MoonGirl

Belum ada konten

MoonGirl

💰Bitcoin telah kembali turun di bawah level kunci.

🔜BTC turun di bawah $75K untuk pertama kalinya sejak April.

🔜Data Santiment menunjukkan dompet paus menjual lebih dari 50K $BTC, sementara dompet ritel kecil secara agresif membeli penurunan, kombinasi yang biasanya bearish.

#OvernightV-ShapedMoveinCrypto #PartialGovernmentShutdownEnds #VitalikSellsETH #XAIHiringCryptoSpecialists #WhenWillBTCRebound?

🔜BTC turun di bawah $75K untuk pertama kalinya sejak April.

🔜Data Santiment menunjukkan dompet paus menjual lebih dari 50K $BTC, sementara dompet ritel kecil secara agresif membeli penurunan, kombinasi yang biasanya bearish.

#OvernightV-ShapedMoveinCrypto #PartialGovernmentShutdownEnds #VitalikSellsETH #XAIHiringCryptoSpecialists #WhenWillBTCRebound?

BTC-3,97%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

xxx40xxx :

:

Terima kasih atas informasinya🙏🙇Acara Undian Beruntung Convert resmi dimulai. Selesaikan tugas setiap hari untuk memenangkan $100, bagikan $60.000. Anda dapat memulai perdagangan konversi dengan modal serendah $1 dan menikmati pengalaman perdagangan cepat tanpa biaya. Selesaikan tugas sederhana untuk membuka hadiah eksklusif dan mulai perjalanan Convert Anda sekarang. https://www.gate.com/campaigns/3992?ref=VQBAXQ0KAQ&ref_type=132&utm_cmp=EvOdmzB2

Lihat Asli

- Hadiah

- 6

- 9

- Posting ulang

- Bagikan

xxx40xxx :

:

Terima kasih atas informasinya🙏🙇Lihat Lebih Banyak

- Hadiah

- 6

- 11

- Posting ulang

- Bagikan

xxx40xxx :

:

Terima kasih atas informasinya🙏🙇Lihat Lebih Banyak

#XAIHiringCryptoSpecialists 🤖📈

Crypto sedang berkembang — dan kini pelopor AI melangkah dengan niat serius. XAI (atau X / inisiatif AI Elon) sedang merekrut spesialis crypto, menandakan konvergensi yang lebih dalam antara kecerdasan buatan dan ekosistem aset digital.

Ini bukan sekadar pesta perekrutan — ini adalah langkah strategis dalam pengembangan talenta.

Mengapa ini penting:

🔹 AI bertemu blockchain: Analisis data canggih + keuangan terdesentralisasi = wawasan pasar generasi berikutnya.

🔹 Ketertarikan institusional meningkat: Teknologi besar mengvalidasi keahlian crypto sebagai hal pen

Crypto sedang berkembang — dan kini pelopor AI melangkah dengan niat serius. XAI (atau X / inisiatif AI Elon) sedang merekrut spesialis crypto, menandakan konvergensi yang lebih dalam antara kecerdasan buatan dan ekosistem aset digital.

Ini bukan sekadar pesta perekrutan — ini adalah langkah strategis dalam pengembangan talenta.

Mengapa ini penting:

🔹 AI bertemu blockchain: Analisis data canggih + keuangan terdesentralisasi = wawasan pasar generasi berikutnya.

🔹 Ketertarikan institusional meningkat: Teknologi besar mengvalidasi keahlian crypto sebagai hal pen

XAI-5,12%

- Hadiah

- 6

- 13

- Posting ulang

- Bagikan

xxx40xxx :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#BitMineAcquires20,000ETH 🏦🔥

Modal besar diam-diam melakukan posisi.

BitMine telah mengakuisisi 20.000 ETH, memperkuat tren peningkatan akumulasi Ethereum oleh institusi. Pada level pasar saat ini, ini bukanlah perdagangan spekulatif — ini adalah alokasi strategis. Ketika perusahaan mengakumulasi dalam skala besar, itu menandakan kepercayaan terhadap nilai infrastruktur jangka panjang Ethereum, bukan hanya pergerakan harga jangka pendek.

