BLOCKST vs ETC: Comparing Blockchain Storage Solutions for Enterprise Data Management

Introduction: BLOCKST vs ETC Investment Comparison

In the cryptocurrency market, the comparison between Block (BLOCKST) vs Ethereum Classic (ETC) remains a crucial topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance but also represent different positioning within the crypto asset space.

Block (BLOCKST): Launched recently, it has gained market recognition for its role in empowering builders and driving USD1 adoption.

Ethereum Classic (ETC): Introduced in 2016, it has been hailed as the continuation of the original Ethereum blockchain, upholding the "code is law" principle.

This article will provide a comprehensive analysis of the investment value comparison between BLOCKST and ETC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future projections, attempting to answer the question most crucial to investors:

"Which is the better buy right now?"

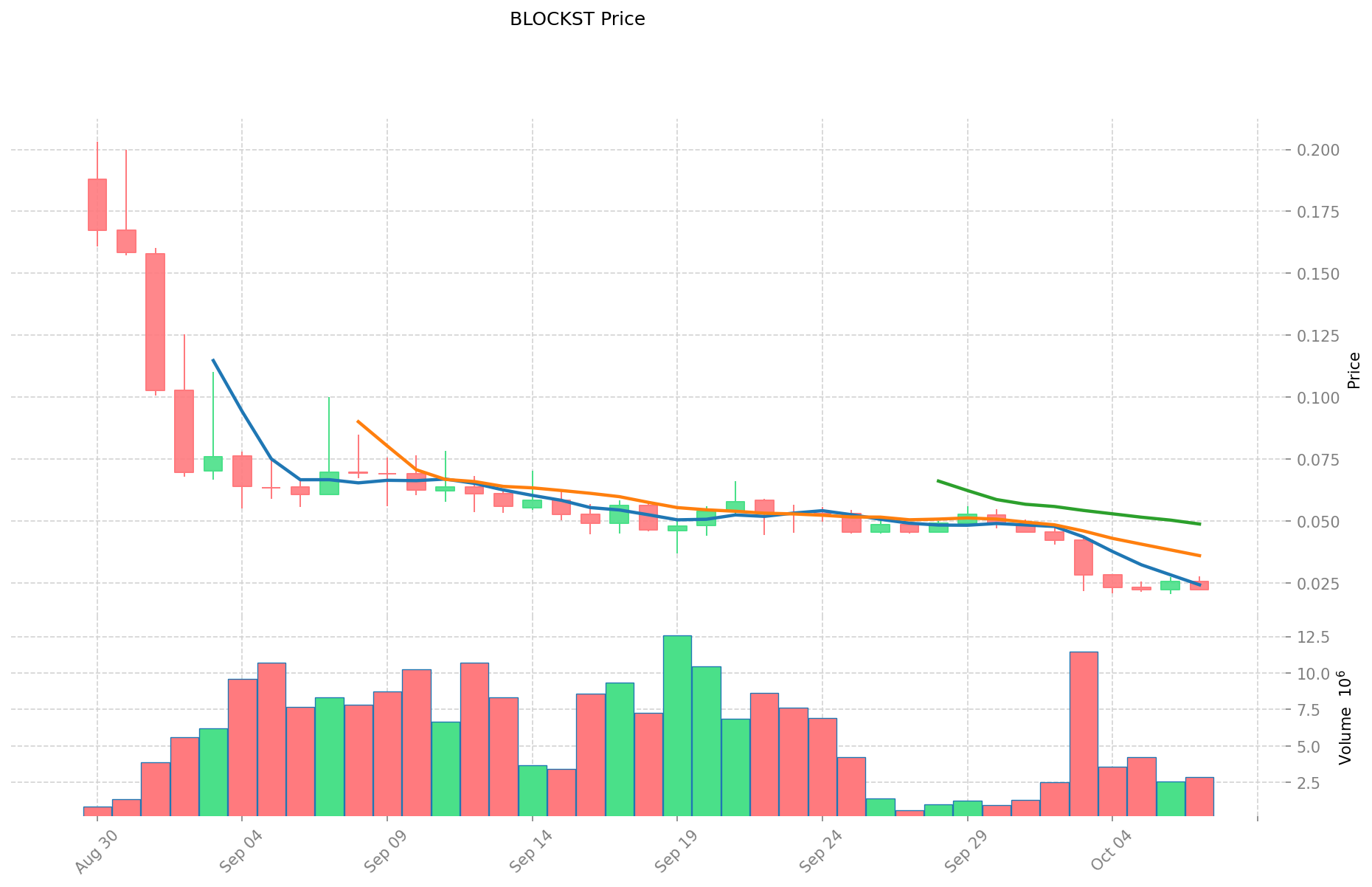

I. Price History Comparison and Current Market Status

BLOCKST and ETC Historical Price Trends

- 2025: BLOCKST reached its all-time high of $0.2032 on August 30.

