | 905736.95K | 18.11% |

| 3 | 0xf89d...5eaa40 | 17846.55K | 0.35% |

| 4 | 0x0d07...b492fe | 3575.59K | 0.07% |

| 5 | 0x2943...970c40 | 2814.47K | 0.05% |

| - | Others | 3205.56K | 0.090000000000018% |

II. Core Factors Influencing COOK's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve has implemented consecutive rate cuts, with the federal funds target range adjusted from 3.75%-4% to 3.5%-3.75%. According to the CME Fed Watch tool, futures traders anticipate an additional two rate cuts in 2026, suggesting a cumulative 50 basis points of cuts expected. Lower interest rate environments typically support cryptocurrency valuations by reducing discount rates for growth-oriented assets like DeFi tokens.

-

Interest Rate Trajectory: Rate expectations will shift focus toward the magnitude and speed of rate cuts, along with policy stability and forward guidance management. As interest rate expectations decline, they reduce the discount rate for high-growth DeFi assets, providing valuation support for COOK as a decentralized finance protocol token.

Technology Development and Ecosystem Building

-

DeFi Market Trends: COOK's future price is substantially influenced by broader decentralized finance market trends. As a DeFi protocol token, its value is directly correlated with the adoption and growth of the decentralized finance ecosystem.

-

Technological Advancements: Continued innovation within the DeFi space, including improvements to protocol security, scalability, and functionality, positively impacts COOK's investment thesis. Market participants increasingly scrutinize actual business applications and return on investment rather than infrastructure-level innovations alone.

Market Competition and Risk Factors

-

Competitive Landscape: The DeFi industry experiences significant competitive pressures with numerous competing protocols. Market participants must evaluate COOK's relative positioning and competitive advantages within this dynamic environment.

-

Security and Volatility Considerations: The cryptocurrency market's inherent volatility and potential security vulnerabilities within DeFi protocols present material risks to COOK's price. Regulatory changes and institutional adoption patterns also play critical roles in determining long-term value trajectories.

III. 2025-2030 COOK Price Forecast

2025 Outlook

- Conservative Forecast: $0.003 - $0.00385

- Base Forecast: $0.00385 (average price)

- Optimistic Forecast: $0.0047 (requires market stabilization and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.00372 - $0.00538 (9% upside potential)

- 2027: $0.00449 - $0.00546 (24% upside potential)

- Key Catalysts: Ecosystem expansion, increased token utility, growing community engagement, and improved market sentiment

2028-2030 Long-term Outlook

- Base Scenario: $0.00339 - $0.00694 (32% potential appreciation by 2028, assuming steady adoption)

- Optimistic Scenario: $0.00414 - $0.00978 (93% potential upside by 2030, assuming accelerated ecosystem development and institutional interest)

- Transformative Scenario: $0.00532 - $0.009 (55% gains by 2029, contingent on breakthrough partnerships and mainstream integration)

- 2025-12-24: COOK at $0.00385 (consolidation phase with positive long-term outlook)

Note: These forecasts are based on historical data analysis and should be monitored regularly on Gate.com and other market monitoring tools for accuracy adjustments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0047 | 0.00385 | 0.003 | 0 |

| 2026 | 0.00538 | 0.00427 | 0.00372 | 9 |

| 2027 | 0.00546 | 0.00483 | 0.00449 | 24 |

| 2028 | 0.00694 | 0.00514 | 0.00339 | 32 |

| 2029 | 0.009 | 0.00604 | 0.00532 | 55 |

| 2030 | 0.00978 | 0.00752 | 0.00414 | 93 |

mETH Protocol (COOK) Investment Strategy and Risk Management Report

IV. COOK Professional Investment Strategy and Risk Management

COOK Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Crypto enthusiasts and passive income seekers interested in Ethereum staking yield strategies

- Operation Recommendations:

- Accumulate COOK tokens during market downturns to benefit from the protocol's staking and restaking opportunities

- Hold positions for extended periods to capture compounded Ethereum staking yields through the protocol's capital efficiency mechanisms

- Participate in the mETH Protocol ecosystem to earn additional protocol-specific rewards

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Volatility Monitoring: Track the 24-hour trading volume ($12,102.18) and price fluctuations to identify optimal entry and exit points

- Historical Price Levels: Reference the all-time high of $0.04584 (November 9, 2024) and current price of $0.003886 to assess valuation extremes

-

Wave Trading Key Points:

- Monitor the significant year-to-date decline of -86.15% to identify potential capitulation or recovery signals

- Utilize the 24-hour positive movement of +0.77% as a potential reversal indicator

- Track 7-day and 30-day trends (-2.90% and -16.35% respectively) to assess medium-term momentum

COOK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation

- Active Investors: 1-3% of portfolio allocation

- Professional Investors: 3-5% of portfolio allocation

(2) Risk Mitigation Strategies

- Diversification Approach: Combine COOK holdings with established Ethereum staking alternatives to reduce protocol-specific concentration risk

- Position Sizing Strategy: Implement strict position limits based on individual risk tolerance, given the token's high volatility and -86.15% yearly decline

(3) Secure Storage Solution

- Recommended Security Practice: Use Gate.com's Web3 wallet infrastructure for convenient COOK token management and direct access to trading pairs

