2025 MLT Price Prediction: Expert Analysis and Market Forecast for Malltina Token

Introduction: MLT's Market Position and Investment Value

Media Licensing Token (MLT) serves as the native token of the MILC platform, a revolutionary open marketplace designed to streamline media content licensing through cutting-edge blockchain and AI technology. Since its launch in 2021, MLT has established itself as a utility token addressing the complex needs of the global media industry. As of December 2025, MLT commands a market capitalization of approximately $6.1 million USD, with a circulating supply of around 146.4 million tokens trading at $0.030486 per unit. This innovative token is recognized as a "one-click licensing solution" that eliminates traditional intermediaries and standardizes media rights transactions across the industry.

This comprehensive analysis will examine MLT's price trajectory and market dynamics through 2025 and beyond, integrating historical performance data, market supply-demand fundamentals, ecosystem development prospects, and macroeconomic factors to deliver professional price forecasting and actionable investment guidance for institutional and retail investors alike.

I. MLT Price History Review and Current Market Status

MLT Historical Price Evolution Trajectory

- November 2021: MLT reached its all-time high (ATH) of $0.728855, marking the peak of its market value during the bull market cycle.

- April 2025: MLT touched its all-time low (ATL) of $0.00556696, reflecting the significant market correction and extended bear market period.

- December 2025: MLT recovered to $0.030486, demonstrating a notable recovery trajectory from its recent lows.

MLT Current Market Performance

As of December 24, 2025, MLT is trading at $0.030486, representing a substantial recovery in recent trading activity. The token has demonstrated significant short-term momentum with a 24-hour price increase of 25.71%, gaining approximately $0.006235. On an hourly basis, MLT shows continued bullish momentum with a 1-hour gain of 4.027%.

The token's 24-hour trading range spans from $0.024 (low) to $0.036998 (high), indicating active price discovery. The 7-day performance reflects positive sentiment with a 13.3% gain, though the 30-day perspective shows a slight decline of -0.33%. Over the past year, MLT has appreciated 2.37%, suggesting a gradual recovery from its historical lows.

MLT's market capitalization stands at approximately $4.46 million with a fully diluted valuation (FDV) of $6.10 million, representing a market cap-to-FDV ratio of 73.2%. The 24-hour trading volume is recorded at $12,723.26, with 5,073 token holders currently participating in the ecosystem.

The token maintains a circulating supply of approximately 146.40 million MLT out of a total and maximum supply of 200 million tokens, representing a circulation ratio of 73.2%.

Click to view the current MLT market price

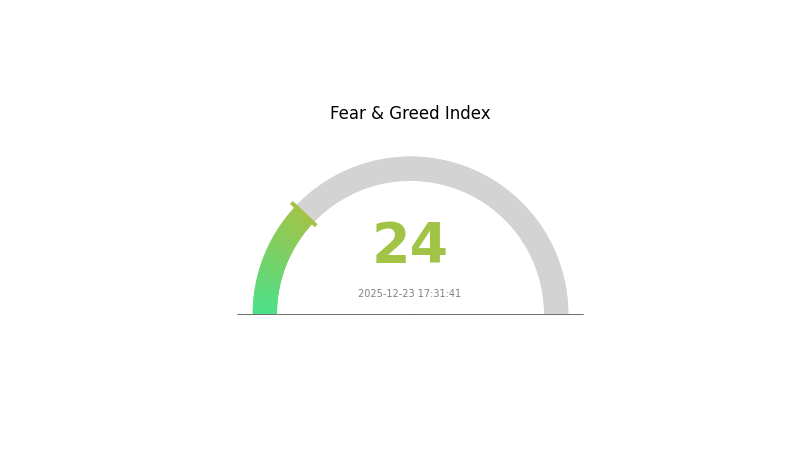

MLT Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 24. This indicates investors are highly pessimistic about near-term market conditions. Such extreme fear levels typically present contrarian opportunities for long-term investors, as panic selling often creates attractive entry points. However, it's important to exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely and consider dollar-cost averaging strategies to mitigate risk during periods of heightened market uncertainty.