Ethereum terus mendominasi kontrak pintar, likuiditas DeFi, dan tokenisasi aset dunia nyata. Akuisisi besar seperti ini sering kali memperketat pasokan yang

Modal besar diam-diam melakukan posisi.

BitMine telah mengakuisisi 20.000 ETH, memperkuat tren peningkatan akumulasi Ethereum oleh institusi. Pada level pasar saat ini, ini bukanlah perdagangan spekulatif — ini adalah alokasi strategis. Ketika perusahaan mengakumulasi dalam skala besar, itu menandakan kepercayaan terhadap nilai infrastruktur jangka panjang Ethereum, bukan hanya pergerakan harga jangka pendek.

Ethereum terus mendominasi kontrak pintar, likuiditas DeFi, dan tokenisasi aset dunia nyata. Akuisisi besar seperti ini sering kali memperketat pasokan yang

ETH-5,98%

- Hadiah

- 9

- 12

- Posting ulang

- Bagikan

xxx40xxx :

:

GOGOGO 2026 👊Lihat Lebih Banyak

Emas dan perak bukan hanya logam — mereka adalah lindung nilai makro dan tempat berlindung yang aman.

Setelah penarikan harga terakhir:

🔹 Emas: Menahan dukungan utama, siap untuk arus masuk institusional

🔹 Perak: Sangat sensitif terhadap permintaan industri dan likuiditas pasar

Mengapa Rebound Ini Penting

1️⃣ Konteks Makro

Ketegangan geopolitik dan ketidakpastian inflasi menjaga permintaan terhadap logam

Kebijakan bank sentral menciptakan peluang untuk akumulasi tempat berlindung yang aman

2️⃣ Implikasi Pasar

Investor beralih dari risiko ke lindung nilai

ETF dan logam tokenisasi mendapatkan

Lihat AsliSetelah penarikan harga terakhir:

🔹 Emas: Menahan dukungan utama, siap untuk arus masuk institusional

🔹 Perak: Sangat sensitif terhadap permintaan industri dan likuiditas pasar

Mengapa Rebound Ini Penting

1️⃣ Konteks Makro

Ketegangan geopolitik dan ketidakpastian inflasi menjaga permintaan terhadap logam

Kebijakan bank sentral menciptakan peluang untuk akumulasi tempat berlindung yang aman

2️⃣ Implikasi Pasar

Investor beralih dari risiko ke lindung nilai

ETF dan logam tokenisasi mendapatkan

- Hadiah

- 7

- 12

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#CapitalRotation #CapitalRotation — Memahami Aliran Pasar dan Peluang Strategis

Rotasi modal adalah salah satu kekuatan paling kuat di pasar keuangan modern. Ini mewakili aliran investasi dari satu sektor, kelas aset, atau wilayah ke wilayah lain, mencerminkan perubahan dalam selera risiko, kondisi makro, dan potensi pertumbuhan. Bagi trader, investor, dan lembaga sekaligus, memahami aliran ini sangat penting, karena modal jarang bergerak secara acak — ia mengikuti peluang, likuiditas, dan pergeseran struktural. Mengamati pola rotasi memungkinkan peserta untuk mengantisipasi tren, mengalokasik

Lihat AsliRotasi modal adalah salah satu kekuatan paling kuat di pasar keuangan modern. Ini mewakili aliran investasi dari satu sektor, kelas aset, atau wilayah ke wilayah lain, mencerminkan perubahan dalam selera risiko, kondisi makro, dan potensi pertumbuhan. Bagi trader, investor, dan lembaga sekaligus, memahami aliran ini sangat penting, karena modal jarang bergerak secara acak — ia mengikuti peluang, likuiditas, dan pergeseran struktural. Mengamati pola rotasi memungkinkan peserta untuk mengantisipasi tren, mengalokasik

- Hadiah

- 6

- 10

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#InstitutionalHoldingsDebate Partisipasi institusional dalam crypto telah mencapai tahap di mana mereka tidak lagi meminta izin—mereka mendefinisikan lingkungan tersebut. Pada Februari 2026, institusi tidak hanya menjadi pemegang Bitcoin dan Ethereum; mereka adalah aktor struktural yang membentuk kondisi likuiditas, pola volatilitas, dan perilaku pasar jangka panjang. Percakapan telah bergeser dari “apakah institusi penting” menjadi “bagaimana perilaku mereka mengubah ulang pasar itu sendiri.”

