2025 USDE Price Prediction: Analyzing Future Trends and Market Potential in the Digital Currency Landscape

Introduction: USDE's Market Position and Investment Value

Ethena USDe (USDE) as a censorship-resistant and scalable synthetic dollar solution, has achieved significant milestones since its inception. As of 2025, USDE's market capitalization has reached $12.92 billion, with a circulating supply of approximately 12.91 billion tokens, maintaining a price around $1.0009. This asset, hailed as the "stable crypto-native solution for money," is playing an increasingly crucial role in decentralized finance and digital asset management.

This article will comprehensively analyze USDE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

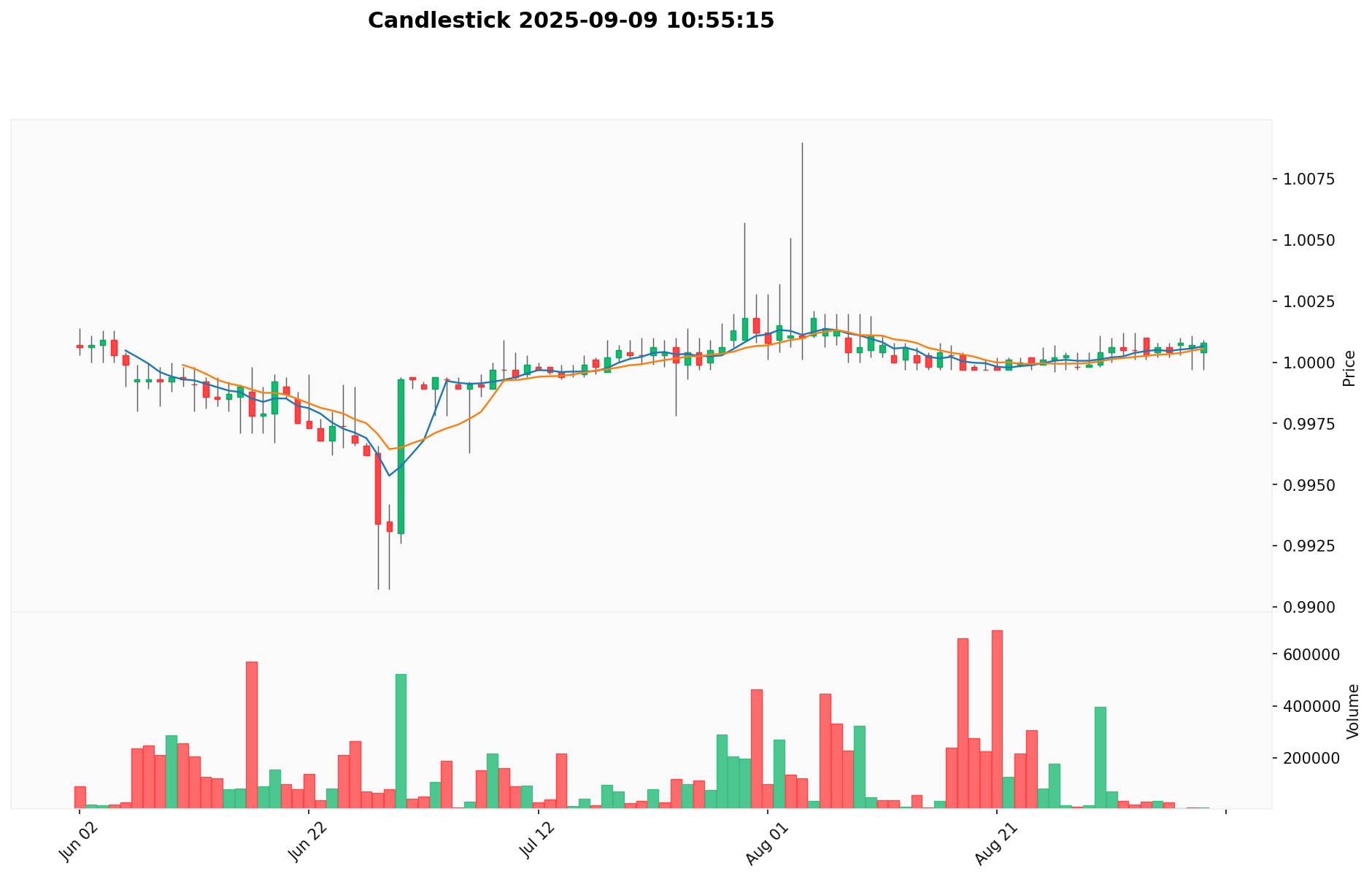

I. USDE Price History Review and Current Market Status

USDE Historical Price Evolution

- 2024: Initial launch, price stabilized around $1

- 2024: Reached all-time high of $1.5 on November 14

- 2025: Experienced volatility, dropping to all-time low of $0.9603 on February 21

USDE Current Market Situation

As of September 9, 2025, USDE is trading at $1.0009, maintaining its peg to the US dollar. The 24-hour trading volume stands at $41,639.38, indicating moderate market activity. USDE has shown slight positive momentum with a 0.12% increase in the past 24 hours and a 0.02% gain in the last hour. However, it has experienced a minor decline of 0.02% over the past week and a more noticeable decrease of 0.086% in the last 30 days. The stablecoin's market capitalization is currently $12,924,965,428, ranking it 17th in the overall cryptocurrency market with a 0.14% market share.