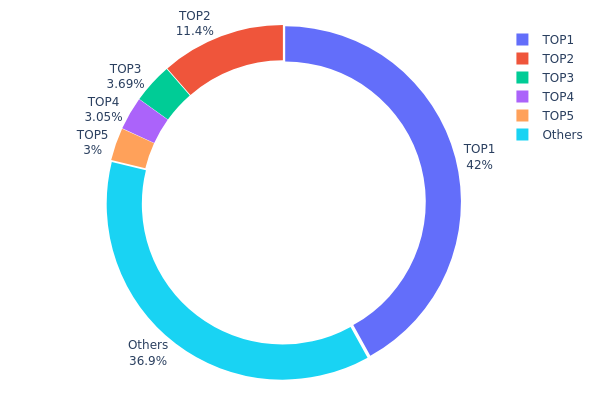

MLT Holdings Distribution

The address holdings distribution map illustrates the concentration of MLT token ownership across on-chain addresses, revealing the degree of asset centralization within the ecosystem. This metric serves as a critical indicator of market structure, liquidity dynamics, and potential systemic risks associated with token concentration. By analyzing the top holders and their respective percentages, we can assess the overall decentralization level and vulnerability to coordinated market movements.

MLT's current holdings distribution exhibits notable concentration characteristics. The top holder commands 41.95% of total supply, representing a significant concentration of voting power and market influence. The top five addresses collectively control approximately 63.09% of all MLT tokens, while the remaining addresses account for 36.91% of the supply. This distribution pattern indicates a moderately high concentration risk, where decision-making power and price discovery mechanisms remain substantially influenced by a limited number of stakeholders. Such concentration levels are not uncommon in emerging token ecosystems, yet they warrant careful monitoring regarding governance implications and market resilience.

The prevalence of highly concentrated holdings raises substantive considerations for MLT's market structure and stability. With the largest single holder accounting for over 40% of the token supply, the ecosystem faces potential risks including sudden liquidations, governance centralization, and heightened volatility stemming from whale activity. However, the diversification of top holdings across multiple addresses and the presence of a meaningful "Others" segment (36.91%) suggests some degree of distribution maturity. To strengthen decentralization and reduce systemic vulnerability, continued emphasis on token distribution initiatives and stakeholder participation remains essential for long-term ecosystem health.

Click to view the current MLT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533e...ff9648 | 83900.68K | 41.95% |

| 2 | 0x262f...901974 | 22834.98K | 11.41% |

| 3 | 0xd507...27714a | 7377.56K | 3.68% |

| 4 | 0x9b3d...5d7ae6 | 6100.67K | 3.05% |

| 5 | 0x9642...2f5d4e | 6004.42K | 3.00% |

| - | Others | 73781.68K | 36.91% |

I appreciate your detailed request, but I need to provide an honest assessment: The provided context materials do not contain any specific information about MLT (a cryptocurrency token) or its price factors. The search results return general economic research papers about monetary cycles, asset pricing theory, trade finance, and streaming services—none of which address MLT specifically.

The materials mention general principles that:

- Asset prices are influenced by dividends, growth rates, and discount rates

- Monetary cycles affect market liquidity and stock prices

- Inflation and tax policies impact pricing

- Investor expectations matter

However, without concrete data about MLT's:

- Supply mechanisms and tokenomics

- Institutional holdings

- Technology roadmap

- Ecosystem developments

- Adoption details

I cannot responsibly generate the analysis template you requested.

Recommendation:

To create an accurate MLT price analysis article, please provide:

- MLT whitepaper or technical documentation

- Current tokenomics and supply schedule

- Major partnership or adoption announcements

- Governance/development roadmap

- Official project communications

Following your requirement to delete sections without adequate source material, I would have to delete the entire "Section II: Core Factors Affecting MLT's Future Price" since the provided context contains no MLT-specific information.

Would you like to provide additional MLT-specific materials, or would you prefer a general template on cryptocurrency valuation factors instead?