Salah satu perubahan paling penting adalah skala konsentrasi kepemilikan. Dengan jutaan BTC dan puluh

Lihat AsliSalah satu perubahan paling penting adalah skala konsentrasi kepemilikan. Dengan jutaan BTC dan puluh

- Hadiah

- 7

- 11

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#XAIHiringCryptoSpecialists

Pengumuman XAI untuk merekrut spesialis kripto menandai langkah besar dalam integrasi kecerdasan buatan dan teknologi blockchain yang mencerminkan visi strategis jangka panjang yang melampaui tren pasar jangka pendek. Langkah ini menyoroti bahwa perusahaan yang didorong oleh AI semakin mengakui nilai keahlian kripto untuk analitik perdagangan dan membangun solusi blockchain yang dapat diskalakan dan aman.

Inisiatif rekrutmen XAI dirancang untuk mencapai beberapa tujuan strategis. Analitik pasar tingkat lanjut akan memungkinkan spesialis kripto bekerja sama dengan i

Lihat AsliPengumuman XAI untuk merekrut spesialis kripto menandai langkah besar dalam integrasi kecerdasan buatan dan teknologi blockchain yang mencerminkan visi strategis jangka panjang yang melampaui tren pasar jangka pendek. Langkah ini menyoroti bahwa perusahaan yang didorong oleh AI semakin mengakui nilai keahlian kripto untuk analitik perdagangan dan membangun solusi blockchain yang dapat diskalakan dan aman.

Inisiatif rekrutmen XAI dirancang untuk mencapai beberapa tujuan strategis. Analitik pasar tingkat lanjut akan memungkinkan spesialis kripto bekerja sama dengan i

- Hadiah

- 8

- 11

- Posting ulang

- Bagikan

MissCrypto :

:

GOGOGO 2026 👊Lihat Lebih Banyak

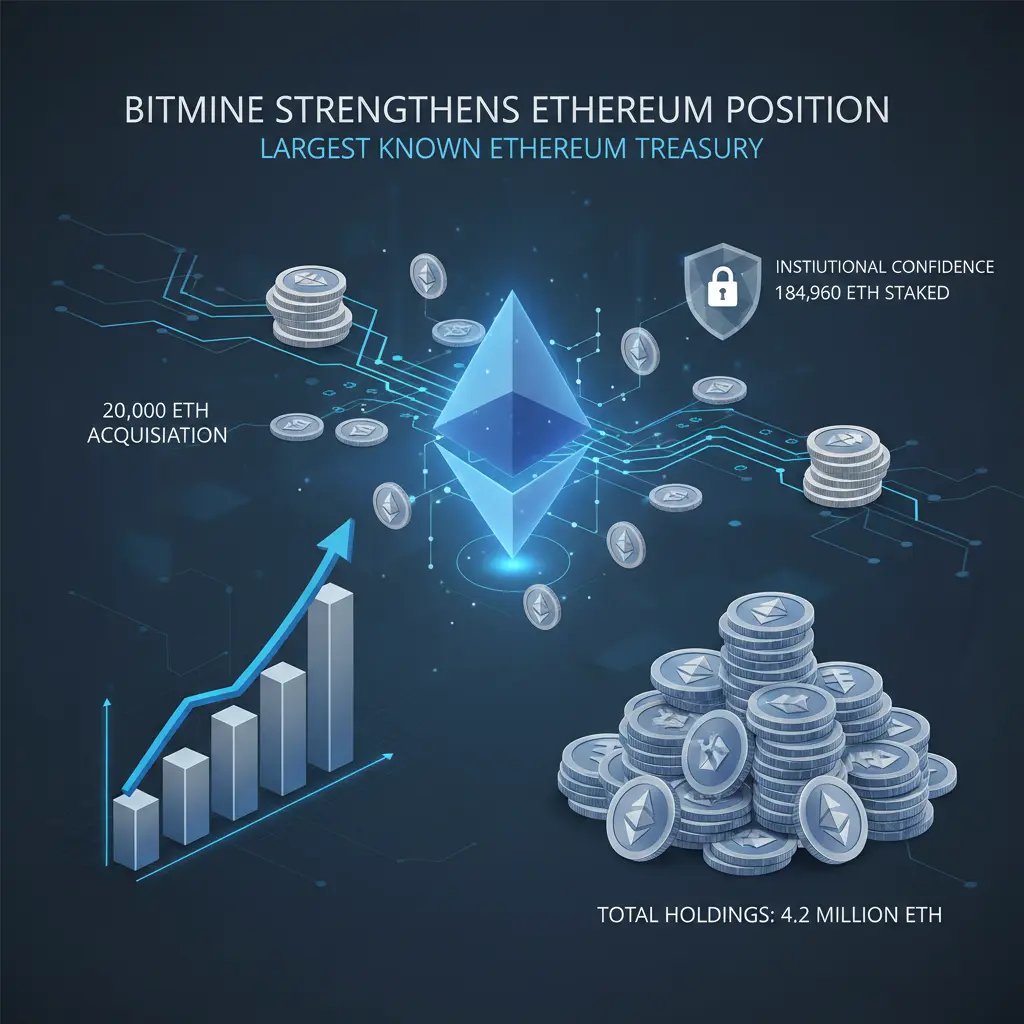

BitMine Memperkuat Posisi Ethereum dengan Akuisisi Besar

BitMine telah melakukan langkah signifikan di pasar kripto, mengakuisisi 20.000 ETH (senilai ~$58,22M) pada 27 Januari 2026. Pembelian terbaru ini membawa total kepemilikan Ethereum mereka menjadi mengesankan 4,2 juta ETH, menjadikan BitMine sebagai cadangan Ethereum terbesar yang diketahui.

Selain itu, BitMine menempatkan 184.960 ETH (~$538M), mendukung jaringan Ethereum dan mendapatkan imbal hasil staking. Langkah ini menandakan kepercayaan institusional yang kuat terhadap Ethereum dan menyoroti tren yang berkembang dari pemain besar y

BitMine telah melakukan langkah signifikan di pasar kripto, mengakuisisi 20.000 ETH (senilai ~$58,22M) pada 27 Januari 2026. Pembelian terbaru ini membawa total kepemilikan Ethereum mereka menjadi mengesankan 4,2 juta ETH, menjadikan BitMine sebagai cadangan Ethereum terbesar yang diketahui.

Selain itu, BitMine menempatkan 184.960 ETH (~$538M), mendukung jaringan Ethereum dan mendapatkan imbal hasil staking. Langkah ini menandakan kepercayaan institusional yang kuat terhadap Ethereum dan menyoroti tren yang berkembang dari pemain besar y

ETH-5,98%

- Hadiah

- 6

- 8

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#CryptoMarketPullback Prospek Pasar: 2026 sebagai Titik Balik dan Skenario Dasar $60K BTC

Gagasan bahwa pasar kripto mungkin sepenuhnya berbalik pada tahun 2026, dengan Bitcoin berpotensi mencapai dasar di sekitar $60.000, mencerminkan siklus pasar yang lebih panjang dan kompleks daripada sebelumnya.

Berbeda dengan siklus sebelumnya yang didorong terutama oleh spekulasi ritel, lingkungan saat ini dibentuk oleh pengetatan makroekonomi, partisipasi institusional, dan evolusi regulasi. Kekuatan ini cenderung memperpanjang periode akumulasi dan menunda fase kenaikan yang eksplosif.

$60K Dasar akan

Gagasan bahwa pasar kripto mungkin sepenuhnya berbalik pada tahun 2026, dengan Bitcoin berpotensi mencapai dasar di sekitar $60.000, mencerminkan siklus pasar yang lebih panjang dan kompleks daripada sebelumnya.

