Bitcoin Price Prediction: Why Liquidity Peak Could Trigger A Downside Cycle For BTC

Is BTC Entering a New Phase Amid Global Liquidity Cycle Shifts?

Global liquidity expert Michael Howell recently cautioned on the Bankless podcast that risk assets face headwinds: the massive bubbles that have built up since the financial crisis are now gradually deflating. Rather than starting a new cycle, the crypto market has likely entered its latter stages.

Howell’s approach differs from the traditional M2 money supply metric. Instead, he examines actual capital flows in financial markets, including the repo market, shadow banking, and cross-border fund movements. His Global Liquidity Index (GLI) indicates that global liquidity stood below $100 trillion in 2010 but has nearly doubled to $200 trillion over the past 15 years.

Has Global Liquidity Peaked?

Howell argues that the direction of liquidity is more critical than its scale. The 65-month global liquidity cycle he tracks reflects the pace of global debt refinancing. He notes that currently, 70% to 80% of financial market activity revolves around debt refinancing—not new investment.

Roughly 75% of loans worldwide are collateralized, so liquidity hinges on debt, and debt depends on liquidity. To gauge overall market health, Howell uses the Debt-to-Liquidity Ratio (total debt divided by refinancing liquidity) for high-income economies:

- Lower ratio → abundant liquidity → asset bubbles form easily

- Higher ratio → liquidity tightens → financing pressures mount, raising the risk of financial events

He points out that the world is emerging from an extended “Everything Bubble.” The surge in long-term, low-rate borrowing during the pandemic delayed real stress, causing a concentration of debt maturities between 2025 and 2028.

Crypto Market Positioning

In Howell’s model, crypto assets are positioned between technology stocks and commodities:

- Roughly 40%–45% of Bitcoin’s price action is driven by Global Liquidity

- The remainder is shaped by its Safe-Haven Appeal and Risk Sentiment

On the widely discussed four-year Halving Cycle, Howell is direct: “I haven’t seen compelling evidence. What truly drives BTC is the 65-month Global Liquidity Cycle.” Based on this, he believes the crypto market is in the late stage of the cycle, not the beginning.

Market Overview

With volatility rising and liquidity tightening, Howell remains neutral in the short term—not bearish, but also not optimistic. If risk assets see a further pullback, he views it as a long-term buying opportunity.

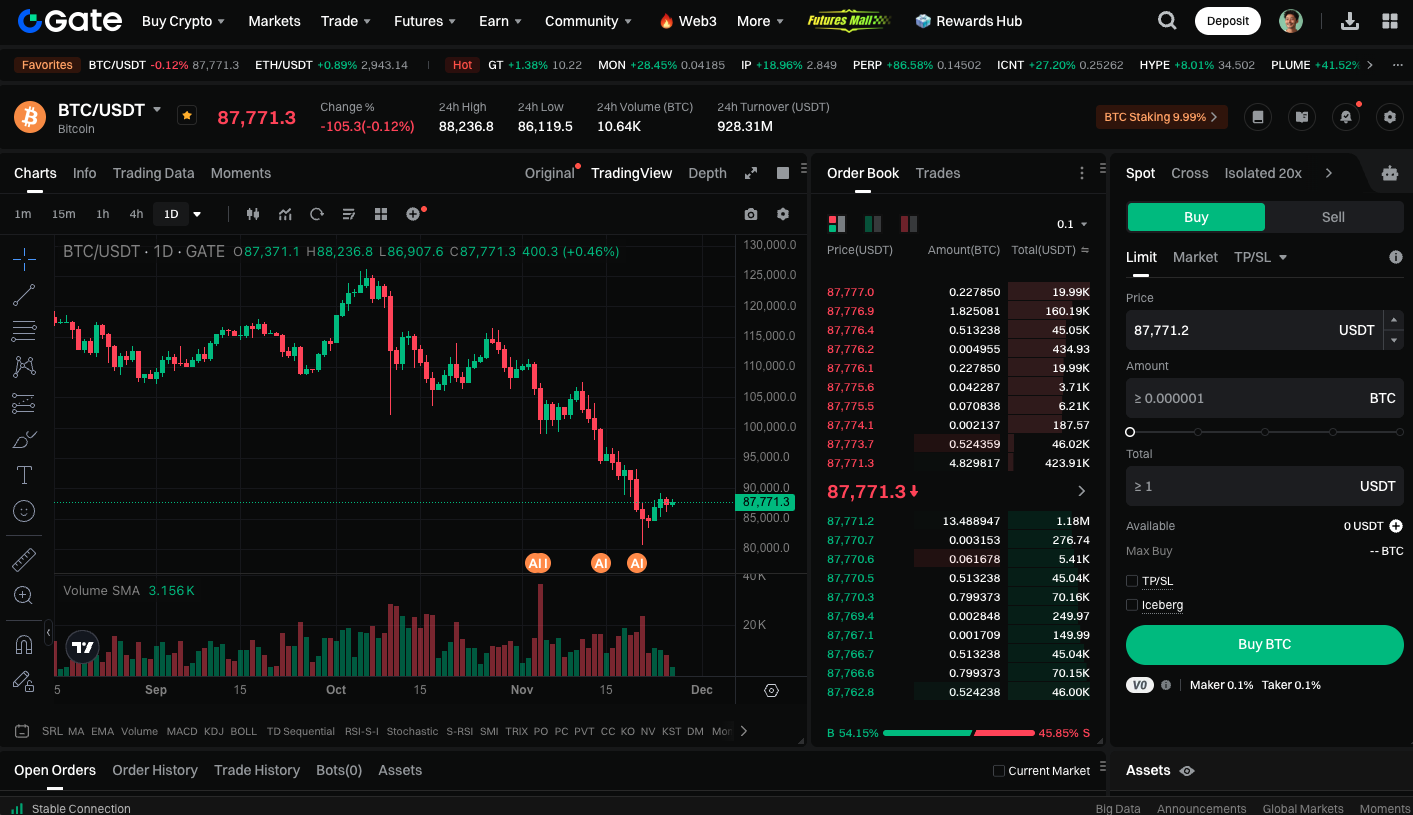

You can start Spot Trading BTC now: https://www.gate.com/trade/BTC_USDT

Summary

According to Michael Howell’s framework, Bitcoin’s price trajectory hinges not on Sentiment or Halving events, but on the Global Debt Refinancing and Liquidity Cycle. With Global Liquidity near a cyclical peak, BTC may already be in the latter half of its cycle. Short-term Volatility Risks are rising, while ongoing Monetary Inflation continues to provide robust support over the long term. Investors should monitor Liquidity Pressures in the financial markets in the near term, while the case for holding BTC as a long-term Inflation Hedge remains fundamentally strong.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution