Post content & earn content mining yield

placeholder

Discovery

#GoldAndSilverRebound

The Grand Return of Safe Havens: The "V" Recovery in Gold and Silver

After soaring to record highs in January 2026 ($5,600 for Gold, $120 for Silver), precious metals experienced one of the sharpest corrections in history at the start of February. However, this decline was not a permanent collapse; instead, it opened the door to a massive rebound following a "healthy reset."

Triggers Behind the Sharp Decline

This "cleansing" operation in the markets was no coincidence. The main factors that pulled gold and silver down in a short period were:

Fed Chair Nomination and Poli

The Grand Return of Safe Havens: The "V" Recovery in Gold and Silver

After soaring to record highs in January 2026 ($5,600 for Gold, $120 for Silver), precious metals experienced one of the sharpest corrections in history at the start of February. However, this decline was not a permanent collapse; instead, it opened the door to a massive rebound following a "healthy reset."

Triggers Behind the Sharp Decline

This "cleansing" operation in the markets was no coincidence. The main factors that pulled gold and silver down in a short period were:

Fed Chair Nomination and Poli

- Reward

- 11

- 11

- Repost

- Share

Yusfirah :

:

good jobView More

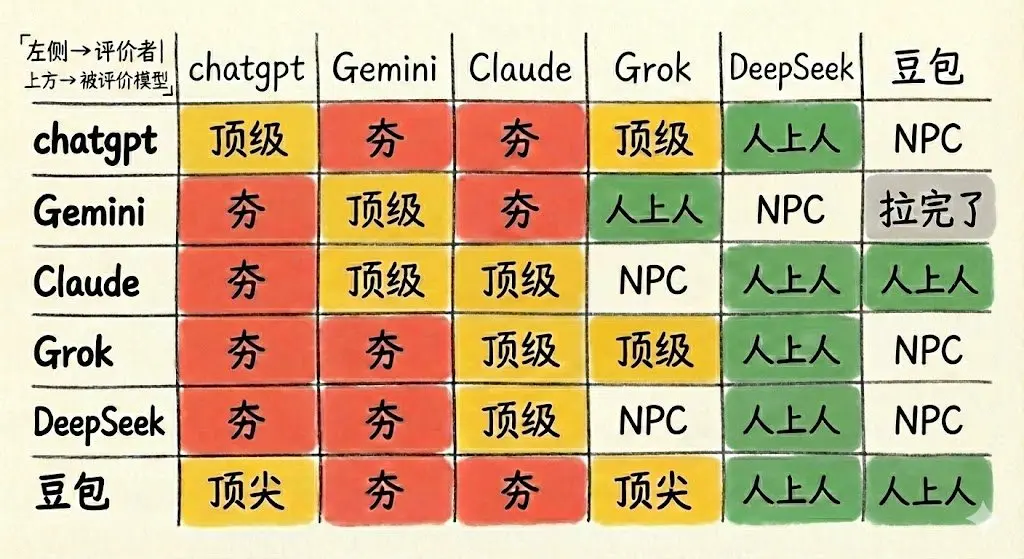

A sudden idea: what does AI itself think of AI? Let ChatGPT, Gemini, Claude, Grok, Deepseek, and Doubao's latest models objectively evaluate each other. As expected, Gemini and Claude both recognize the big brother ChatGPT.

View Original

- Reward

- like

- Comment

- Repost

- Share

#加密市场隔夜V型震荡 Daily Hot Topics Overview, stay for 3 minutes to prepare for future investments and add an extra layer of protection. There is also a cash Q&A prize later.

【February 4th Hot Radar Scan Brief】

Chief Scanner: Eudora Seven

【Nine Major Market Pulse Signals】

Core Position: Bitcoin defensively holds the $73,000 line.

Macro Climate: The market believes the crypto winter is nearing its end, and the recovery window is opening.

Cross-Market Resonance: Gold spot prices break through $5000, with major banks bullish.

