Korean_Girl

#Gate广场发帖领五万美金红包

Your bonus is waiting — post to claim!

Gate Square’s $50,000 Red Packet Rain is ongoing!

Bigger rewards, higher winning chances!

🐎 New users win 100%. Quality posts win 100%. Up to 28U per post!

The more you post, the more you win — no cap!

Post now to unlock your reward 👉 https://www.gate.com/post

📌 Update to App v8.8.0 to join

Details: https://www.gate.com/announcements/article/49773

Your bonus is waiting — post to claim!

Gate Square’s $50,000 Red Packet Rain is ongoing!

Bigger rewards, higher winning chances!

🐎 New users win 100%. Quality posts win 100%. Up to 28U per post!

The more you post, the more you win — no cap!

Post now to unlock your reward 👉 https://www.gate.com/post

📌 Update to App v8.8.0 to join

Details: https://www.gate.com/announcements/article/49773

- Reward

- 6

- 8

- Repost

- Share

Lock_433 :

:

To The Moon 🌕View More

#VitalikSellsETH #VitalikSellsETH

The news of Vitalik Buterin selling a portion of his Ethereum holdings marks a notable moment in the cryptocurrency space, attracting both attention and speculation across markets. As the co-founder of Ethereum, his moves are closely watched by investors, traders, and industry participants, not only because of the financial impact but also due to the potential influence on sentiment and market perception. While such actions can trigger discussion, it is important to consider context, strategy, and broader ecosystem developments.

Historically, asset sales by fo

The news of Vitalik Buterin selling a portion of his Ethereum holdings marks a notable moment in the cryptocurrency space, attracting both attention and speculation across markets. As the co-founder of Ethereum, his moves are closely watched by investors, traders, and industry participants, not only because of the financial impact but also due to the potential influence on sentiment and market perception. While such actions can trigger discussion, it is important to consider context, strategy, and broader ecosystem developments.

Historically, asset sales by fo

ETH6.54%

- Reward

- 4

- 4

- Repost

- Share

Lock_433 :

:

To The Moon 🌕View More

- Reward

- 3

- 4

- Repost

- Share

PiBIsKing :

:

真敢想,整个加密市值有多少?我国gdp有多少?View More

- Reward

- 2

- 3

- Repost

- Share

PinkMemory :

:

That's right, I lost it and I'm not playing anymore.View More

- Reward

- 3

- 2

- Repost

- Share

CaiDi :

:

Bulls and bears explosiveView More

- Reward

- 3

- 2

- Repost

- Share

GateUser-f29f7728 :

:

As long as the code is fully open source, it cannot be changed, and the project team cannot control the decentralized network. This moment will come sooner or later.View More

- Reward

- 1

- 2

- Repost

- Share

LateNightWine :

:

You can ruin yourself just with the charges.View More

- Reward

- 1

- 4

- Repost

- Share

TheKingOfStockGods :

:

跌跌跌View More

- Reward

- 4

- 3

- 1

- Share

GateUser-bd637ac6 :

:

To The Moon 🌕View More

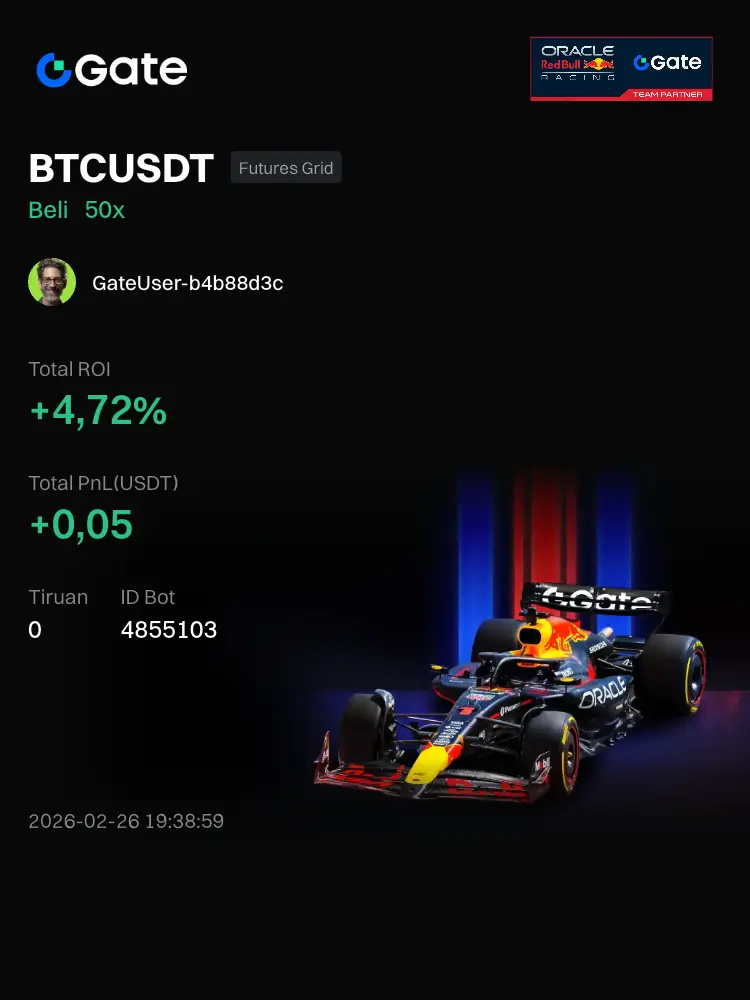

#Bot#Saat ini I am using the BTCUSDT Futures Grid bot on Gate. The ROI since the bot was created has reached +4.72%

View Original

- Reward

- 3

- 50

- Repost

- Share

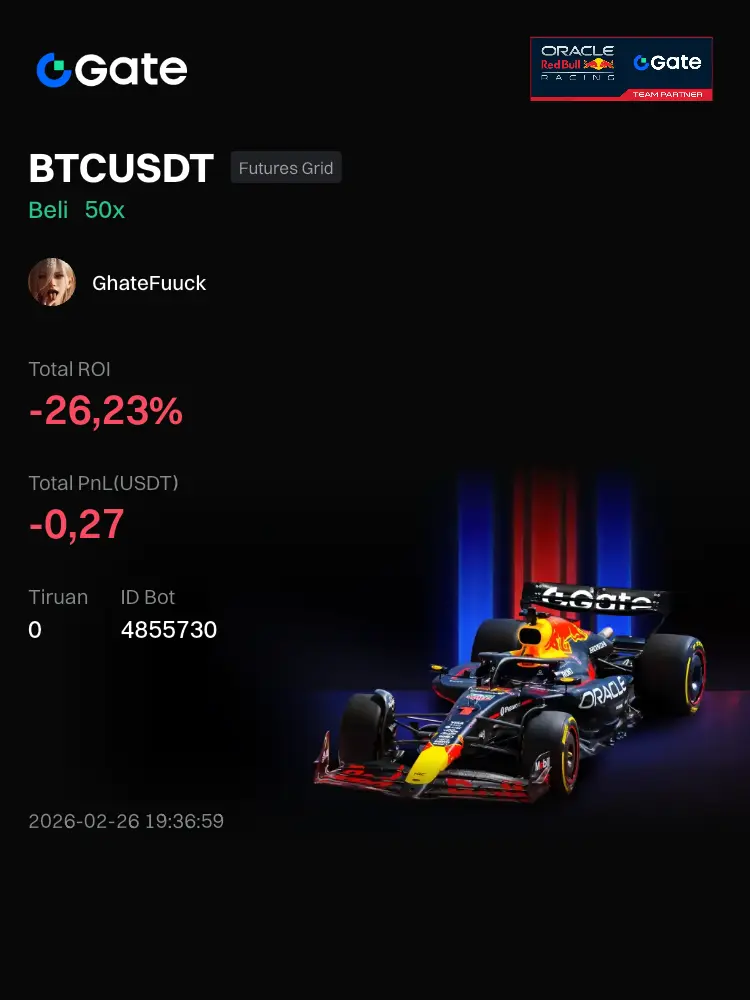

GhateFuuck :

:

HODL Tight 💪View More

#Bot#Saat ini I am using the BTCUSDT Futures Grid bot on Gate. The ROI since the bot was created has reached -26.23%

View Original

- Reward

- 4

- 30

- Repost

- Share

GateUser-b4b88d3c :

:

Ape In 🚀View More

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref=VLRHVGPAVQ&ref_type=132

- Reward

- 3

- 1

- Repost

- Share

AngryBird :

:

To The Moon 🌕#加密市场反弹 Bearish divergence established, bulls are favored but pressure is clear

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low not seen since July 2022. A historically extreme oversold signal appears with 4-hour MACD bullish divergence + golden cross. Short-term bullish momentum is sufficient. Key zones:

Strong support: 66,500–67,500

Strong resistance: 69,500–70,000

Structural judgment: The rebound trend is clear, but the 70,000 level remains a watershed between bulls and bears.