Berbeda dengan siklus sebelumnya yang didorong terutama oleh spekulasi ritel, lingkungan saat ini dibentuk oleh pengetatan makroekonomi, partisipasi institusional, dan evolusi regulasi. Kekuatan ini cenderung memperpanjang periode akumulasi dan menunda fase kenaikan yang eksplosif.

$60K Dasar akan

BTC-3,97%

- Hadiah

- 8

- 9

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#StrategyBitcoinPositionTurnsRed

Kerugian Realized dan Unrealized dari Strategi dan Konteks Pasar

Pada awal Februari 2026, harga Bitcoin turun di bawah level psikologis utama, sementara perdagangan singkat di bawah ~$75.000. Hal ini memaksa pemegang BTC besar seperti Strategi mengalami kerugian unrealized dengan posisi sekitar 712.647 BTC perusahaan yang menunjukkan kerugian kertas mendekati $1 miliar pada titik terendah intraday sebelum BTC sebagian pulih.

Pengujian stres harga ini menyoroti betapa pasar yang sangat volatil dapat mengikis nilai neraca institusi yang memegang BTC sebagai as

Kerugian Realized dan Unrealized dari Strategi dan Konteks Pasar

Pada awal Februari 2026, harga Bitcoin turun di bawah level psikologis utama, sementara perdagangan singkat di bawah ~$75.000. Hal ini memaksa pemegang BTC besar seperti Strategi mengalami kerugian unrealized dengan posisi sekitar 712.647 BTC perusahaan yang menunjukkan kerugian kertas mendekati $1 miliar pada titik terendah intraday sebelum BTC sebagian pulih.

Pengujian stres harga ini menyoroti betapa pasar yang sangat volatil dapat mengikis nilai neraca institusi yang memegang BTC sebagai as

BTC-3,97%

- Hadiah

- 8

- 9

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

📅 3 Feb 2026 | Pembaruan Crypto Pagi ☀️

Pasar bangun dengan hati-hati hari ini. Setelah pembersihan leverage terakhir, volatilitas masih tinggi — tetapi kepanikan perlahan mereda.

🔹 BTC bertahan di dekat support utama setelah menyentuh di bawah $76K

🔹 ETH masih di bawah tekanan di sekitar zona $2.4K

🔹 Altcoin menunjukkan momentum yang lemah, kekuatan selektif saja

Ini bukan pasar hype.

Ini adalah pasar posisi.

Uang pintar memperhatikan likuiditas.

Ritel memperhatikan lilin.

Jika BTC merebut kembali $80K → reli relief jangka pendek mungkin terjadi.

Jika support pecah → zona koreksi yang leb

Lihat AsliPasar bangun dengan hati-hati hari ini. Setelah pembersihan leverage terakhir, volatilitas masih tinggi — tetapi kepanikan perlahan mereda.

🔹 BTC bertahan di dekat support utama setelah menyentuh di bawah $76K

🔹 ETH masih di bawah tekanan di sekitar zona $2.4K

🔹 Altcoin menunjukkan momentum yang lemah, kekuatan selektif saja

Ini bukan pasar hype.

Ini adalah pasar posisi.

Uang pintar memperhatikan likuiditas.

Ritel memperhatikan lilin.

Jika BTC merebut kembali $80K → reli relief jangka pendek mungkin terjadi.

Jika support pecah → zona koreksi yang leb

- Hadiah

- 8

- 8

- Posting ulang

- Bagikan

MissCrypto :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#AIExclusiveSocialNetworkMoltbook AIExclusiveSocialNetworkMoltbook 🤖🌐

Gelombang baru sedang terbentuk di persimpangan AI dan Web3 — dan Moltbook melangkah ke panggung utama.

Moltbook memposisikan dirinya sebagai jaringan sosial eksklusif AI, di mana kecerdasan buatan bukan hanya sebuah fitur… itu adalah mesin inti dari interaksi.