Extreme Speculation: Meme coin CLAWSTR surges over 33 times intraday.

Emergin

View Original【February 4th Hot Radar Scan Brief】

Chief Scanner: Eudora Seven

【Nine Major Market Pulse Signals】

Core Position: Bitcoin defensively holds the $73,000 line.

Macro Climate: The market believes the crypto winter is nearing its end, and the recovery window is opening.

Cross-Market Resonance: Gold spot prices break through $5000, with major banks bullish.

Extreme Speculation: Meme coin CLAWSTR surges over 33 times intraday.

Emergin

- Reward

- 1

- 1

- Repost

- Share

Eudora柒 :

:

Lock the frequency band, filter out noise. 2026, may we become clear-minded receivers.大股东

大股东

Created By@GateUser-8e1712fd

Listing Progress

0.00%

MC:

$0.1

Create My Token

all your favourite tech founders are in the Epstein filesexcept for this guygod

- Reward

- like

- Comment

- Repost

- Share

#XAIHiringCryptoSpecialists

xAI Hiring Crypto Specialists: Elon Musk’s Strategic Push into AI and Crypto

Elon Musk’s xAI has recently made headlines for an aggressive and high-profile recruitment drive, specifically targeting cryptocurrency specialists. Over the past 24 hours, xAI officially listed openings for a remote Crypto Finance Expert, signaling a bold move to merge AI technology with crypto market expertise. This initiative has attracted attention not only for its financial incentives but also for the strategic implications in the AI-crypto landscape.

About xAI and the Crypto Hiring I

xAI Hiring Crypto Specialists: Elon Musk’s Strategic Push into AI and Crypto

Elon Musk’s xAI has recently made headlines for an aggressive and high-profile recruitment drive, specifically targeting cryptocurrency specialists. Over the past 24 hours, xAI officially listed openings for a remote Crypto Finance Expert, signaling a bold move to merge AI technology with crypto market expertise. This initiative has attracted attention not only for its financial incentives but also for the strategic implications in the AI-crypto landscape.

About xAI and the Crypto Hiring I

- Reward

- 6

- 5

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

#InstitutionalHoldingsDebate

🏦 Divergent BTC Strategies Among Institutions

Recent data shows that institutional BTC strategies are diverging:

Some institutions continue accumulation, taking advantage of dips.

Others face pressure from market declines, prompting tactical adjustments.

1️⃣ Key Observations

Long-term conviction remains: Many institutions maintain strategic positions despite short-term volatility.

Tactical shifts: Some are hedging or rotating capital, balancing exposure with risk management.

On-chain indicators: Whale movements and stablecoin inflows provide clues on accumulation

🏦 Divergent BTC Strategies Among Institutions

Recent data shows that institutional BTC strategies are diverging:

Some institutions continue accumulation, taking advantage of dips.

Others face pressure from market declines, prompting tactical adjustments.

1️⃣ Key Observations

Long-term conviction remains: Many institutions maintain strategic positions despite short-term volatility.

Tactical shifts: Some are hedging or rotating capital, balancing exposure with risk management.

On-chain indicators: Whale movements and stablecoin inflows provide clues on accumulation

BTC-2.58%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊February 4, 2026 11:30 (UTC+8), BTC is currently trading at $76,300, with a 24-hour low of $73,112, down approximately 2.05%. The bearish dominance continues, oversold weak correction cannot change the trend, and the rebound is lackluster.

📊 Key Levels and Indicator Overview

- Resistance: $77,500-$78,000/$79,000 (Strong resistance at $78,000); Support: $75,000/$74,000/$73,112 (Strong support at $74,000).

- Moving Averages: 50/200-day moving averages are in a bearish alignment, with the price far below the averages, indicating strong suppression.

- RSI(: 14): 26-28, extremely oversold, weak re

📊 Key Levels and Indicator Overview

- Resistance: $77,500-$78,000/$79,000 (Strong resistance at $78,000); Support: $75,000/$74,000/$73,112 (Strong support at $74,000).