- Cold Storage Alternative: For long-term holdings exceeding trading allocations, consider self-custody solutions with proper backup protocols

- Security Notice: Never share private keys or seed phrases; enable two-factor authentication on exchange accounts; regularly verify smart contract addresses before transactions

V. COOK Potential Risks and Challenges

COOK Market Risk

- Extreme Volatility Risk: The token has declined 86.15% over the past year while previously reaching $0.04584, indicating extreme price fluctuations that can result in substantial losses

- Low Liquidity Risk: With only 4 exchange listings and relatively modest 24-hour trading volume of $12,102.18, liquidity constraints may impact entry and exit execution

- Market Cap Concentration Risk: At a fully diluted valuation of $19.43 million with only 19.2% of tokens in circulation, significant dilution risk exists if vesting tokens enter the market

COOK Regulatory Risk

- Staking Protocol Compliance: Regulatory frameworks around staking-as-a-service protocols remain uncertain in many jurisdictions, potentially affecting the protocol's operational model

- Restaking Regulatory Uncertainty: The emerging restaking sector faces evolving regulatory scrutiny, which could impact mETH Protocol's core functionality

- Ethereum Protocol Changes: Updates to Ethereum's consensus mechanism could directly impact the staking yields that form the protocol's value proposition

COOK Technology Risk

- Protocol Dependency Risk: mETH Protocol's functionality is inherently dependent on Mantle Network's stability and continued development

- Smart Contract Risk: As a DeFi protocol involving staking mechanics, smart contract vulnerabilities could lead to fund loss or yield disruption

- Scalability Execution Risk: While the protocol emphasizes scalability, implementation challenges in vertical integration could affect performance and user experience

VI. Conclusion and Action Recommendations

COOK Investment Value Assessment

mETH Protocol presents a specialized investment opportunity centered on Ethereum staking yield optimization through the Mantle Network ecosystem. However, the token exhibits extreme volatility (-86.15% annually) combined with limited market adoption (194 holders, 4 exchange listings) and modest liquidity. The project's technical merit in offering capital-efficient staking is offset by significant execution risks, regulatory uncertainties in the staking sector, and substantial token dilution ahead. Investors should view COOK as a high-risk, speculative position within the broader staking derivatives market rather than a core allocation.

COOK Investment Recommendations

✅ Beginners: Consider minimal allocation (0.1-0.5% of experimental portfolio) only after thorough understanding of Ethereum staking mechanics and mETH Protocol's specific mechanisms; prioritize learning over trading.

✅ Experienced Investors: Potential accumulation during extended downturns with strict risk management; analyze staking yield rates relative to alternatives; maintain tight stop-losses given volatility.

✅ Institutional Investors: Conduct comprehensive due diligence on Mantle Network's development roadmap, protocol security audits, and competitive positioning within the restaking landscape before consideration.

COOK Trading Participation Methods

- Direct Exchange Trading: Purchase COOK on Gate.com through standard spot trading pairs for immediate exposure

- Staking Integration: Participate in the mETH Protocol directly on Mantle Network to earn Ethereum staking yields alongside token appreciation upside

- Dollar-Cost Averaging: Implement systematic purchases over extended periods to reduce timing risk and average entry prices

Cryptocurrency investments carry extreme risk and may result in total capital loss. This report is not investment advice. Investors must conduct independent research and consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Will COOK stock go up?

Based on current market analysis, COOK is projected to experience price fluctuations. While short-term volatility exists, long-term fundamentals suggest potential growth opportunities as adoption and trading volume increase in the market.

What is the future outlook for $coco?

$COCO shows strong growth potential with analysts projecting a price target of 55.44 USD by 2026, ranging from 49.00 to 61.00 USD. Increasing adoption and market momentum suggest positive long-term performance ahead.

What factors influence COOK price movements?

COOK price movements are driven by market demand, trading volume, project developments, investor sentiment, and broader cryptocurrency market trends. Regulatory announcements and ecosystem partnerships also impact price dynamics significantly.

What is the historical price performance of COOK?

COOK has shown fluctuating performance recently. As of December 2025, prices ranged around $1.02-$1.08, reflecting moderate volatility. The token's historical trajectory demonstrates typical market dynamics with periodic adjustments based on market demand and trading volume.

What are the risks associated with COOK price prediction?

COOK price prediction faces regulatory risks from uncertain DeFi compliance landscapes, market volatility from trading volume fluctuations, and liquidity challenges. Smart contract vulnerabilities and governance changes can also impact price movements unpredictably.

2025 REZ Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

What is REZ: A Comprehensive Guide to Understanding Real Estate Investment Zones and Their Impact on Property Markets

What is SWELL: A Comprehensive Guide to Understanding Liquid Staking and Ethereum's Future

Is Swell Network (SWELL) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

What is COOK: A Comprehensive Guide to Understanding Cooking Techniques, Equipment, and Culinary Arts

How to Analyze On-Chain Data: Active Address Count, Transaction Volume, Whale Distribution, and Fee Trends in 2026

Will Stellar (XLM) Price Reach $1?

What is Tokenomics and Why Is It Important?

What is tokenomics: token distribution mechanisms, inflation design, and governance rights explained

What are the core technical innovations and ecosystem challenges of Internet Computer (ICP) in 2026?