2025 SPS Price Prediction: Analyzing Market Trends and Future Potential for Splinterlands' Native Token

Introduction: SPS's Market Position and Investment Value

Splinterlands (SPS), as a cryptocurrency governance token integrated into the Splinterlands game, has been providing high-level decision-making ability and product control for player groups, asset owners, and other stakeholders since its inception in 2021. As of 2025, Splinterlands has reached a market capitalization of $3,667,993, with a circulating supply of approximately 489,718,725 tokens, and a price hovering around $0.00749. This asset, often referred to as the "governance token of Splinterlands," is playing an increasingly crucial role in the blockchain gaming sector.

This article will comprehensively analyze the price trends of Splinterlands from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SPS Price History Review and Current Market Status

SPS Historical Price Evolution

- 2021: SPS launched, reaching an all-time high of $1.065 on July 28

- 2024: Market downturn, price dropped to an all-time low of $0.00414734 on August 5

- 2025: Gradual recovery, price fluctuating around $0.00749

SPS Current Market Situation

As of October 13, 2025, SPS is trading at $0.00749, with a 24-hour trading volume of $18,906.94. The token has seen a significant 9.1% increase in the last 24 hours, indicating short-term bullish momentum. However, the 7-day and 30-day trends show declines of 2.7% and 9.21% respectively, suggesting overall bearish sentiment in the medium term.

SPS currently ranks 1961st in the cryptocurrency market with a market capitalization of $3,667,993.25. The circulating supply stands at 489,718,725.35 SPS tokens, representing 16.32% of the maximum supply of 3 billion tokens. The fully diluted market cap is $22,470,000.

The token is trading significantly below its all-time high, at about 0.7% of its peak value. This suggests that SPS has experienced a substantial correction since its 2021 high and is currently in a recovery phase.

Click to view the current SPS market price

SPS Market Sentiment Indicator

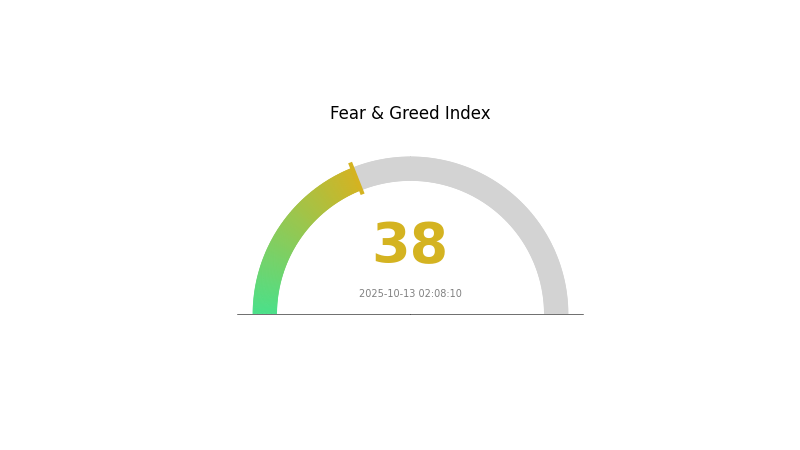

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of uncertainty, with the Fear and Greed Index at 38, indicating a fearful sentiment. This suggests that investors are cautious and possibly concerned about market conditions. During such times, it's crucial to stay informed and make rational decisions. Remember, market cycles are normal, and periods of fear can sometimes present opportunities for those with a long-term perspective. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.

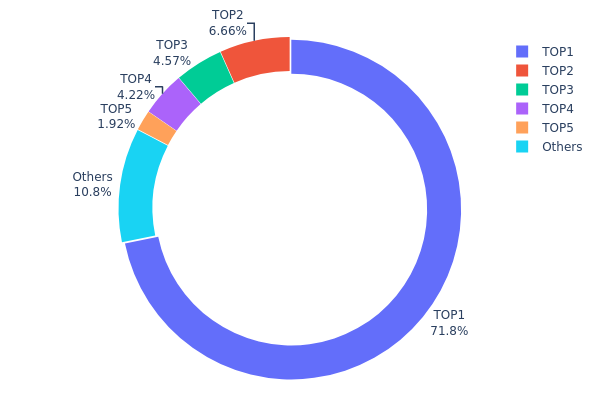

SPS Holdings Distribution

The address holdings distribution data for SPS reveals a highly concentrated ownership structure. The top address holds a staggering 71.79% of the total supply, amounting to 953,364.50K SPS tokens. This extreme concentration is followed by four other significant holders, collectively accounting for 17.36% of the supply. The remaining 10.85% is distributed among other addresses.

Such a concentrated distribution raises concerns about centralization and potential market manipulation. With over 70% of tokens held by a single address, there's a significant risk of price volatility should this holder decide to make large transactions. This concentration also implies that the SPS market structure is vulnerable to the decisions of a few major players, potentially undermining its stability and fairness.

From a market perspective, this distribution pattern suggests a low degree of decentralization for SPS. The on-chain structure appears unstable due to the dominance of a single address, which could lead to unpredictable market behavior and increased vulnerability to large-scale sell-offs or accumulation events.