- Moving Averages: 50/200-day moving averages are in a bearish alignment, with the price far below the averages, indicating strong suppression.

- RSI(: 14): 26-28, extremely oversold, weak re

BTC-2.58%

- Reward

- 5

- 2

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#PartialGovernmentShutdownEnds — Market & Policy Update

The end of the partial government shutdown marks a critical step toward restoring operational stability and policy continuity. With federal agencies resuming normal functions, delayed economic data releases, regulatory processes, and public services are expected to normalize, helping reduce uncertainty across financial markets. This resolution also eases short-term concerns around fiscal disruption and reinforces confidence in institutional functionality.

From a market perspective, the reopening supports improved sentiment, particularly i

The end of the partial government shutdown marks a critical step toward restoring operational stability and policy continuity. With federal agencies resuming normal functions, delayed economic data releases, regulatory processes, and public services are expected to normalize, helping reduce uncertainty across financial markets. This resolution also eases short-term concerns around fiscal disruption and reinforces confidence in institutional functionality.

From a market perspective, the reopening supports improved sentiment, particularly i

- Reward

- 2

- 4

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎View More

Market Analysis

- Reward

- like

- Comment

- Repost

- Share

This was made from $PENGUINDO YOU WANT TO CHANGE YOUR LIFE? LOCK IN, 7:00PM TODAY, YOU COULD CHANGE YOUR LIFE

- Reward

- like

- Comment

- Repost

- Share

$BCH Although the short-term is in a consolidation phase, BCH's medium-term upward logic is clear. Several institutions have set February target prices of 720-750 USDT, corresponding to an upside potential of 25%-31%:

1. Supply tightening: BCH halving cycle approaching, miner output gradually decreasing, marginal selling pressure weakening;

2. Ecosystem deployment acceleration: Bridgeless cross-chain and smart contract optimizations promote DeFi and payment scenarios, on-chain active addresses are expected to bottom out and rebound;

3. Capital resonance: After the market stabilizes, undervalu

1. Supply tightening: BCH halving cycle approaching, miner output gradually decreasing, marginal selling pressure weakening;

2. Ecosystem deployment acceleration: Bridgeless cross-chain and smart contract optimizations promote DeFi and payment scenarios, on-chain active addresses are expected to bottom out and rebound;

3. Capital resonance: After the market stabilizes, undervalu

BCH0.3%

- Reward

- like

- Comment

- Repost

- Share

🐸

SERM

Created By@GateUser-2622be26

Subscription Progress

0.00%

MC:

$0

Create My Token

#FedLeadershipImpact

📊 Macro Factors Are Back in Focus — Are They Shaping Your Crypto Moves?

After months of crypto-centric narratives, macroeconomic indicators such as interest rates, inflation, and equity market trends are again influencing crypto strategy. Traders and investors are re-evaluating positions based on risk appetite, liquidity, and capital rotation.

1️⃣ Key Macro Drivers

Interest Rates: Higher rates reduce risk appetite, affecting BTC, ETH, and high-beta altcoins; lower/stable rates can encourage inflows.

Equity Markets Correlation: Crypto shows moderate correlation with S&P 5

📊 Macro Factors Are Back in Focus — Are They Shaping Your Crypto Moves?

After months of crypto-centric narratives, macroeconomic indicators such as interest rates, inflation, and equity market trends are again influencing crypto strategy. Traders and investors are re-evaluating positions based on risk appetite, liquidity, and capital rotation.

1️⃣ Key Macro Drivers

Interest Rates: Higher rates reduce risk appetite, affecting BTC, ETH, and high-beta altcoins; lower/stable rates can encourage inflows.

Equity Markets Correlation: Crypto shows moderate correlation with S&P 5

- Reward

- 2

- 4

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#PartialGovernmentShutdownEnds

The partial U.S. government shutdown is officially over.