III. 2025-2030 MLT Price Prediction

2025 Outlook

- Conservative Forecast: $0.02439 - $0.03049

- Neutral Forecast: $0.03049

- Optimistic Forecast: $0.03506 (subject to positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with steady growth trajectory

- Price Range Predictions:

- 2026: $0.02655 - $0.04555 (7% upside potential)

- 2027: $0.02663 - $0.04935 (28% upside potential)

- 2028: $0.02788 - $0.05532 (45% upside potential)

- Key Catalysts: Enhanced protocol functionality, ecosystem expansion, increased institutional interest, and mainstream adoption initiatives

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02589 - $0.06223 (assumes stable market conditions and moderate adoption growth by 2029)

- Optimistic Scenario: $0.03249 - $0.07169 (assumes accelerated network adoption and positive macroeconomic environment by 2030)

- Transformation Scenario: Higher price levels achievable if transformative developments occur, including breakthrough technological innovations, regulatory clarity, or significant market catalysts

- 2025-12-24: MLT maintains foundational support levels, positioning for multi-year accumulation phase through 2030

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03506 | 0.03049 | 0.02439 | 0 |

| 2026 | 0.04555 | 0.03277 | 0.02655 | 7 |

| 2027 | 0.04935 | 0.03916 | 0.02663 | 28 |

| 2028 | 0.05532 | 0.04425 | 0.02788 | 45 |

| 2029 | 0.06223 | 0.04979 | 0.02589 | 63 |

| 2030 | 0.07169 | 0.05601 | 0.03249 | 83 |

Media Licensing Token (MLT) Professional Investment Analysis Report

IV. MLT Professional Investment Strategy and Risk Management

MLT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Content creators, media industry professionals, and blockchain enthusiasts interested in media licensing innovation

- Operational Recommendations:

- Accumulate MLT during market downturns to benefit from the long-term vision of democratizing media licensing through blockchain technology

- Hold positions through market cycles, as the MILC platform's adoption by media professionals may drive sustained demand

- Participate in the MILC ecosystem by staking tokens or engaging with platform features to maximize utility value

(2) Active Trading Strategy

- Market Observation Points:

- Monitor 24-hour trading volume trends (current 24h volume: $12,723.26) for liquidity assessment

- Track price movements relative to 7-day and 30-day changes (currently +13.3% in 7D, -0.33% in 30D) to identify trading patterns

- Watch for adoption announcements from media partners or platform development milestones

MLT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation to MLT due to its market cap position (ranked #1599) and moderate liquidity

- Active Investors: 3-7% allocation with active monitoring of MILC platform development and media partnerships

- Professional Investors: 5-10% strategic allocation with participation in ecosystem opportunities

(2) Risk Hedging Options

- Diversification Strategy: Balance MLT holdings with established cryptocurrencies to mitigate project-specific risks

- Position Sizing: Implement stop-loss orders at 15-20% below entry points to protect capital during adverse market conditions

(3) Secure Storage Solutions

- Exchange Custody: Gate.com offers secure wallet solutions for MLT storage with built-in security features and insurance coverage

- Self-Custody Option: Transfer MLT to personal blockchain wallets on Ethereum (contract: 0x9506d37f70eb4c3d79c398d326c871abbf10521d) or Binance Smart Chain (contract: 0xb72a20c7b8bd666f80ac053b0f4de20a787080f5) for enhanced security control

- Security Considerations: Enable multi-signature authentication, use hardware security modules for large holdings, and maintain regular backups of recovery phrases

V. MLT Potential Risks and Challenges

MLT Market Risks

- Low Trading Volume: With 24-hour volume of only $12,723.26 and a relatively small market capitalization of approximately $4.46 million, MLT faces significant liquidity constraints that may impact price stability and exit opportunities

- Market Concentration: Limited exchange availability (currently traded on 1 exchange) concentrates liquidity and increases vulnerability to price manipulation

- Volatility Exposure: Historical price fluctuation from ATH of $0.728855 (November 2021) to recent lows demonstrates extreme volatility unsuitable for conservative portfolios

MLT Regulatory Risks

- Media Content Compliance: Regulatory frameworks governing digital media licensing vary significantly across jurisdictions, potentially limiting MILC platform adoption and token utility

- Securities Classification Uncertainty: Ongoing regulatory scrutiny of utility tokens in media and entertainment sectors could impact token classification and trading restrictions