- 2025: ETC experienced price fluctuations with a 52-week range of $12.88 to $39.92.

- Comparative analysis: In recent market cycles, BLOCKST dropped from its peak of $0.2032 to a low of $0.0203, while ETC has shown more stability with a current price near the middle of its yearly range.

Current Market Situation (2025-10-08)

- BLOCKST current price: $0.02228

- ETC current price: $19.099

- 24-hour trading volume: BLOCKST $72,273.8381 vs ETC $4,125,967.284301

- Market Sentiment Index (Fear & Greed Index): 60 (Greed)

Click to view real-time prices:

- View BLOCKST current price Market Price

- View ETC current price Market Price

II. Core Factors Influencing BLOCKST vs ETC Investment Value

Supply Mechanism Comparison (Tokenomics)

- BLOCKST: Focuses on decentralized finance applications with integrated tokenomics structure

- ETC: Fixed supply model with emphasis on immutability and "code is law" principle

- 📌 Historical Pattern: Supply mechanisms have historically created different price cycle patterns, with ETC's immutability providing stability while BLOCKST's DeFi focus enables more dynamic market responses.

Institutional Adoption and Market Applications

- Institutional Holdings: ETC has longer history with established institutional presence

- Enterprise Adoption: BLOCKST shows growing implementation in DeFi systems while ETC maintains value in smart contract applications

- Regulatory Attitudes: Both face varying regulatory frameworks across jurisdictions, with blockchain technology regulations evolving globally

Technology Development and Ecosystem Building

- BLOCKST Technology Upgrades: Continuous innovation in decentralized finance applications

- ETC Technical Development: Maintains original Ethereum codebase with commitment to immutability and security improvements

- Ecosystem Comparison: BLOCKST ecosystem centers on financial applications while ETC maintains broader smart contract capabilities

Macroeconomic Factors and Market Cycles

- Inflation Performance: Both assets have shown potential as inflation hedges within the broader digital asset class

- Monetary Policy Impact: Interest rates and dollar strength affect both assets, though their correlation patterns may differ

- Geopolitical Factors: Cross-border transaction demand affects both, with their decentralized nature providing utility during periods of economic uncertainty

III. 2025-2030 Price Prediction: BLOCKST vs ETC

Short-term Prediction (2025)

- BLOCKST: Conservative $0.0214 - $0.0223 | Optimistic $0.0223 - $0.0250

- ETC: Conservative $12.39 - $19.06 | Optimistic $19.06 - $27.25

Mid-term Prediction (2027)

- BLOCKST may enter a growth phase, with prices estimated at $0.0190 - $0.0310

- ETC may enter a consolidation phase, with prices estimated at $15.74 - $31.25

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- BLOCKST: Base scenario $0.0236 - $0.0336 | Optimistic scenario $0.0336 - $0.0366

- ETC: Base scenario $32.86 - $34.59 | Optimistic scenario $34.59 - $46.00

Disclaimer

BLOCKST:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0249648 | 0.02229 | 0.0213984 | 0 |

| 2026 | 0.03071562 | 0.0236274 | 0.014885262 | 6 |

| 2027 | 0.0309755214 | 0.02717151 | 0.019020057 | 21 |

| 2028 | 0.035760424311 | 0.0290735157 | 0.027910575072 | 30 |

| 2029 | 0.034686157905885 | 0.0324169700055 | 0.023016048703905 | 45 |

| 2030 | 0.036571204711704 | 0.033551563955692 | 0.023150579129427 | 50 |

ETC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 27.25437 | 19.059 | 12.38835 | 0 |

| 2026 | 24.5460861 | 23.156685 | 18.29378115 | 21 |

| 2027 | 31.2453150705 | 23.85138555 | 15.741914463 | 24 |

| 2028 | 38.016723428145 | 27.54835031025 | 16.8044936892525 | 44 |

| 2029 | 36.388615924809225 | 32.7825368691975 | 27.5373309701259 | 71 |

| 2030 | 45.998816608014472 | 34.585576397003362 | 32.856297577153194 | 81 |

IV. Investment Strategy Comparison: BLOCKST vs ETC

Long-term vs Short-term Investment Strategy

- BLOCKST: Suitable for investors focusing on DeFi applications and ecosystem potential