Click to view the current USDE market price

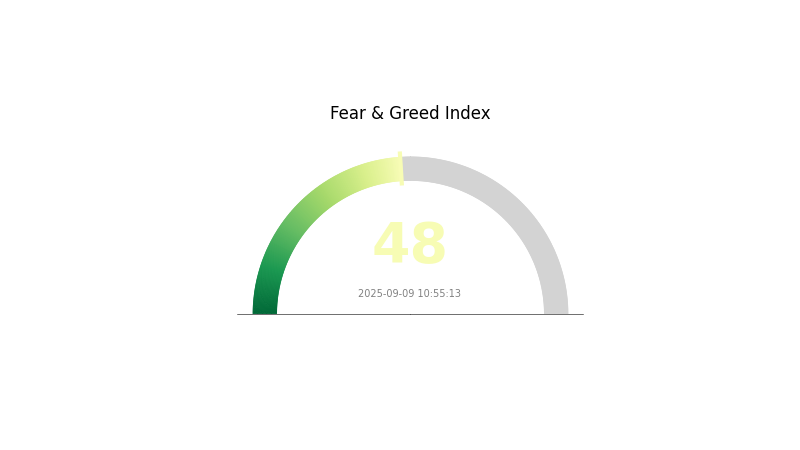

USDE Market Sentiment Indicator

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral, with the Fear and Greed Index standing at 48. This balanced state suggests that investors are neither overly fearful nor excessively greedy. While caution is still present, there's a sense of stability in the market. Traders should remain vigilant and consider diversifying their portfolios. As always, it's crucial to conduct thorough research and manage risks effectively before making any investment decisions in the volatile crypto space.

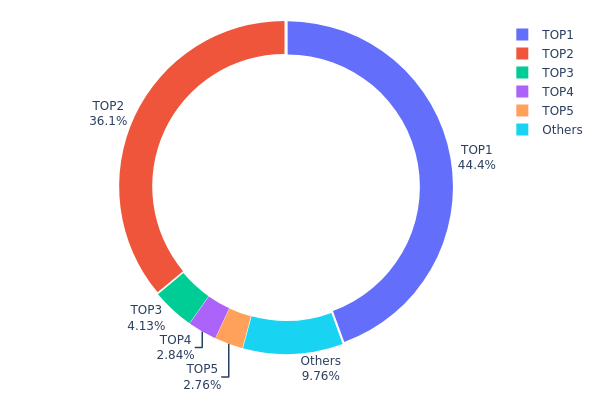

USDE Holdings Distribution

The address holdings distribution data reveals a significant concentration of USDE tokens among a few top addresses. The top two addresses collectively hold over 80% of the total supply, with 44.43% and 36.08% respectively. This high concentration suggests a centralized control structure within the USDE ecosystem.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. The top holders have substantial influence over the token's circulating supply and could impact market dynamics if large amounts are moved or sold. Moreover, this concentration contradicts the principle of decentralization often associated with cryptocurrencies.

While the presence of other smaller holders provides some balance, the current distribution indicates a relatively low level of on-chain decentralization for USDE. This structure may lead to increased volatility and susceptibility to large-scale market movements initiated by top holders.

Click to view the current USDE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9d39...7a3497 | 5721753.06K | 44.43% |

| 2 | 0xf3db...753ffe | 4645892.08K | 36.08% |

| 3 | 0x5d3a...52ef34 | 531469.12K | 4.12% |

| 4 | 0x90d2...74cc8f | 365555.32K | 2.83% |

| 5 | 0x1601...18347e | 355061.48K | 2.75% |

| - | Others | 1256821.82K | 9.79% |

II. Key Factors Influencing Future USDE Price

Supply Mechanism

- Elastic Supply: USDE's supply adjusts based on market demand to maintain its peg to the US dollar.

- Current Impact: The elastic supply mechanism helps stabilize USDE's price around $1, reducing volatility.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have shown increasing interest in USDE, potentially boosting its adoption and stability.

- Corporate Adoption: Several companies have begun using USDE for cross-border transactions and treasury management.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve decisions on interest rates and quantitative easing will continue to affect USDE's stability and demand.

- Inflation Hedging Properties: As a USD-pegged stablecoin, USDE may see increased demand during periods of high inflation as a store of value.

- Geopolitical Factors: Global economic uncertainties and trade tensions could drive more users towards stablecoins like USDE.

