2025 APRS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: APRS's Market Position and Investment Value

Apeiron (APRS), as a revolutionary Web3 game blending god simulation and Roguelike adventures, has made significant strides since its inception. As of 2025, APRS has a market capitalization of $530,271, with a circulating supply of approximately 197,714,888 tokens, and a price hovering around $0.002682. This asset, hailed as the "strategic play-to-earn masterpiece," is playing an increasingly crucial role in the gaming and blockchain sectors.

This article will comprehensively analyze APRS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. APRS Price History Review and Current Market Status

APRS Historical Price Evolution

- 2024: APRS reached its all-time high of $0.7901 on May 24, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with APRS price dropping to its all-time low of $0.0014 on November 24.

APRS Current Market Situation

As of November 27, 2025, APRS is trading at $0.002682, showing a 33.46% increase in the last 24 hours. The token's market capitalization stands at $530,271.33, ranking it at 3197th position in the global cryptocurrency market. APRS has a circulating supply of 197,714,888.37 tokens, representing 19.77% of its total supply of 1,000,000,000 tokens.

Despite the recent 24-hour gain, APRS has shown negative performance over longer timeframes, with a 13.16% decrease in the past week and a substantial 65.73% drop over the last 30 days. The year-to-date performance is even more dramatic, with a 97.43% decline.

The trading volume in the past 24 hours reached $14,656.91, indicating moderate market activity. The token is currently trading significantly below its all-time high, suggesting a challenging market environment for APRS holders.

Click to view the current APRS market price

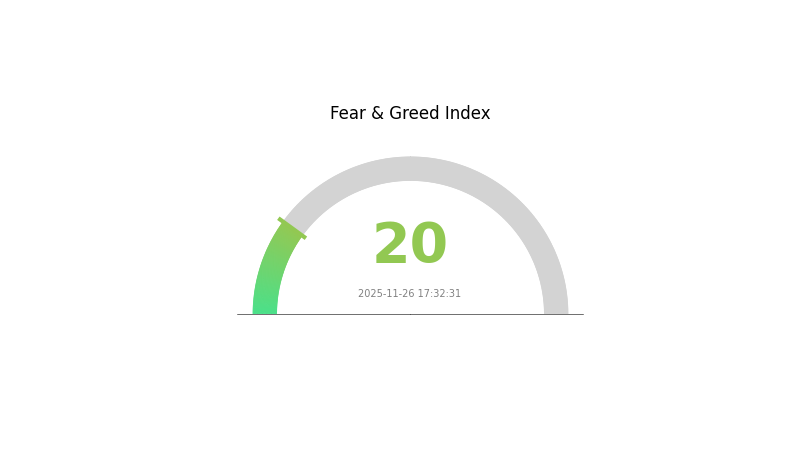

APRS Market Sentiment Indicator

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to 20. This sentiment often signals a potential buying opportunity for long-term investors, as markets tend to overreact during periods of intense fear. However, caution is advised as further downside may still be possible. Traders should closely monitor market trends and consider dollar-cost averaging strategies. Remember, market sentiment can shift rapidly, and it's crucial to conduct thorough research before making any investment decisions.

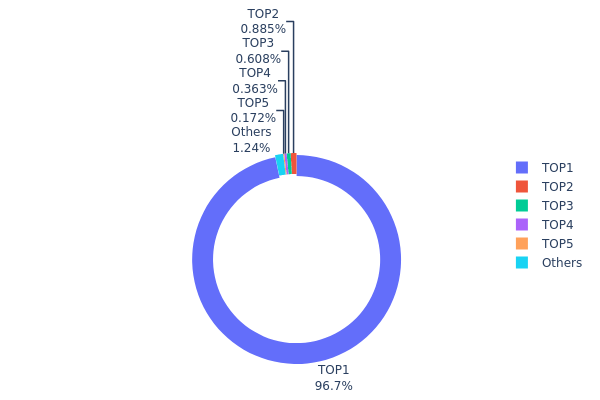

APRS Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for APRS tokens. The top address holds a staggering 96.72% of the total supply, which amounts to 967,298.32K tokens. This level of concentration raises significant concerns about the token's decentralization and market dynamics.

The remaining top 4 addresses collectively hold only about 2% of the supply, with individual holdings ranging from 0.17% to 0.88%. All other addresses combined account for a mere 1.27% of the total supply. This extreme concentration in a single address could potentially lead to increased volatility and susceptibility to market manipulation, as any significant movement from the top holder could dramatically impact the token's price and liquidity.

Such a distribution pattern may indicate a lack of widespread adoption or a tightly controlled initial token allocation. It also suggests that the current market structure of APRS is highly vulnerable to the decisions and actions of a single entity, which could deter potential investors and limit the token's ability to achieve true decentralization in the near term.