- ETC: Suitable for investors seeking stability and immutability principles

Risk Management and Asset Allocation

- Conservative investors: BLOCKST: 20% vs ETC: 80%

- Aggressive investors: BLOCKST: 60% vs ETC: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- BLOCKST: Higher volatility due to newer market presence and DeFi focus

- ETC: Susceptibility to broader crypto market trends and Ethereum ecosystem changes

Technical Risk

- BLOCKST: Scalability, network stability

- ETC: Hash rate concentration, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may have differing impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BLOCKST advantages: Growing DeFi ecosystem, potential for higher growth

- ETC advantages: Established history, immutability principle, broader smart contract capabilities

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards ETC for its established history

- Experienced investors: Explore BLOCKST for DeFi exposure while maintaining ETC for stability

- Institutional investors: Evaluate both for portfolio diversification, with emphasis on regulatory compliance

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between BLOCKST and ETC? A: BLOCKST focuses on decentralized finance applications with an integrated tokenomics structure, while ETC follows a fixed supply model emphasizing immutability and the "code is law" principle. BLOCKST is newer with potential for higher growth in the DeFi sector, while ETC has a longer history and broader smart contract capabilities.

Q2: Which cryptocurrency has shown better price performance recently? A: Based on recent data, BLOCKST reached an all-time high of $0.2032 in August 2025 but has since dropped to around $0.02228. ETC has shown more stability, with its current price near the middle of its 52-week range of $12.88 to $39.92.

Q3: How do the supply mechanisms of BLOCKST and ETC differ? A: BLOCKST has an integrated tokenomics structure focused on DeFi applications, allowing for more dynamic market responses. ETC, on the other hand, has a fixed supply model that provides more stability due to its emphasis on immutability.

Q4: What are the main risks associated with investing in BLOCKST and ETC? A: BLOCKST faces higher volatility due to its newer market presence and DeFi focus, as well as potential scalability and network stability issues. ETC is susceptible to broader crypto market trends and potential security vulnerabilities, with risks related to hash rate concentration.

Q5: How do institutional adoption rates compare between BLOCKST and ETC? A: ETC has a longer history with established institutional presence, while BLOCKST is showing growing implementation in DeFi systems. Both face varying regulatory frameworks across jurisdictions, which can affect institutional adoption rates.

Q6: What are the long-term price predictions for BLOCKST and ETC by 2030? A: For BLOCKST, the base scenario predicts a range of $0.0236 - $0.0336, with an optimistic scenario of $0.0336 - $0.0366. For ETC, the base scenario predicts $32.86 - $34.59, with an optimistic scenario of $34.59 - $46.00.

Q7: How should investors allocate their portfolio between BLOCKST and ETC? A: Conservative investors might consider allocating 20% to BLOCKST and 80% to ETC, while aggressive investors might opt for 60% BLOCKST and 40% ETC. New investors are advised to lean towards ETC for its established history, while experienced investors might explore BLOCKST for DeFi exposure.

when a crypto coin gets an ETF..

2025 COMP Price Prediction: Will Compound Finance Token Reach New Heights in the DeFi Market?

Is Gelato (GEL) a Good Investment?: Analyzing the Potential and Risks of This Emerging DeFi Protocol

Is Uniswap (UNI) a good investment?: Analyzing the potential and risks of the leading DEX token

ETH vs CRO: Which Cryptocurrency Offers Better Long-Term Investment Potential?

Is Livepeer (LPT) a good investment?: Analyzing the potential of this decentralized video streaming protocol

Exploring the Fundamentals of Web3 Technology

Understanding Web3 Community Building: Essential Guide to PAWS

Exploring Volt (XVM): A Fast-Growing Token on Solana with Significant Market Volatility

Exploring Volt (XVM): Rising Solana Asset Token with Impressive Market Performance

Exploring FIFA Coin: Purchasing Guide and Its Impact on Sport Crypto's Future