🟢

Conclusion: Low-cost long positions are more favorable than high-leverage shorts

Technical

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low not seen since July 2022. A historically extreme oversold signal appears with 4-hour MACD bullish divergence + golden cross. Short-term bullish momentum is sufficient. Key zones:

Strong support: 66,500–67,500

Strong resistance: 69,500–70,000

Structural judgment: The rebound trend is clear, but the 70,000 level remains a watershed between bulls and bears.

🟢

Conclusion: Low-cost long positions are more favorable than high-leverage shorts

Technical

BTC3.61%

- Reward

- 1

- 5

- Repost

- Share

Ryakpanda :

:

Stay strong and HODL💎View More

#Gate广场发帖领五万美金红包

Your bonus is waiting — post to claim!

Gate Square’s $50,000 Red Packet Rain is ongoing!

Bigger rewards, higher winning chances!

🐎 New users win 100%. Quality posts win 100%. Up to 28U per post!

The more you post, the more you win — no cap!

Post now to unlock your reward 👉 https://www.gate.com/post

📌 Update to App v8.8.0 to join

Details: https://www.gate.com/announcements/article/49773

Your bonus is waiting — post to claim!

Gate Square’s $50,000 Red Packet Rain is ongoing!

Bigger rewards, higher winning chances!

🐎 New users win 100%. Quality posts win 100%. Up to 28U per post!

The more you post, the more you win — no cap!

Post now to unlock your reward 👉 https://www.gate.com/post

📌 Update to App v8.8.0 to join

Details: https://www.gate.com/announcements/article/49773

- Reward

- 2

- 1

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊- Reward

- 3

- 1

- Repost

- Share

DcContinuesItsUpwardTrend :

:

1728 1718 1708#BuyTheDipOrWaitNow?

📉🚀 #BuyTheDipOrWaitNow? — Smart Entry or Patience Play?

4

The market pulls back… and the big question appears:

Is this the dip to buy — or a trap before another leg down?

In volatile cycles, emotional entries destroy capital. Strategic entries build it.

🔎 Before Buying the Dip, Check This:

• Is price holding a strong higher-timeframe support?

• Is volume increasing on the bounce?

• Are funding rates cooling off?

• Is fear sentiment peaking?

A healthy dip often shows:

✔ Strong reaction from key levels

✔ Liquidity sweep followed by reversal

✔ Buyers stepping in with conv

📉🚀 #BuyTheDipOrWaitNow? — Smart Entry or Patience Play?

4

The market pulls back… and the big question appears:

Is this the dip to buy — or a trap before another leg down?

In volatile cycles, emotional entries destroy capital. Strategic entries build it.

🔎 Before Buying the Dip, Check This:

• Is price holding a strong higher-timeframe support?

• Is volume increasing on the bounce?

• Are funding rates cooling off?

• Is fear sentiment peaking?

A healthy dip often shows:

✔ Strong reaction from key levels

✔ Liquidity sweep followed by reversal

✔ Buyers stepping in with conv

- Reward

- 2

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊💌【The Top Cryptocurrency Course on the Entire Network】

We've been working on this content for half a year.

Today, we can finally share it with you.

Eight years of trading,

This isn't just a course; it's a letter I wrote to myself eight years ago.

The letter is a bit long,

Divided into 20 to 30 sections.

(Each section is 30 minutes, and you'll feel like your brain is getting a workout)

Starting today, one lesson every night, with 10 lessons available for free.

(10 lessons are more than enough)

Covering the fundamental logic of the crypto world

+

A complete set of trading skills and internal te

View OriginalWe've been working on this content for half a year.

Today, we can finally share it with you.

Eight years of trading,

This isn't just a course; it's a letter I wrote to myself eight years ago.

The letter is a bit long,

Divided into 20 to 30 sections.

(Each section is 30 minutes, and you'll feel like your brain is getting a workout)

Starting today, one lesson every night, with 10 lessons available for free.

(10 lessons are more than enough)

Covering the fundamental logic of the crypto world

+

A complete set of trading skills and internal te

- Reward

- 5

- 1

- Repost

- Share

Nick|TheMostPremium :

:

Old friends, you can leave a message saying "I'm here" so I can see your presence~ See you in the live room on 9.20, starting from 9.30~Load More