Click to view the current APRS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5882...fe97b1 | 967298.32K | 96.72% |

| 2 | 0xf89d...5eaa40 | 8854.70K | 0.88% |

| 3 | 0xeab4...6bdc15 | 6079.99K | 0.60% |

| 4 | 0xa461...705867 | 3631.70K | 0.36% |

| 5 | 0x3563...a704cc | 1724.04K | 0.17% |

| - | Others | 12411.25K | 1.27% |

II. Key Factors Affecting APRS Future Price

Supply Mechanism

- Historical Pattern: Past supply changes have typically influenced APRS price movements, with controlled supply often supporting price stability.

- Current Impact: The current supply changes are expected to have a moderate impact on APRS price, potentially leading to gradual price appreciation if demand remains consistent.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions have shown increasing interest in APRS, with some accumulating significant positions.

- Corporate Adoption: Several prominent companies have begun exploring APRS integration for various applications, which could drive demand.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of major economies, are likely to influence APRS price as they affect overall market sentiment.

- Inflation Hedging Properties: APRS has demonstrated some potential as an inflation hedge, which may become more relevant in the current economic climate.

- Geopolitical Factors: International tensions and economic uncertainties could lead investors to consider APRS as part of a diversified portfolio.

Technical Development and Ecosystem Building

- Ecosystem Applications: The APRS ecosystem is growing, with several DApps and projects being developed to enhance its utility and adoption.

III. APRS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00169 - $0.00250

- Neutral prediction: $0.00250 - $0.00280

- Optimistic prediction: $0.00280 - $0.00292 (requires positive market sentiment and project developments)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.00165 - $0.00311

- 2027: $0.00151 - $0.00334

- Key catalysts: Technological advancements, partnerships, and market expansion

2030 Long-term Outlook

- Base scenario: $0.00283 - $0.00378 (assuming steady market growth)

- Optimistic scenario: $0.00378 - $0.00536 (with significant ecosystem expansion)

- Transformative scenario: $0.00536+ (extreme favorable conditions and widespread adoption)

- 2030-12-31: APRS $0.00536 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00292 | 0.00268 | 0.00169 | 0 |

| 2026 | 0.00311 | 0.0028 | 0.00165 | 4 |

| 2027 | 0.00334 | 0.00296 | 0.00151 | 10 |

| 2028 | 0.00365 | 0.00315 | 0.0017 | 17 |

| 2029 | 0.00415 | 0.0034 | 0.00201 | 26 |

| 2030 | 0.00536 | 0.00378 | 0.00283 | 40 |

IV. APRS Professional Investment Strategies and Risk Management

APRS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operation suggestions:

- Accumulate APRS during market dips

- Set price targets for partial profit-taking

- Store tokens in secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined resistance levels

APRS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for APRS

APRS Market Risks

- High volatility: Extreme price fluctuations common in crypto markets

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

APRS Regulatory Risks

- Uncertain regulations: Potential for unfavorable government policies

- Cross-border restrictions: Possible limitations on international trading

- Tax implications: Evolving tax laws may impact profitability

APRS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Blockchain scalability: Network congestion may affect transactions

- Cybersecurity threats: Risk of hacks or security breaches

VI. Conclusion and Action Recommendations

APRS Investment Value Assessment

APRS offers potential long-term value in the Play-to-Earn gaming sector but faces significant short-term volatility and adoption challenges.

APRS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the ecosystem ✅ Experienced investors: Consider dollar-cost averaging, monitor project developments ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified crypto portfolio

APRS Trading Participation Methods

- Spot trading: Buy and sell APRS on Gate.com

- Staking: Participate in available staking programs for passive income

- GameFi participation: Engage with the Apeiron game ecosystem for potential rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for ADX in 2030?

Based on market trends and potential growth, ADX could reach $5 to $7 by 2030, driven by increased adoption and technological advancements in the crypto space.

What is the ARPA chain price prediction for 2030?

Based on market analysis and potential growth, ARPA chain price could reach $5 to $7 by 2030, reflecting significant adoption and technological advancements in the blockchain industry.

What is the price prediction for AR in 2030?

Based on market trends and potential growth, AR could reach $150-$200 by 2030, driven by increased adoption of decentralized storage solutions.

What is the price prediction for RSR in 2025?

Based on market analysis and trends, RSR is predicted to reach around $0.15 to $0.20 by 2025, showing potential for significant growth.

2025 ZTX Price Prediction: Bullish Outlook as Adoption and Technology Advancements Drive Growth

2025 STARHEROES Price Prediction: Navigating the Crypto Galaxy's Rising Star

2025 SHARDS Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 GHX Price Prediction: Navigating the Future of Gaming Tokens in a Volatile Crypto Market

2025 UDS Price Prediction: Market Trends and Expert Forecasts for the Digital Asset

2025 CREO Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Cryptocurrency

How to Analyze On-Chain Data: Active Address Count, Transaction Volume, Whale Distribution, and Fee Trends in 2026

Will Stellar (XLM) Price Reach $1?

What is Tokenomics and Why Is It Important?

What is tokenomics: token distribution mechanisms, inflation design, and governance rights explained

What are the core technical innovations and ecosystem challenges of Internet Computer (ICP) in 2026?