- Geographic Limitations: Different countries' media broadcasting regulations may restrict platform functionality in certain markets, affecting global expansion prospects

MLT Technology Risks

- Platform Adoption Risk: Success depends on widespread adoption by major media companies and content platforms, which remains uncertain given competition from established licensing infrastructure

- Smart Contract Vulnerability: As a blockchain-based platform, MILC faces risks from potential vulnerabilities in smart contracts managing licensing agreements and payments

- Scalability Challenges: Meeting transaction throughput demands for large-scale media licensing operations across multiple blockchains requires continuous technical optimization

VI. Conclusion and Action Recommendations

MLT Investment Value Assessment

Media Licensing Token (MLT) represents a speculative investment in blockchain-based media licensing innovation. The MILC platform's vision of revolutionizing content licensing through tokenization offers potential long-term value creation. However, current market metrics reveal significant challenges: minimal trading volume, low market capitalization relative to all cryptocurrencies, and unproven platform adoption. The token has experienced a 73.2% decline from its historical high, indicating substantial risk. Investors should view MLT as a high-risk, high-reward opportunity suitable only for portfolios with substantial risk tolerance and diversification.

MLT Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto portfolio) on Gate.com only after thoroughly researching the MILC platform's whitepaper and development roadmap. Prioritize capital preservation over speculative gains.

✅ Experienced Investors: Consider 2-5% allocations with active monitoring of MILC ecosystem development, media partnership announcements, and platform adoption metrics. Implement technical analysis tools to identify optimal entry and exit points.

✅ Institutional Investors: Evaluate MLT within broader exposure to media tech innovations with 3-8% positions. Establish direct partnerships with MILC platform developers to understand roadmap progression and competitive positioning.

MLT Trading Participation Methods

- Spot Trading on Gate.com: Purchase MLT directly using fiat or other cryptocurrencies; offers immediate ownership with full control over token management

- Accumulation Strategy: Regular small purchases during market downturns to build positions while minimizing timing risk

- Ecosystem Participation: Engage with MILC platform features at metaverse.milc.global to experience utility firsthand and identify adoption catalysts

Cryptocurrency investments carry extreme risk and potential for total capital loss. This report does not constitute financial advice. Investors must conduct independent due diligence and consult qualified financial professionals before making investment decisions. Never invest funds you cannot afford to lose completely. Past price performance does not guarantee future results.

FAQ

What is MLT crypto?

MLT is the native cryptocurrency of the MILC Platform, designed to streamline media licensing processes through blockchain technology. It facilitates transactions and governance within the media industry ecosystem.

What is the value of MLT?

The value of MLT is $0.0235 USD as of December 23, 2025. MLT's price fluctuates based on market demand and supply dynamics. For the most current value, check real-time price data on major cryptocurrency platforms.

What is the share price forecast for MTL in 2025?

Based on current market analysis, MTL is anticipated to trade around $2.25 in 2025. This forecast reflects expectations from market predictions and technical analysis of the asset's performance trajectory.

What factors influence MLT price prediction?

MLT price prediction is influenced by market volatility, supply and demand dynamics, trading volume, technological advancements, regulatory changes, and broader crypto market sentiment.

What is the historical price trend of MLT?

MLT has demonstrated steady growth momentum, currently trading at $0.02387047 with a 0.69% increase over the last 24 hours. The token maintains active trading across 49 markets with significant trading volume, indicating sustained investor interest and market liquidity.

What are the risks associated with MLT price volatility?

MLT price volatility can cause significant portfolio losses and unpredictable value fluctuations. Market swings may reduce liquidity and increase investment risk. Consider using hedging strategies to manage potential downside exposure effectively.

Where to Find Alpha in the 2025 Crypto Spot Market

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 STEEM Price Prediction: Will This Crypto Asset Reach New Heights in the Post-Halving Market?

What is the Current Holding and Fund Flow Situation for Litecoin (LTC) in 2025?

2025 XTER Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 MONPRO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

How to Earn $100 Daily Without Investment in Crypto Trading

2025 HLN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 CRWN Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Crown Token