# InstitutionsAccelerateDigitalAssetPositioning

3.45K

EagleEye

#InstitutionsAccelerateDigitalAssetPositioning

Как сигналы о снижении ставки ФРС формируют потоки институционального криптоинвестирования: мое мнение о BTC, ETH, SOL и динамике рынка

За последние недели я внимательно наблюдаю за тем, как макроэкономические сигналы, особенно недавние указания ФРС о возможном снижении ставки, влияют на поведение институциональных участников на крипторынках. С моей точки зрения, реакция была решительной: институты ускоряют свои позиции в крупных цифровых активах, таких как Bitcoin, Ethereum и Solana. Это не просто спекуляции; это стратегическая переоценка портфе

Посмотреть ОригиналКак сигналы о снижении ставки ФРС формируют потоки институционального криптоинвестирования: мое мнение о BTC, ETH, SOL и динамике рынка

За последние недели я внимательно наблюдаю за тем, как макроэкономические сигналы, особенно недавние указания ФРС о возможном снижении ставки, влияют на поведение институциональных участников на крипторынках. С моей точки зрения, реакция была решительной: институты ускоряют свои позиции в крупных цифровых активах, таких как Bitcoin, Ethereum и Solana. Это не просто спекуляции; это стратегическая переоценка портфе

- Награда

- 17

- 13

- Репост

- Поделиться

BabaJi :

:

HODL крепко держи 💪Подробнее

#InstitutionsAccelerateDigitalAssetPositioning #InstitutionsAccelerateDigitalAssetPositioning – Гонка за цифровыми активами началась!

Ландшафт криптовалют и цифровых активов развивается с молниеносной скоростью, и это уже не просто игровая площадка для розничных трейдеров. Крупные институты – включая глобальные банки, хедж-фонды, пенсионные фонды и корпорации – не просто выходят на рынок; они активно занимают позиции, чтобы доминировать на нем. Это больше, чем инвестиции; это стратегическая игра, формирующая будущее финансов.

Разбор по пунктам:

1️⃣ Институты:

Это финансовые титаны, контролирую

Посмотреть ОригиналЛандшафт криптовалют и цифровых активов развивается с молниеносной скоростью, и это уже не просто игровая площадка для розничных трейдеров. Крупные институты – включая глобальные банки, хедж-фонды, пенсионные фонды и корпорации – не просто выходят на рынок; они активно занимают позиции, чтобы доминировать на нем. Это больше, чем инвестиции; это стратегическая игра, формирующая будущее финансов.

Разбор по пунктам:

1️⃣ Институты:

Это финансовые титаны, контролирую

- Награда

- 16

- 7

- Репост

- Поделиться

BabaJi :

:

Бычья пробежка 🐂Подробнее

#InstitutionsAccelerateDigitalAssetPositioning

Стратегический сдвиг в движении

В глобальных финансах происходит тихая, но мощная трансформация. Институциональные игроки ускоряют свои позиции в цифровых активах не как спекулятивную ставку, а как продуманный стратегический шаг. Этот сдвиг носит структурный, долгосрочный характер и глубоко укоренился в том, как капитал теперь воспринимает риск, доходность и актуальность в меняющейся финансовой системе.

От любопытства к убеждению

Ранее институты наблюдали за криптовалютами издалека, называя их экспериментальными. Этот этап завершился. Сегодня циф

Посмотреть ОригиналСтратегический сдвиг в движении

В глобальных финансах происходит тихая, но мощная трансформация. Институциональные игроки ускоряют свои позиции в цифровых активах не как спекулятивную ставку, а как продуманный стратегический шаг. Этот сдвиг носит структурный, долгосрочный характер и глубоко укоренился в том, как капитал теперь воспринимает риск, доходность и актуальность в меняющейся финансовой системе.

От любопытства к убеждению

Ранее институты наблюдали за криптовалютами издалека, называя их экспериментальными. Этот этап завершился. Сегодня циф

- Награда

- 5

- 6

- Репост

- Поделиться

BabaJi :

:

HODL крепко держи 💪Подробнее

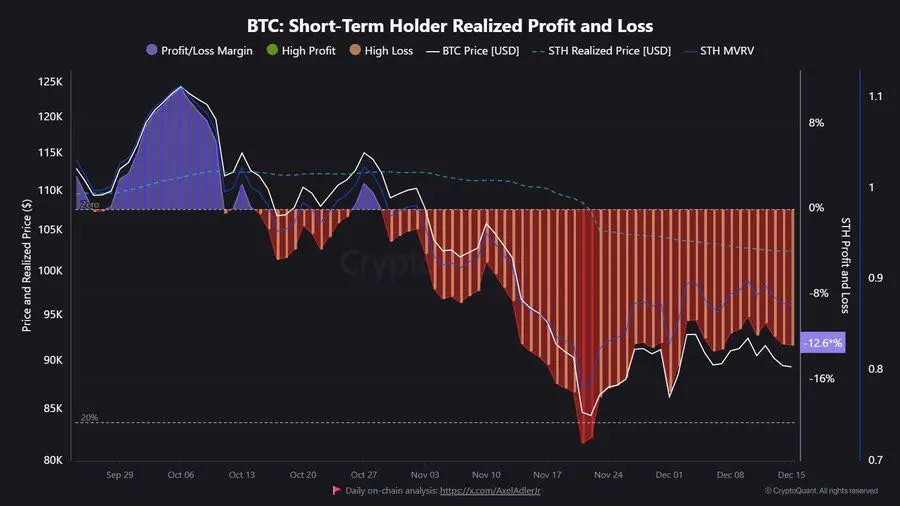

🚨КРАТКОСРОЧНЫЕ ДЕРЖАТЕЛИ BITCOIN В УБЫТКЕ

С 30 октября $BTC остается ниже стоимости краткосрочного держателя, что ставит недавних покупателей в нереализованные убытки.

За этот период краткосрочные держатели также продавали с зафиксированными убытками в среднем -12,6%, что сигнализирует о активной капитуляции.

$104K #BitcoinDropsBelowKeyPriceLevel #BTCMarketAnalysis #GatePlatformDynamicsAndIncentiveActivities #InstitutionsAccelerateDigitalAssetPositioning $BTC

С 30 октября $BTC остается ниже стоимости краткосрочного держателя, что ставит недавних покупателей в нереализованные убытки.

За этот период краткосрочные держатели также продавали с зафиксированными убытками в среднем -12,6%, что сигнализирует о активной капитуляции.

$104K #BitcoinDropsBelowKeyPriceLevel #BTCMarketAnalysis #GatePlatformDynamicsAndIncentiveActivities #InstitutionsAccelerateDigitalAssetPositioning $BTC

BTC-1,43%

- Награда

- 1

- комментарий

- Репост

- Поделиться

#InstitutionsAccelerateDigitalAssetPositioning

Как сигналы о снижении ставки ФРС формируют потоки институционального криптовалютного рынка: мой взгляд на BTC, ETH, SOL и динамику рынка

За последние недели я внимательно наблюдаю за тем, как макроэкономические сигналы, особенно недавние указания ФРС о возможном снижении ставки, влияют на поведение институциональных участников на крипторынке. С моей точки зрения, реакция была решительной: институты ускоряют свои позиции в крупных цифровых активах, таких как Bitcoin, Ethereum и Solana. Это не просто спекуляции; это стратегическая переоценка портф

Посмотреть ОригиналКак сигналы о снижении ставки ФРС формируют потоки институционального криптовалютного рынка: мой взгляд на BTC, ETH, SOL и динамику рынка

За последние недели я внимательно наблюдаю за тем, как макроэкономические сигналы, особенно недавние указания ФРС о возможном снижении ставки, влияют на поведение институциональных участников на крипторынке. С моей точки зрения, реакция была решительной: институты ускоряют свои позиции в крупных цифровых активах, таких как Bitcoin, Ethereum и Solana. Это не просто спекуляции; это стратегическая переоценка портф

- Награда

- 1

- 1

- Репост

- Поделиться

Discovery :

:

Со сигналами о снижении ставки Федеральной резервной системы учреждения быстро занимают позиции в BTC, ETH и SOL; стратегические ожидания по ликвидности формируют рынок.- Награда

- лайк

- комментарий

- Репост

- Поделиться

Загрузить больше

Присоединяйтесь к 40M пользователям в нашем растущем сообществе

⚡️ Присоединяйтесь к 40M пользователям в обсуждении криптовалют

💬 Общайтесь с любимыми авторами

👍 Посмотрите, что вас интересует

Популярные темы

207.25K Популярность

6.98K Популярность

9.32K Популярность

10.38K Популярность

4.7K Популярность

55.16K Популярность

2.46K Популярность

4.17K Популярность

25.03K Популярность

2.15K Популярность

2.95K Популярность

12.93K Популярность

3.6K Популярность

19.33K Популярность

11.35K Популярность

Новости

ПодробнееФРС Логан: снижение ставок в прошлом году было «страховкой» на случай охлаждения рынка труда

6 м

Логан: Инфляция уже почти пять лет подряд превышает целевой уровень в 2%

11 м

ФРС Логан: В случае снижения инфляции в ближайшие несколько месяцев снижение процентных ставок не потребуется

11 м

ФРС Логан: снижение ставок может быть подходящим моментом для охлаждения рынка труда

13 м

Логан: больше беспокоит, что инфляция стойко сохраняется на высоком уровне

16 м

Закрепить