Search results for "USDC"

Lighter Protocol Signals Buyback, Fueling LIT Token Rally

Lighter Protocol’s LIT jumped above $3 after on-chain activity sparked speculation of fee-funded buybacks, pointing to a supply reduction.

On-chain trackers showed a whale moving USDC into Lighter and buying about 1.12M LIT.

Lighter Protocol’s LIT token rallied over 14% after on-chain activi

CryptoNewsFlash·11m ago

Next Big Winners: 3 Altcoins Expected to Outperform Ethereum

Sui: Nasdaq-listed ETF boosts exposure, price rebound signals potential to surpass $2.

Cardano: Ambitious roadmap and strong recovery suggest long-term growth beyond Ethereum.

Solana: USDC liquidity surge and technical momentum position SOL for potential $200 rally.

Ethereum often

CryptoNewsLand·2h ago

USDC.n May Go to Zero in March! Sei Warns 1.4 Million Dollar Holders to Quickly Swap to Native Tokens

Sei warns USDC.n holders must exchange for native USDC before the March SIP-3 upgrade, otherwise they risk losing value. USDC.n is bridged via Noble, with a value of $1.4 million. After the upgrade, Sei will transition to EVM and abandon Cosmos. For small amounts, use DragonSwap or Symphony; for large amounts, use the Brr tool for batch processing.

MarketWhisper·5h ago

Altcoin Market Roadmap: TOTAL2 Still 55% Below Cycle Highs as Investors Eye 5 High-Conviction Tokens

TOTAL2 is at the level of 55% of the cycle peaks, underlining the consolidation of the market.

USDT and USDC have remained very liquid and stable in their adoption in networks.

BNB, XRP, and BCH have quantifiable fundamentals, which makes them high-conviction tokens.

The

CryptoNewsLand·10h ago

$500 Million USDC Mint Signals a Return of Optimism to Crypto Markets

A strong signal of renewed momentum is emerging across cryptocurrency markets. A fresh issuance of $500 million worth of USD Coin (USDC) has entered circulation, a move that investors traditionally interpret as capital positioning itself for deployment into risk-on digital assets. Large-scale

Moon5labs·10h ago

Flare Launches First XRP Spot Market on Hyperliquid

_Flare introduces FXRP spot trading on Hyperliquid, expanding XRP DeFi utility through non-custodial infrastructure and cross-chain liquidity access._

Flare announced the first XRP spot market on Hyperliquid through FXRP listing. The beginning of the launch is an FXRP/USDC trading pair today.

LiveBTCNews·16h ago

MANTRA Supports $USDC and $USDT Bridging Via Hyperlane

MANTRA Chain has introduced a straightforward method for converting EVM-based assets like $USDC and $USDT through the Hyperlane Nexus Bridge, enhancing cross-chain interoperability. Users can easily follow a video guide for seamless asset bridging with minimal fees.

USDC0.05%

BlockChainReporter·17h ago

Polymarket Introduces Taker Fees in 15-Minute Markets - Unchained

Polymarket introduced taker fees for its 15-minute crypto prediction markets, with fees up to 3% returned to market makers as USDC rebates. This may tighten spreads and impact arbitration bots, though some believe optimized bots could thrive.

USDC0.05%

UnchainedCrypto·22h ago

U.S. Treasury bonds are about to surpass $40 trillion. Why might Bitcoin become the biggest winner?

By the end of 2025, the total US federal government debt has approached $38.4 trillion, equivalent to about $28.5 thousand per American household, and is rushing towards the $40 trillion mark at a rate of $5 billion to $7 billion per day. Behind this massive figure is an astonishing interest expense of over $1.2 trillion annually.

Traditionally, the ever-expanding national debt has been viewed as a pressure on the long-term value of the dollar, reinforcing Bitcoin's narrative as "digital gold" and an inflation hedge. However, a disruptive turn is occurring in this debt story: mainstream stablecoin issuers, led by USDT and USDC, are transforming from external observers to significant internal buyers of the US debt market by holding large amounts of short-term US Treasuries. This role reversal has created an unprecedented deep linkage between the cryptocurrency market and the "vessels" of the US financial system—the Treasury market and global dollar liquidity—causing Bitcoin's future to be simultaneously influenced by "hard currency" faith and short-term liquidity tides.

MarketWhisper·01-07 07:45

[Crypto Capital Inflows and Outflows] BTC inflow of $100 million · outflow of $400 million

In the cryptocurrency market, the conversion between USDT and USDC on both the inflow and outflow sides is expanding synchronously, with a clear trend of reallocation centered around BTC.

According to CryptoMeter data from the 7th, the total euro (EUR) funds inflow on that day was $22.5 million. Among them, $9.9 million flowed directly into BTC, $6.5 million into USDC, with some funds also moving through stablecoin pathways.

Turkish Lira (TRY) funds amounted to $14.9 million, with $11 million flowing into USDT. South Korean Won (KRW) funds totaled $13.5 million, confirming the existence of stablecoin-mediated flows.

Brazilian Real (BRL) funds reached $6.9 million, and Japanese Yen (JPY) funds were $1.2 million, with relatively limited inflow.

USDT funds totaled $462.8 million, of which $415.6 million

TechubNews·01-07 04:34

Whale Scoops 2.29M EDEL Tokens Worth $65,000 Amid Edel Finance’s Tokenized Stocks Traction and In...

Edel (EDEL), a DeFi cryptocurrency powering a decentralized lending protocol (money market) for tokenized assets, is attracting investor attention, according to data reported today by market analyst Lookonchain. The analyst flagged a whale who today spent $65,000 in USDC to purchase 2.29 million EDE

BlockChainReporter·01-06 12:13

Whale Buys EDEL as Holders Jump 126% in 3 Days and Edel Finance Testnet Tops 26K Users

_Whale wallet dtht bought 2.29M EDEL for 65,000 USDC as Edel Finance testnet users passed 26,000, and holders rose 126%._

Market activity around Edel Finance increased after a tracked whale transaction drew attention across crypto platforms worldwide.

At the same time, user participation and h

USDC0.05%

LiveBTCNews·01-06 11:15

MANTRA Launches MANTRA USD Stablecoin for Tokenized RWAs

MANTRA has launched MANTRA USD, a purpose-built stablecoin in collaboration with M0, aiming to challenge existing leaders, $USDC and $USDT. With a focus on equitable value distribution and community benefits, it represents a pivotal shift in stablecoin economics and promises innovative reward sharing in the evolving ecosystem.

USDC0.05%

BlockChainReporter·01-06 09:33

JupUSD Launches Shockingly! BlackRock BUIDL Fund Supports 90% Reserve Disclosure

Jupiter launches native stablecoin JupUSD, in collaboration with Ethena, with 90% reserves supported by the BAILD BUIDL Fund. It will be integrated into the entire Jupiter product suite, with a phased plan to exchange $500 million USDC collateral. JupUSD will become the key accounting unit of Jupiter's "super application."

MarketWhisper·01-06 04:04

Crypto giant spends $21 million to support Trump, launching the midterm election "policy defense battle"

The latest documents from the U.S. Federal Election Commission (FEC) show that two major cryptocurrency trading platforms, Gemini and Crypto.com, have contributed over $21 million to the super PAC "MAGA Inc.," which supports President Trump. They are among the largest single donors to the committee. Specifically, Gemini contributed 1.5 million USDC that has been settled, while Crypto.com's parent company, Foris DAX, invested $20 million in two separate transactions.

Although this massive donation occurred during a cycle when Trump does not need to run for re-election, its target is the critical midterm elections in 2026 that will determine control of Congress. The goal is to influence the direction of digital asset regulation policies in the coming years. This move marks that mainstream crypto companies are no longer content with behind-the-scenes lobbying but are instead engaging in the core political battles in the U.S. with unprecedented scale and directness, aiming to tilt legislation in favor of the industry.

MarketWhisper·01-06 02:56

Last night's and this morning's important news (January 5th - January 6th)

Cryptocurrency exchanges Gemini and Crypto.com parent company donate $21 million to pro-Trump super PAC

According to FinanceFeeds, Gemini and Crypto.com parent company Foris Dax recently donated a total of $21 million to MAGA Inc., a super PAC supporting Trump, with Gemini providing $1.5 million in USDC and Foris Dax donating $10 million in cash twice.