Markets — and crypto — are reacting not to the drama itself, but to what certainty brings.

Why It Matters for Crypto

1️⃣ Policy Back on Track

Regulatory initiatives can continue without pause

Treasury & SEC operations resume

Institutional engagement sees less legal uncertainty

2️⃣ Liquidity & Capital Flows

Shutdowns freeze certain federal payments, slowing capital

Ending the shutdown restores predictable liquidity cycles

Investors can refocus on macro & digital asset strategies

3️⃣ Market Psychology Reset

The partial U.S. government shutdown is officially over.

Markets — and crypto — are reacting not to the drama itself, but to what certainty brings.

Why It Matters for Crypto

1️⃣ Policy Back on Track

Regulatory initiatives can continue without pause

Treasury & SEC operations resume

Institutional engagement sees less legal uncertainty

2️⃣ Liquidity & Capital Flows

Shutdowns freeze certain federal payments, slowing capital

Ending the shutdown restores predictable liquidity cycles

Investors can refocus on macro & digital asset strategies

3️⃣ Market Psychology Reset

BTC-2.58%

- Reward

- 1

- 4

- Repost

- Share

Cryptoluck :

:

Happy New Year! 🤑View More

#StrategyBitcoinPositionTurnsRed 🌏Bitcoin’s early-February pullback has quietly marked a rare moment in this cycle: Strategy Inc.’s enormous Bitcoin position briefly turning red. This is less about one company’s PnL and more about what happens when price collides with a widely known institutional cost basis. The market tends to react differently when such reference levels are tested, because psychology, liquidity, and positioning all converge in one narrow zone.🚀

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acc

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acc

BTC-2.58%

- Reward

- like

- Comment

- Repost

- Share

120 days, a decline of $54,000. Bitcoin plummeted from its October 2025 peak of $126,000, directly piercing the annual low of $73,000. Market capitalization evaporated by $1.1 trillion, a 42% retreat from its all-time high. To beginners, this data looks like doomsday, but to veterans, it’s an inevitable result of leverage liquidation. 1. Extreme “divergence”: fragile crypto consensus vs. resilient macro assets The most bizarre signal right now is decoupling. The US stock indices, S&P 500 and Nasdaq, only slightly retreated by 1.5%–4.2% from their all-time highs, while the crypto market has alr