Click to view the current SPS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xec93...69e5f6 | 953364.50K | 71.79% |

| 2 | 0xdf5f...4f432c | 88457.94K | 6.66% |

| 3 | 0x96e5...3b699e | 60694.90K | 4.57% |

| 4 | 0x0000...00dead | 56000.10K | 4.21% |

| 5 | 0x42ed...8f66a3 | 25542.59K | 1.92% |

| - | Others | 143880.14K | 10.85% |

II. Key Factors Affecting Future SPS Price

Supply Mechanism

- Market Supply and Demand: The balance between supply and demand is a crucial factor influencing SPS price trends.

- Historical Pattern: Past supply changes have shown a significant impact on price fluctuations.

- Current Impact: Expected supply changes are likely to influence price movements in the coming period.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions may affect SPS pricing.

- Inflation Hedging Properties: SPS performance in inflationary environments could impact its valuation.

Technological Development and Ecosystem Building

- Raw Material Costs: Changes in production costs, particularly raw material prices, can significantly influence SPS pricing.

- Technological Advancements: Innovations in production or application technologies may affect market demand and pricing.

III. SPS Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.00457 - $0.0075

- Neutral estimate: $0.0075 - $0.01

- Optimistic estimate: $0.01 - $0.01094 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00545 - $0.01433

- 2028: $0.00676 - $0.01764

- Key catalysts: Project upgrades, market adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.0098 - $0.01628 (assuming steady growth and adoption)

- Optimistic scenario: $0.01749 - $0.02312 (assuming strong market performance and project success)

- Transformative scenario: $0.02312+ (extreme favorable conditions and widespread adoption)

- 2030-12-31: SPS $0.02312 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01094 | 0.0075 | 0.00457 | 0 |

| 2026 | 0.01217 | 0.00922 | 0.00765 | 23 |

| 2027 | 0.01433 | 0.01069 | 0.00545 | 42 |

| 2028 | 0.01764 | 0.01251 | 0.00676 | 67 |

| 2029 | 0.01749 | 0.01508 | 0.0098 | 101 |

| 2030 | 0.02312 | 0.01628 | 0.01335 | 117 |

IV. SPS Professional Investment Strategies and Risk Management

SPS Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Game enthusiasts and blockchain believers

- Operation suggestions:

- Accumulate SPS tokens during market dips

- Participate in Splinterlands gameplay to earn additional rewards

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential support/resistance levels

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Splinterlands game updates and player activity

- Track overall crypto market sentiment and its impact on gaming tokens

SPS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance SPS holdings with other gaming tokens and major cryptocurrencies

- Stop-loss orders: Set appropriate stop-loss levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SPS

SPS Market Risks

- Volatility: Gaming tokens can experience significant price swings

- Competition: Emergence of new blockchain gaming projects may impact SPS value

- Market sentiment: Overall crypto market trends can affect SPS price

SPS Regulatory Risks

- Gaming regulations: Changes in online gaming laws could impact Splinterlands adoption

- Cryptocurrency regulations: Evolving global crypto regulations may affect SPS trading and usage

- Token classification: Potential for SPS to be classified as a security in some jurisdictions

SPS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the SPS token contract

- Scalability issues: Challenges in handling increased transaction volume as the game grows

- Blockchain network congestion: High gas fees or slow transaction times on the BSC network

VI. Conclusion and Action Recommendations

SPS Investment Value Assessment

SPS presents a unique opportunity in the blockchain gaming sector, with potential for long-term growth tied to Splinterlands' success. However, investors should be aware of short-term volatility and the evolving nature of the gaming industry.

SPS Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding the Splinterlands ecosystem ✅ Experienced investors: Consider a balanced approach, combining SPS holdings with active gameplay ✅ Institutional investors: Conduct thorough due diligence on Splinterlands' growth metrics and tokenomics

SPS Trading Participation Methods

- Direct purchase: Buy SPS tokens on Gate.com

- Gameplay earnings: Earn SPS through active participation in Splinterlands

- Staking: Participate in SPS staking programs for additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Pepe's price prediction for 2025?

Based on current trends, Pepe's price prediction for 2025 is bearish. Market sentiment is negative and historical data suggests limited growth potential.

Is splintershards a good investment?

Yes, Splintershards appears to be a good investment. Forecasts suggest price increases, with potential for profitable returns. Always review current market data for the most up-to-date trends.

Would hamster kombat coin reach $1?

Unlikely to reach $1 soon. Analysts project $0.67 by 2025. Growth depends on user interest and market conditions.

Will SLP reach $1?

Based on current trends, SLP is unlikely to reach $1. It would require a massive 60,000% gain, which is not projected in the foreseeable future.

2025 DIO Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

2025 CHAIN Price Prediction: Will This Emerging Blockchain Platform Reach New Heights?

2025 MONPRO Price Prediction: Analyzing Market Trends and Expert Forecasts for Future Growth

2025 MIST Price Prediction: Analyzing Market Trends and Future Prospects for the Mist Network Token

2025 ZEUM Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AXSPrice Prediction: Bull Run Analysis and Strategic Investment Opportunities in the Gaming Token Market

Understanding Cryptocurrency Bags: Effective Management Tips

What is SCA: A Comprehensive Guide to Strong Customer Authentication in Digital Payment Security

What is CLV: A Complete Guide to Customer Lifetime Value and Its Impact on Business Growth

What is CATE: A Comprehensive Guide to Computer-Aided Training and Education

What is GOATED: Understanding the Meaning and Origins of Internet's Favorite Slang Term