Hasil pencarian untuk "SAY"

Pemikiran pasar prediksi: Ketika probabilitas menggantikan ketakutan, kita bisa benar-benar bebas.

Judul asli: Ketika seorang ayah menggunakan prediction market untuk mengurangi kecemasan dalam membesarkan anak

Penulis asli: Polyfactual

Sumber asli:

Repost: Daisy, Mars Finance

Pada pagi Selasa lalu, saya berdiri di antrean penjemputan di sekolah dasar, memegang ransel anak saya, terdiam di sana. Akhir pekan yang baru saja berlalu, sekali lagi sebuah insiden penembakan di kampus mendominasi berita utama.

Ketika dia berlari dengan semangat masuk ke gedung sekolah, saya merasakan ketegangan yang familiar di dada saya—sebuah perasaan yang menyayat hati, seolah-olah seiring mereka semakin mandiri di dunia yang penuh permusuhan ini, segala sesuatu bisa saja terjadi.

Dalam perjalanan ke kantor dengan mobil, saya memutar sebuah buku audio panjang yang sedang saya dengarkan: "Pengakuan yang Diam" (Say Nothing), sebuah catatan sejarah tentang konflik Irlandia Utara (The Troubles) - dari tahun 1969 hingga akhir 1990-an, berlangsung selama tiga puluh tahun melawan kolonialisme.

MarsBitNews·2025-10-15 13:26

Michael Saylor: Protokol Bitcoin dapat menghadapi ancaman komputasi kuantum dengan mengatasi risiko potensial melalui pembaruan perangkat lunak.

Techub News melaporkan, menurut CoinDesk, pendiri Strategy Michael Saylor baru-baru ini meremehkan ancaman komputasi kuantum terhadap Bitcoin dalam sebuah wawancara, dengan mengatakan bahwa ketika ancaman menjadi nyata, protokol Bitcoin dapat mengatasi risiko potensial melalui pembaruan perangkat lunak. Dia menyatakan: "Ini terutama merupakan taktik pemasaran dari mereka yang ingin menjual koin konsep kuantum berikutnya kepada Anda. Google dan Microsoft tidak akan menjual komputer yang dapat membongkar teknologi enkripsi modern, karena itu akan menghancurkan Google dan Microsoft—juga akan menghancurkan pemerintah AS dan sistem perbankan."

Saat ini, sudah ada beberapa solusi yang meneliti bagaimana cara membuat Bitcoin Proof of Work (PoW) tahan terhadap serangan kuantum, termasuk perangkat keras enkripsi tahan kuantum yang dikembangkan oleh startup seperti BTQ. Seorang pengembang Bitcoin telah mengajukan proposal perbaikan (BIP), yang menyarankan untuk memigrasikan alamat dompet ke alamat yang aman terhadap kuantum melalui hard fork. Say

BTC-0,74%

TechubNews·2025-06-09 01:08

Hedera Eyes $0.25 as Experts Say HBAR has 90% Upside

Pasar cryptocurrency menunjukkan tanda-tanda sentimen positif, terutama untuk aset seperti Hedera (HBAR) dengan pembicaraan tentang potensi keuntungan. Para ahli memprediksi kenaikan 90% untuk HBAR, mencapai $0.25. Diskusi tentang HBAR ETF dan proyeksi tinggi $0.46 turut berkontribusi pada pandangan optimis.

CryptosHeadlines·2025-03-07 02:46

Seorang Hakim Federal Baru Saja Menghentikan SEC. Inilah Artinya. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

Gary Gensler's 'last public speech' before stepping down, what did he say about cryptocurrency?

Ketua SEC Gary Gensler dalam pidatonya yang terakhir menyebutkan pentingnya pelaksanaan yang efektif dari hukum sekuritas, menekankan bahwa pasar yang diawasi dengan baik dapat membangun kepercayaan dan menciptakan lingkungan yang sukses secara ekonomi. Dia menjelaskan pentingnya menerapkan 'aturan jalan' ini, dan menyoroti bagaimana memperbarui dan memperkuat peraturan untuk mengurangi risiko, membentuk skala pasar modal, dan Kedalaman. Gensler juga menyebutkan kontribusi hukum sekuritas terhadap keberhasilan ekonomi negara bagi para investor dan penerbit. Dia juga menyentuh prinsip-prinsip penting hukum sekuritas dalam pasar saham, tata kelola perusahaan, dan pengungkapan informasi.

動區BlockTempo·2024-11-17 05:07

Bull run has just begun! When will BTC reach 100,000? Let's see what 11 experts and Satoshi have to say.

Sejak kemenangan Trump dalam pemilihan presiden AS 2024 pada tanggal 5 November, harga BTC mencapai rekor tertinggi dalam seminggu terakhir. Menurut data pasar, pada malam pemilihan, harga BTC melampaui titik tertinggi sebelumnya yaitu $73.730, saat ini harga perdagangan BTC berada di kisaran $88.000 - $89.000 Fluktuasi, dengan puncak harian mencapai $90.036,17.

Berapa lama kenaikan BTC setelah pemilihan akan berlangsung mengikuti harapan Informasi menguntungkan dari terpilihnya Trump, kemungkinan negara-negara berdaulat akan mengadopsi strategi cadangan BTC AS, dan kebijakan suku bunga yang longgar?

"Jangan melawan tren," kata analis Bernstein dalam laporan kepada kliennya, "Selamat datang di pasar banteng enkripsi - belilah semua yang bisa kamu beli."