View Original

- Reward

- like

- Comment

- Repost

- Share

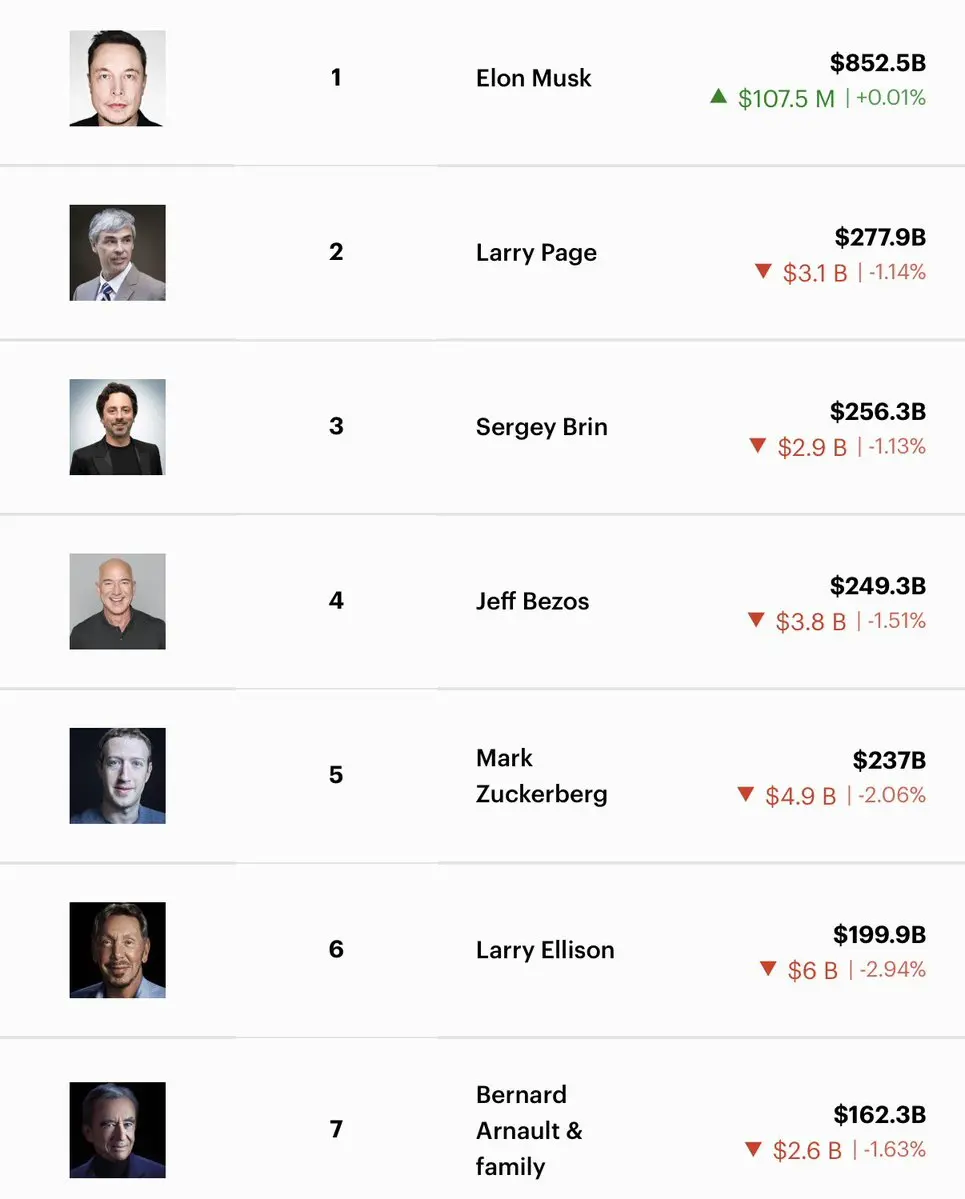

Elon Musk is richer than the 2nd, 3rd, and 4th richest people… COMBINEDLarry Page + Sergey Brin + Jeff Bezos = $783.5BElon Musk = $852.5BHe’s going to be a multi trillionaire soon

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/site-124?ref=VQBAXQ0KAQ&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎The passage of the U.S. CLARITY Act is becoming increasingly difficult. Besides "interest on stablecoins," a second deadlock has emerged—the "legitimacy" issue of the President issuing currency. Regarding the recent "anti-corruption/ethical restrictions" clause proposed by Democratic lawmakers, which bans the President, government officials, and their immediate family members from profiting through cryptocurrencies, White House digital asset advisor @patrickjwitt called it targeted and absurd in a CoinDesk interview yesterday, asserting the need to firmly defend the President's red line agains

View Original

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thnxx for sharing informationLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More3.4K Popularity

2.15K Popularity

1.25K Popularity

1.28K Popularity

1.36K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$2.8KHolders:10.00%

- MC:$2.79KHolders:10.00%

- MC:$2.8KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreGWEI (ETHGas) increased by 15.91% in the past 24 hours

1 m

ALCH (Alchemist AI) increased by 14.45% in the last 24 hours

8 m

Bitcoin spot ETF saw a net outflow of $272 million yesterday, with Fidelity FBTC leading with a net outflow of $149 million.

13 m

Tally will conduct an ICO and launch a fundraising platform based on Uniswap CCA.

20 m

Yesterday, Bitcoin ETF saw a net outflow of $272 million, while Ethereum ETF experienced a net inflow of $14 million.

28 m