Crypto data platform The

PANews·01-06 02:41

BlackRock Tokenized Fund BUIDL endorsement, Ethena support, Jupiter launches native stablecoin JupUSD

Solana's leading infrastructure aggregator Jupiter officially launches its native stablecoin JupUSD, which is provided with white-label services by Ethena Labs. Its reserve assets are 90% supported by BlackRock's tokenized fund BUIDL.

JupUSD is not an isolated product; its core strategy is to serve as a "unified accounting unit" deeply integrated into Jupiter's increasingly extensive "super app" matrix, including lending, perpetual contracts, spot trading, and prediction markets. As a signaling move, Jupiter plans to gradually convert approximately $500 million worth of USDC in the perpetual contract liquidity pool (JLP) into JupUSD. This marks a decisive step for Jupiter to evolve from a simple trading aggregator to a "super app" that controls the core financial layer, and introduces the first native stablecoin in the Solana DeFi ecosystem to receive deep endorsement from mainstream traditional financial giants.

MarketWhisper·01-06 02:30

Big Whale Move Shakes $LIT Market By Buying More Tokens Worth $908,412 USDC

A big whale has made a notable move in the $LIT token. On-chain wallet activity shows that izebel\_eth, deposited $908,412 of USDC to purchase additional $LIT tokens.

This trade was fast to attract attention, as it occurred at a time when the token is already weak in terms of price action, and it i

BlockChainReporter·01-03 17:23

Circle Gain Conditional Approval for National Bank

Circle has received conditional approval to establish a federally regulated national trust bank for USDC custody, enhancing transparency and institutional trust. This follows Ripple's similar approval for XRP custody, indicating a growing federal regulatory framework for digital assets.

CryptoFrontNews·01-03 09:06

Circle Mints $1B USDC on Solana as $2B Stablecoin Liquidity Floods Crypto

Circle mints $1B USDC on Solana, boosting on-chain liquidity within hours.

Circle and Tether minted nearly $2B stablecoins.

Solana is the preferred stablecoin settlement network.

Circle mints $1B USDC on Solana during a short window of intensified stablecoin issuance. The move coincides wi

CryptoFrontNews·01-03 04:16

Lighter leaks insider airdrop! Nearly ten million LIT mysteriously distributed, sparking controversy online: DeFi projects are self-serving

Lighter's LIT Airdrop Suspected of Insider Manipulation, On-Chain Data Shows a Few Wallets Divided Over $26 Million, Sparking Fairness Controversy in DeFi.

At the start of the new year, the decentralized perpetual contract exchange Lighter launched the Lighter Infrastructure Token (LIT) airdrop plan, which was originally seen as a "model of reward" in the DeFi community. However, it is now embroiled in suspicion of "insider manipulation." According to on-chain analysts, a group of wallets appears to have coordinated their actions to pre-position and divide over $26 million worth of LIT tokens, triggering strong community backlash and distrust.

Five Wallets' Master Moves: $500,000 USDC Invested to Receive 9,999,999.6 LIT

CryptoCity·01-02 03:26

Fed Volatility Event Approaches: 4 Altcoins Positioned for Sharp Moves if FOMC Sparks Risk Rotation — 2x Scenarios in Play

BNB and XRP respond sharply to liquidity shifts and macro-driven events.

USDC activity reflects defensive capital positioning during volatile periods.

TRON activity signals transactional flows rather than speculative momentum.

As the Federal Reserve’s policy announcement nears, di

CryptoNewsLand·01-01 23:16

Crypto Trader Bets Heavy on New Year’s 1st Day With $8M Longs on Hyperliquid

On January 1, 2026, a crypto trader deposited $8M in USDC into Hyperliquid, opening significant long positions across multiple tokens, mainly $XPL. This bold gamble has sparked discussions within the crypto community regarding its implications and potential outcomes.

BlockChainReporter·01-01 10:23

Lighter exposes the "Insider Airdrop Scandal"! 9,999,999.6 LIT mysteriously allocated, sparking controversy, with the community condemning DeFi's self-serving chaos

At the beginning of the new year, the decentralized perpetual contract exchange Lighter launched the Lighter Infrastructure Token (LIT) airdrop plan, which was originally regarded as a "model of rewards" in the DeFi community. However, it is now embroiled in suspicions of "insider manipulation." According to on-chain analysts, a group of wallets is suspected of coordinating operations to pre-position and divide over $26 million worth of LIT tokens, triggering strong community backlash and distrust.

Five wallets' masterful operation: 5 million USDC invested to exchange for 9,999,999.6 LIT

Well-known on-chain analyst @mlmabc posted a detailed analysis on the social platform X, pointing out that a group of five wallets collectively engaged with Lighter approximately nine months ago.

ChainNewsAbmedia·01-01 05:14

Wallets linked to the TRUMP team memecoin have transferred 94 million USDC to Coinbase in December.

On-chain analysts are observing significant USDC withdrawals from the memecoin TRUMP on Solana, totaling $94 million in just one month. The token, linked to the political brand of Donald Trump, has faced a tumultuous year, plummeting nearly 90% from its peak. Recent large transfers have sparked political scrutiny. The memecoin market in 2025 remains precarious, with major coins showing decline and smaller tokens experiencing volatile price swings.

TapChiBitcoin·01-01 02:38

Is TRUMP Coin Officially Dead? On-Chain Data Points to $94 Million USDC Cash-Out

Questions around the future of TRUMP Coin have resurfaced after new blockchain evidence suggested that wallets linked to the project’s operators have been moving tens of millions of dollars to centralized exchanges. The activity has reignited speculation that the team may be executing a

Moon5labs·2025-12-31 14:31

$TRUMP Meme Team Wallet Transfers $33M in $USDC to Coinbase

The Official $TRUMP Meme Team wallet transferred $33M in $USDC to Coinbase, raising total monthly withdrawals to $94M. This has sparked concerns of profit-taking and potential bearish pressure on the $TRUMP token amid market volatility.

BlockChainReporter·2025-12-31 14:04

Is TRUMP Coin Dying? Team Transfers $94,000,000 USDC in Suspected Liquidation

_TRUMP Coin team moves $94M USDC to exchanges amid growing concerns, fueling speculation about the project’s future and possible liquidation._

TRUMP Coin, the political-themed cryptocurrency, is facing increased scrutiny as recent on-chain data reveals large transactions linked to its

LiveBTCNews·2025-12-31 13:15

Trip.com Stablecoin Payment Test: The Technological Revolution and Personal Opportunities Behind the 18% Savings

At the beginning of 2024, the world’s leading online travel platform Trip.com quietly added support for USDT and USDC to its payment options. Even more surprisingly, real-world testing shows that paying for tickets with stablecoins is 18% cheaper than traditional payment methods. This is not only a significant milestone for cryptocurrencies entering mainstream consumer scenarios but also reveals the efficiency gap between traditional financial systems and blockchain technology. This article will analyze the full picture behind this phenomenon from three dimensions: technological implementation, business logic, and personal application.

Technical Architecture: Enterprise-level Payment Solution with Multi-Chain Integration

Trip.com’s crypto payments are not self-developed but are implemented through Singapore-licensed payment institution Triple-A. This choice reflects the core considerations of enterprise-level applications: compliance first and risk isolation. Triple-A holds a payment license issued by the Monetary Authority of Singapore (MAS).