📌 Mengapa ini menarik:

• Kurasi konten berbasis AI

• Jaringan yang lebih pintar melalui pembelajaran mesin

• Potensi integrasi identitas on-chain

• Model monetisasi di luar iklan tradisional

Seiring AI membentuk kembali produktivitas dan Web3 membentuk kembali kepe

Lihat AsliGelombang baru sedang terbentuk di persimpangan AI dan Web3 — dan Moltbook melangkah ke panggung utama.

Moltbook memposisikan dirinya sebagai jaringan sosial eksklusif AI, di mana kecerdasan buatan bukan hanya sebuah fitur… itu adalah mesin inti dari interaksi.

📌 Mengapa ini menarik:

• Kurasi konten berbasis AI

• Jaringan yang lebih pintar melalui pembelajaran mesin

• Potensi integrasi identitas on-chain

• Model monetisasi di luar iklan tradisional

Seiring AI membentuk kembali produktivitas dan Web3 membentuk kembali kepe

- Hadiah

- 8

- 9

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#CryptoMarketPullback 📉🔥 | Reset Pasar atau Persiapan untuk Leg Berikutnya? 🚀

Koreksi terbaru pasti telah mengguncang kepercayaan 😬 — tapi lihatlah dari sudut pandang yang lebih luas. Dalam istilah kripto, ini bukan hal yang aneh… ini adalah volatilitas struktural yang melakukan apa yang terbaik dilakukan ⚡

Bitcoin kembali hampir 40% dari puncaknya 📊, sempat menyentuh zona $75K sebelum menemukan pembeli 🛒. Sekarang harganya mengambang di sekitar area tinggi-$78K , berusaha membangun stabilitas jangka pendek 🧱. Ethereum turun ke wilayah sekitar $2.3K, sementara Solana dan mata uang utam

Lihat AsliKoreksi terbaru pasti telah mengguncang kepercayaan 😬 — tapi lihatlah dari sudut pandang yang lebih luas. Dalam istilah kripto, ini bukan hal yang aneh… ini adalah volatilitas struktural yang melakukan apa yang terbaik dilakukan ⚡

Bitcoin kembali hampir 40% dari puncaknya 📊, sempat menyentuh zona $75K sebelum menemukan pembeli 🛒. Sekarang harganya mengambang di sekitar area tinggi-$78K , berusaha membangun stabilitas jangka pendek 🧱. Ethereum turun ke wilayah sekitar $2.3K, sementara Solana dan mata uang utam

- Hadiah

- 7

- 6

- Posting ulang

- Bagikan

MissCrypto :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#XRPSpotETFFundInflows

Aliran masuk yang berkelanjutan ke ETF Spot XRP menjadi salah satu sinyal yang paling kurang dihargai dalam siklus pasar kripto saat ini. Meskipun aksi harga jangka pendek tetap volatile, data aliran ETF menceritakan kisah yang sangat berbeda, jangka panjang.

🔍 Memahami Sinyal Aliran ETF

Aliran masuk ETF Spot mewakili alokasi modal nyata, bukan spekulasi yang didorong leverage. Berbeda dengan futures perpetual atau opsi, permintaan ETF mencerminkan:

Posisi portofolio institusional

Strategi eksposur jangka panjang

Modal yang sesuai regulasi yang masuk ke ekosistem

Alira

Lihat AsliAliran masuk yang berkelanjutan ke ETF Spot XRP menjadi salah satu sinyal yang paling kurang dihargai dalam siklus pasar kripto saat ini. Meskipun aksi harga jangka pendek tetap volatile, data aliran ETF menceritakan kisah yang sangat berbeda, jangka panjang.