Technical Development and Ecosystem Building

- Blockchain Upgrades: Ongoing improvements to Ethereum and layer-2 solutions may enhance USDE's transaction speed and cost-efficiency.

- Ecosystem Applications: The growing DeFi ecosystem continues to create new use cases for USDE, potentially increasing its utility and demand.

III. USDE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.57057 - $0.80

- Neutral forecast: $0.80 - $1.10

- Optimistic forecast: $1.10 - $1.31131 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.94539 - $1.49473

- 2028: $0.74852 - $1.69109

- Key catalysts: Increasing adoption and technological improvements

2030 Long-term Outlook

- Base scenario: $1.30 - $1.70 (assuming steady market growth)

- Optimistic scenario: $1.70 - $1.99897 (assuming strong market performance)

- Transformative scenario: $2.00+ (under extremely favorable conditions)

- 2030-12-31: USDE $1.5617 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.31131 | 1.001 | 0.57057 | 0 |

| 2026 | 1.39895 | 1.15616 | 0.94805 | 15 |

| 2027 | 1.49473 | 1.27755 | 0.94539 | 27 |

| 2028 | 1.69109 | 1.38614 | 0.74852 | 38 |

| 2029 | 1.58478 | 1.53862 | 0.83085 | 53 |

| 2030 | 1.99897 | 1.5617 | 0.85893 | 56 |

IV. USDE Professional Investment Strategies and Risk Management

USDE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Allocate a portion of portfolio to USDE as a stable asset

- Regularly monitor the peg stability and project developments

- Store USDE in a secure wallet with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price trends

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage risk

- Look for deviations from the $1 peg for potential arbitrage opportunities

USDE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Collateral monitoring: Regularly check the backing and health of USDE's collateral

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for USDE

USDE Market Risks

- Depegging: Risk of USDE losing its $1 peg

- Liquidity concerns: Potential issues with large-scale redemptions

- Market sentiment: Shifts in stablecoin preferences affecting demand

USDE Regulatory Risks

- Stablecoin regulations: Potential new laws affecting USDE's operations

- Cross-border restrictions: Possible limitations on USDE use in certain jurisdictions

- Compliance requirements: Increased KYC/AML measures impacting usability

USDE Technical Risks

- Smart contract vulnerabilities: Potential exploits in the USDE protocol

- Oracle failures: Risks associated with price feed inaccuracies

- Scaling issues: Challenges in maintaining efficiency during high network congestion

VI. Conclusion and Action Recommendations

USDE Investment Value Assessment

USDE presents a unique value proposition as a crypto-native stablecoin with potential for long-term adoption. However, it faces short-term risks related to regulatory uncertainty and market acceptance.

USDE Investment Recommendations

✅ Beginners: Start with small allocations to understand the stablecoin ecosystem ✅ Experienced investors: Consider USDE as part of a diversified stablecoin portfolio ✅ Institutional investors: Monitor USDE's growth and consider for treasury management

USDE Participation Methods

- Direct purchase: Buy USDE on Gate.com

- Yield farming: Explore DeFi protocols that support USDE for potential returns

- Arbitrage: Take advantage of minor price discrepancies across different platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is USDe coin safe?

USDe aims for stability through market-based hedging, but carries risks due to reliance on funding rates and centralized elements. Its safety depends on market conditions and operational integrity.

What is the price prediction for $wepe in 2025?

Based on current market trends, the price for $wepe in 2025 is predicted to range between $0.00003993 and $0.00004364.

What is the price prediction for USDC in 2030?

USDC is predicted to maintain its $1 peg, potentially reaching $1.10-$1.20 in optimistic scenarios due to increased adoption and demand in the crypto ecosystem.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts reaching $127,864. Chainlink follows with a peak prediction of $56.65.

2025 TUSD Price Prediction: Analyzing Stablecoin Trajectory in a Regulated Crypto Economy

2025 USDD Price Prediction: Analyzing Potential Growth and Stability in the Stablecoin Market

Dai Price Analysis 2025: Trends and Outlook for the Stablecoin Market

USDe Price Prediction: 2025 Ethena Stablecoin Market Analysis and Investment Strategy

USD1 stablecoin on Gate: Analysis and Investment Opportunities for WLFI Token

GUSD on Gate in 2025: Advantages and Opportunities of Gemini Dollar

Hiểu Về NFT Treasure: Hướng Dẫn Chi Tiết và Nền Tảng Giao Dịch

What is SEND: A Comprehensive Guide to Understanding Special Educational Needs and Disabilities

What is XEM: A Comprehensive Guide to NEM's Native Cryptocurrency and Its Role in Blockchain Technology

What is NIZA: A Comprehensive Guide to Understanding the Next-Generation Internet Security Architecture

What is PSG: A Comprehensive Guide to Paris Saint-Germain Football Club's History, Achievements, and Global Impact