TechubNews·2025-12-31 10:08

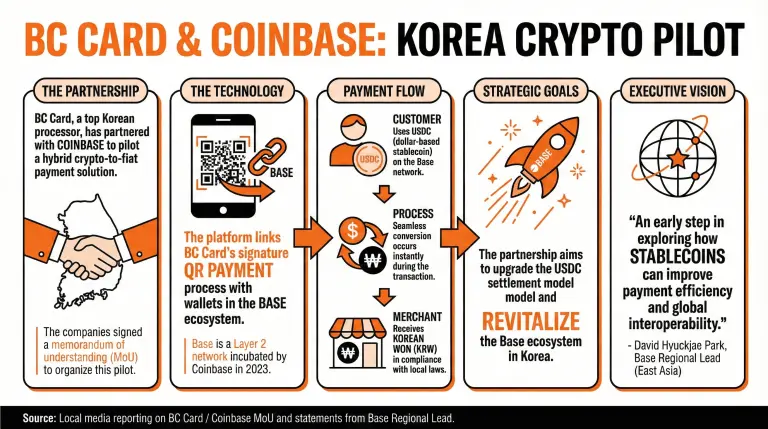

Coinbase Partners With BC Card to Pilot a USDC-Based Payment Solution in Korea

BC Card and Coinbase are piloting a crypto-to-fiat payment solution in Korea, linking USDC payments to local QR systems. The partnership could enhance domestic settlement processes and the Base ecosystem for over 36 million BC Card customers.

Coinpedia·2025-12-31 08:33

TRUMP Coin abandoned by the team? $94 million massive cash-out sparks rumors of "death"

Recently, wallets associated with the political concept coin TRUMP Coin transferred approximately $94 million USDC to mainstream CEXs within 3 weeks, sparking widespread market speculation that the project is "dead."

On-chain analysts pointed out that this cash-out used a sophisticated method similar to the previous liquidation of MELANIA tokens, by providing liquidity unilaterally and selling in segments, directly converting tokens into stablecoins. Although the project team is still attempting to revive the ecosystem through releases like themed mobile games, the suspected large-scale withdrawal of funds by the core team has undoubtedly sentenced TRUMP Coin, which has already lost over 90% of its valuation, to "death." This incident also once again exposed the fragility of political meme coins that lack real utility support when faced with internal selling pressure.

MarketWhisper·2025-12-31 07:26

TRUMP deployer deposits $94M USDC to Coinbase over 3 weeks

Wallets tied to the deployer of the TRUMP memecoin have moved tens of millions of dollars to Coinbase, drawing fresh attention to how liquidity is being unwound.

Summary

Wallets tied to the TRUMP token deployer transferred $94M in USDC to Coinbase over the past three weeks

Funds originated

Cryptonews·2025-12-31 04:54

Pump.fun USDC Transfers Spark Debate Over SOL Activity

Pump.fun's reported $50M cash-out has sparked debate in the crypto community. While Lookonchain highlights massive USDC transfers and SOL sales, Joestar argues these are treasury funds, not market manipulation. The data suggests steady fund consolidation without price impact on $PUMP.

CryptoFrontNews·2025-12-30 22:16

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-30 20:30

$LIT Faces Heavy Selling Pressure As Whales Deploy Leveraged Shorts Worth $3M+ USDC

$LIT has attracted huge interest as per on-chain data, following the addition of multiple high-value traders, also known as whales, to open large short positions on the asset using the Hyperliquid derivatives platform. As the data provided by Onchain Lens show, these roles presuppose several

BlockChainReporter·2025-12-30 14:05

Whale Buys 108501 HYPE On HyperLiquid as Momentum Signals Potential January Rebound Ahead

A whale increases HYPE holdings on HyperLiquid by purchasing 108,501 tokens and keeping 10,030 staked for rewards.

A whale has made a major investment in HYPE tokens on the HyperLiquid platform.

The investor deposited $3 million in USDC and used most of it to acquire a large number of HYPE to

LiveBTCNews·2025-12-30 11:20

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-29 20:26

Whales Are Accumulating These 3 Altcoins Quietly After 30% Pullbacks

Solana: Developers and whales accumulate during 30% pullback as ETF speculation and DeFi inflows grow.

Sei: Native USDC launch drives TVL growth and attracts institutional liquidity during market weakness.

Hedera: Enterprise partnerships and standards compatibility draw quiet whale accumu

CryptoNewsLand·2025-12-29 14:43

Financial Giants Advance Institutional Tokenization

J.P. Morgan and Klarna advanced institutional crypto use, with Klarna raising funds in USDC to reach new regulated investors.

ABN Amro and DZ Bank completed a blockchain-based derivatives trade, pairing smart contracts with EU MiCAR licensing.