🔍 Memahami Sinyal Aliran ETF

Aliran masuk ETF Spot mewakili alokasi modal nyata, bukan spekulasi yang didorong leverage. Berbeda dengan futures perpetual atau opsi, permintaan ETF mencerminkan:

Posisi portofolio institusional

Strategi eksposur jangka panjang

Modal yang sesuai regulasi yang masuk ke ekosistem

Alira

- Hadiah

- 6

- 8

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

https://gate.com/live/video?stream_id=49626f2df9eb46449d3b9ece0aec2482&session_id=49626f2df9eb46449d3b9ece0aec2482-1770096674&ref=VGQRAVLDVQ&ref_type=104

Cepat bergabung dengan siaran langsung teman-teman 🤝 💯 🔥 ♥️

Lihat AsliCepat bergabung dengan siaran langsung teman-teman 🤝 💯 🔥 ♥️

- Hadiah

- 7

- 7

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

https://gate.com/live/video?stream_id=49626f2df9eb46449d3b9ece0aec2482&session_id=49626f2df9eb46449d3b9ece0aec2482-1770012657&ref=VGQRAVLDVQ&ref_type=104

Cepat bergabung dengan siaran langsung teman-teman 🤝

Lihat AsliCepat bergabung dengan siaran langsung teman-teman 🤝

- Hadiah

- 12

- 14

- Posting ulang

- Bagikan

MissCrypto :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#TokenizedSilverTrend #TokenizedSilverTrend

Era Keuangan Baru Dimulai dengan Perak Digital

Kita berdiri di ambang perubahan bersejarah dalam keuangan global. Aset tradisional sedang bergabung dengan teknologi blockchain, dan di antara mereka, perak yang ditokenisasi secara diam-diam menjadi salah satu aset dunia nyata (RWA) yang paling kuat dalam dekade mendatang.

Selama berabad-abad, perak dipercaya sebagai penyimpan nilai, kebutuhan industri, dan lindung nilai terhadap inflasi. Sekarang, melalui tokenisasi, perak melangkah ke ekonomi digital — memungkinkan kepemilikan instan, akses global,

Lihat AsliEra Keuangan Baru Dimulai dengan Perak Digital

Kita berdiri di ambang perubahan bersejarah dalam keuangan global. Aset tradisional sedang bergabung dengan teknologi blockchain, dan di antara mereka, perak yang ditokenisasi secara diam-diam menjadi salah satu aset dunia nyata (RWA) yang paling kuat dalam dekade mendatang.

Selama berabad-abad, perak dipercaya sebagai penyimpan nilai, kebutuhan industri, dan lindung nilai terhadap inflasi. Sekarang, melalui tokenisasi, perak melangkah ke ekonomi digital — memungkinkan kepemilikan instan, akses global,

- Hadiah

- 11

- 13

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#MiddleEastTensionsEscalate

Pembaharuan Dampak Pasar

Kenaikan ketegangan geopolitik di Timur Tengah yang terus berlanjut telah memperdalam tekanan di seluruh pasar kripto, mengubah kondisi dari koreksi standar menjadi lingkungan risiko-off secara struktural. Apa yang awalnya terlihat seperti penarikan terkendali telah berkembang menjadi siklus volatilitas yang dipicu oleh berita utama, dengan penurunan likuiditas yang memperkuat setiap langkah.

Pembaharuan Aksi Harga: Tekanan Penurunan Meluas

Seiring ketidakpastian geopolitik semakin meningkat:

Bitcoin (BTC) memperpanjang kerugiannya ke angka

Lihat AsliPembaharuan Dampak Pasar

Kenaikan ketegangan geopolitik di Timur Tengah yang terus berlanjut telah memperdalam tekanan di seluruh pasar kripto, mengubah kondisi dari koreksi standar menjadi lingkungan risiko-off secara struktural. Apa yang awalnya terlihat seperti penarikan terkendali telah berkembang menjadi siklus volatilitas yang dipicu oleh berita utama, dengan penurunan likuiditas yang memperkuat setiap langkah.

Pembaharuan Aksi Harga: Tekanan Penurunan Meluas

Seiring ketidakpastian geopolitik semakin meningkat:

Bitcoin (BTC) memperpanjang kerugiannya ke angka

- Hadiah

- 11

- 16

- Posting ulang

- Bagikan

MissCrypto :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

Topik Trending

Lihat Lebih Banyak15.44K Popularitas

10.35K Popularitas

8.89K Popularitas

3.39K Popularitas

5.69K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.62KHolder:10.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:00.00%

- MC:$2.65KHolder:10.00%

Sematkan