Bernstein dan Standard Chartered Bank memperkirakan harga BTC akan mencapai 20 pada akhir tahun depan

CryptoCity·2024-11-14 09:01

Odaily x KIP Space Review: Mengangkat Atap Lintasan DeAI dengan Menolak High FDV, Bagaimana KIP Protocol Melakukan

Julian Peh, CEO KIP Protocol, dan Dr. Jennifer Dodgson, Chief AI Strategy Officer, berbagi arah inovatif dan hasil praktis KIP Protocol di bidang Desentralisasi AI, di Chinese Space "Say No to High FDV, How KIP Protocol Lifts the Ceiling of the DeAI Track". Pengembangan produk KIP Protocol didasarkan pada solusi langsung untuk masalah yang ada, dengan fokus pada kasus penggunaan dunia nyata untuk DeAI, dan membangun mekanisme distribusi keuntungan yang kredibel. Visi ekologis Protokol KIP adalah membangun lingkungan di mana AI dan AI saling berhubungan, dan menciptakan "jalan raya" bagi Desentralisasi AI untuk mewujudkan pertukaran nilai. Tamu lain juga berbagi pandangan mereka tentang jalur DeAI.

星球日报·2024-10-28 05:17

Investor mitos hitam berbicara tentang permainan Web3: Tidak mungkin membuat permainan yang bagus tanpa cinta

Mihoyo's Big Brother commented on a friends' circle post, 'I'll just say this here, the strongest investor in the Chinese gaming industry in the past five years: Daniel, no doubt.'

Orang yang memposting di lingkaran teman ini bernama Wu Dan (Daniel), dia adalah orang pertama yang berinvestasi di 'Black Myth: Wukong'. Tujuh tahun yang lalu, ia menginvestasikan 60 juta dalam Hero Game sebagai pemegang saham 20%. Hingga tahun 2021 ketika Tencent masuk sebagai pemegang saham, Hero Game adalah satu-satunya investor dan pemegang saham eksternal terbesar.

Yang tidak diketahui semua orang adalah, selain investasi saham senilai 60 juta, Hero Game juga menambahkan setidaknya satu miliar lagi untuk proyek "Black Myth: Wukong". Satu miliar ini juga membuat Hero Game menjadi satu-satunya mitra bersama untuk "Black Myth: Wukong".

Daniel

金色财经_·2024-09-02 04:52

Arbitrum (ARB) di persimpangan penting: Apakah kenaikan akan berlanjut?

Ethereum'un (ETH) atağa kalkması eşliğinde yükselişe geçen Arbitrum'da (ARB) hangi seviyeler test edilebilir?

Spot ETH ETF news has ignited the altcoin market. The sharp increases in Layer-2 projects, in particular, have not gone unnoticed. When we say Layer-2, the first thing that comes to mind is

Coinkolik·2024-05-22 00:30

Bisnis mesin penambangan sulit dilakukan Bitmain berhenti membayar upah

Bitmain, yang telah lama terdiam, telah menyebabkan diskusi panas di lingkaran karena pengumuman penggajian yang tertunda, di bawah pasar beruang, Bitmain, yang pernah menjadi pusat perhatian, tidak akan mampu menanggung arus kas?

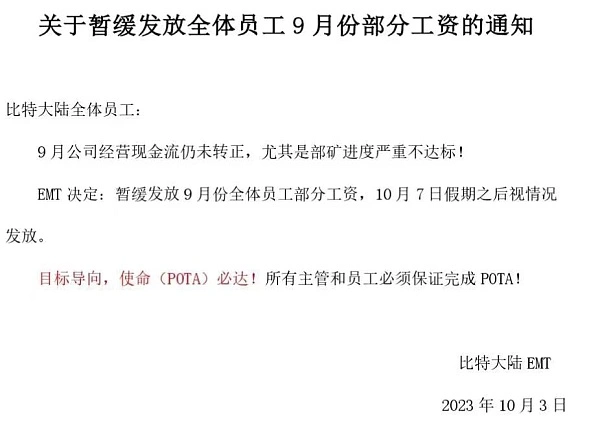

Menurut laporan Wu Say Blockchain, sejumlah karyawan internal Bitmain mengkonfirmasi bahwa Bitmain mengeluarkan pemberitahuan: arus kas operasi perusahaan pada bulan September belum berubah positif, terutama kemajuan tambang (mengacu pada mesin penambangan yang ditempatkan di tambang) secara serius tidak memenuhi standar, EMT memutuskan untuk menangguhkan pembayaran sebagian dari gaji semua karyawan pada bulan September, dan membayarnya sesuai dengan situasi setelah liburan pada 7 Oktober. Sejumlah karyawan mengungkapkan bahwa upah kinerja semua karyawan pada bulan September semuanya dipotong, dan gaji pokok mereka juga dipotong setengahnya, dan upah yang dipotong tidak tahu kapan mereka akan dibayarkan. Hingga 8 Oktober, karyawan belum menerima upah yang belum dibayar, dan bonus akhir tahun 2022 belum dibayarkan.

Bitmain pernah memonopoli lebih dari tujuh puluh persen pangsa pasar mesin penambangan bitcoin global, dan kemudian karena dua pendiri Wu Jihan dan Zhan Ketuan bersaing untuk menguasai "internal ...

金色财经_·2023-10-11 13:37

Muat Lebih Banyak