Hong Kong finalized bank crypto rules as

CryptoFrontNews·2025-12-29 08:38

WLFI's $3 billion treasury proposal faces community resistance! USD1 soars, but WLFI drops 56% this year

DeFi project World Liberty Financial (WLFI) supported by the Trump family background is currently embroiled in a fierce internal struggle. On December 28, the project proposed a controversial governance proposal to use no more than 5% of the unlocked WLFI token treasury to subsidize and incentivize the adoption of its stablecoin USD1, aiming to catch up with giants like USDT and USDC. However, the proposal faced strong opposition during the community voting phase, with over 67% of voters casting against it. Dramatically, almost simultaneously, the circulating market cap of USD1 broke through the $3 billion mark for the first time, ranking as the seventh-largest stablecoin globally. Meanwhile, the WLFI governance token price has fallen 56% from its peak. Amid scrutiny due to political connections and fierce market competition, the project's development path remains full of uncertainties.

MarketWhisper·2025-12-29 02:51

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-28 20:25

PumpFun Extracts $50 Million in 24 Hours as Q4 Cashouts Nears $615 Million Total

Pump.fun offloaded 4.19M SOL worth $757M and sent $617.5M USDC to Kraken since October 2025.

Pump.fun moved another $50M USDC to Kraken recently, continuing large-scale on-chain transfers. Since October 15, the platform has deposited $617.5M USDC into Kraken. During the same period, $1.1

IN9.69%

LiveBTCNews·2025-12-28 19:00

Uniswap Burns 100M UNI Worth $591M After Fee Proposal

Uniswap’s “UNIfication” burn removes 100M UNI, transforming the token from governance-only to value-accruing asset.

Over 125M votes supported fee burns, now directly tying protocol usage to token supply reduction.

UNI wallet holds $1.7B, mainly in UNI; smaller transfers of ETH, USDC,

CryptoFrontNews·2025-12-28 14:41

Pump.fun continues to transfer 50 million USDC to Kraken, PUMP token down 55% compared to the ICO price

Pump.fun recently transferred an additional 50 million USDC to Kraken, totaling 605 million USDC since mid-November. Despite selling ICO tokens at 0.004 USD, PUMP is now trading at 0.0018 USD, raising concerns about selling pressure and the project's long-term prospects.

TapChiBitcoin·2025-12-28 03:56

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-27 20:21

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-26 20:21

Ctrip Overseas Version Launches Stablecoin Payments! Book Tickets with USDT and Save 18% to Tap into Southeast Asia

Trip.com, the overseas version of Ctrip, has quietly launched a stablecoin payment feature, allowing global users to book hotels and flights using USDT and USDC. Real-world testing shows that purchasing tickets from Nha Trang to Ho Chi Minh City in Vietnam with USDT saves about 18% compared to traditional payment methods, and hotel bookings save 2.35%. The platform supports six public blockchains including Ethereum, Solana, and TON.

MarketWhisper·2025-12-26 03:20

Christmas Eve disguised as Circle official releases new products, media rushing to report instead fuels the spread of fake news

Fake Christmas Eve news impersonating Circle introduces CircleMetals and fictitious tokens, misleading users to connect wallets. Circle urgently clarifies and denies, criticizing media for rushing and amplifying scam risks.

Fake news released on Christmas Eve, disguising as official products to mislead the market

-------------------

During Christmas Eve, a press release claiming that stablecoin issuer Circle launched a new platform called "CircleMetals," offering tokenized gold and silver trading, circulated on social media and multiple crypto information channels.

The press release states that users can perform 24-hour exchanges between $USDC and the so-called "$GLDC" gold token and "$SILC" silver token on the CircleMetals platform, claiming liquidity is sourced from COMEX.

USDC0.05%

CryptoCity·2025-12-26 03:06

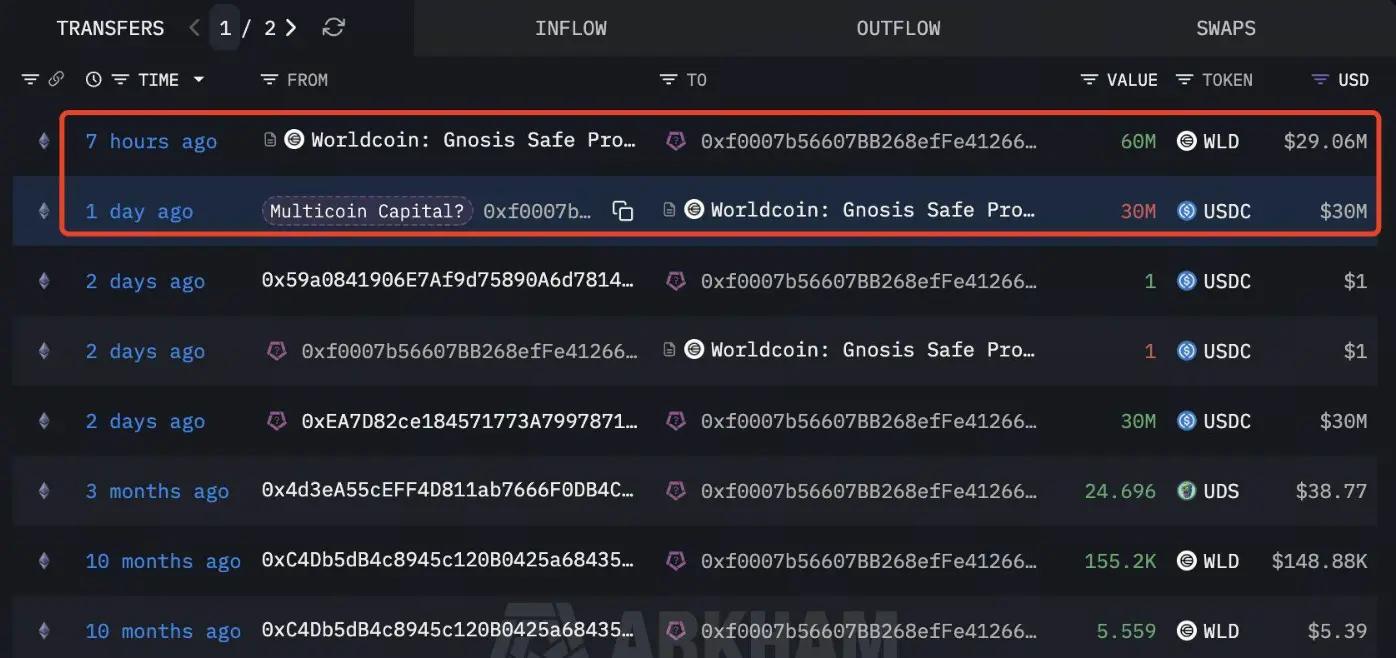

Institutions are boldly spending $30 million against the trend! Multicoin Capital OTC is rushing to acquire 60 million Worldcoin. What is their intention?

Renowned crypto venture capital firm Multicoin Capital recently made a one-time off-market purchase of 60 million WLD tokens from the Worldcoin project team, involving up to 30 million USDC. This transaction comes at a time when Worldcoin is facing multiple difficulties: its token price has dropped over 21% in the past month, on-chain active wallet addresses have sharply declined since the September peak, and global search interest has plummeted 94% from its high. Meanwhile, the project is facing increasingly severe regulatory scrutiny in countries like Thailand, with demands to delete millions of collected user biometric data. The institution's contrarian re-investment amid retail withdrawal and regulatory clouds has sparked deep reflections in the market on Worldcoin's long-term value and the future of the biometric identity track.

MarketWhisper·2025-12-26 01:46

Multicoin Capital bets against the trend! Buys 30 million worth of WLD without fear of regulatory storms

Worldcoin (WLD) monthly down 21%, search volume plummeted from a peak of 100 to 6, Thailand requests deletion of biometric data from millions of users. Just as the market is bearish, Multicoin Capital invests 30 million USDC to acquire 60 million WLD tokens. Lookonchain tracked this OTC trade; why is this top crypto fund increasing its holdings against the trend while retail investors are fleeing?

MarketWhisper·2025-12-26 01:40

Load More