2025 BANANAS31Price Prediction: Market Trends and Investment Outlook for the Emerging Crypto Asset

Introduction: BANANAS31's Market Position and Investment Value

Banana For Scale (BANANAS31) as a meme token on the BNB blockchain, has been making waves in the cryptocurrency market since its inception. As of 2025, BANANAS31's market capitalization has reached $50,850,000, with a circulating supply of 10,000,000,000 tokens and a price hovering around $0.005085. This asset, often referred to as the "banana-themed meme token," is playing an increasingly important role in the meme coin ecosystem and social media-driven crypto trends.

This article will provide a comprehensive analysis of BANANAS31's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BANANAS31 Price History Review and Current Market Status

BANANAS31 Historical Price Evolution

- 2025: Project launch, price reached an all-time high of $0.076 on July 11

- 2025: Market correction, price dropped to an all-time low of $0.0006898 on February 3

- 2025: Recovery phase, price stabilized and currently trades at $0.005085

BANANAS31 Current Market Situation

BANANAS31 is currently trading at $0.005085, with a market capitalization of $50,850,000. The token has experienced a slight increase of 0.23% in the past 24 hours, but shows a decline of 3.93% over the past week and a significant drop of 26.87% in the last 30 days. However, BANANAS31 has demonstrated remarkable growth over the past year, with a staggering 1501.39% increase.

The token's 24-hour trading volume stands at $151,509.55, indicating moderate market activity. With a circulating supply equal to its total supply of 10 billion tokens, BANANAS31 has a fully diluted market cap of $50,850,000. The project currently ranks 669th in the overall cryptocurrency market, with a market dominance of 0.0012%.

Click to view the current BANANAS31 market price

Here's the formatted output based on your request:

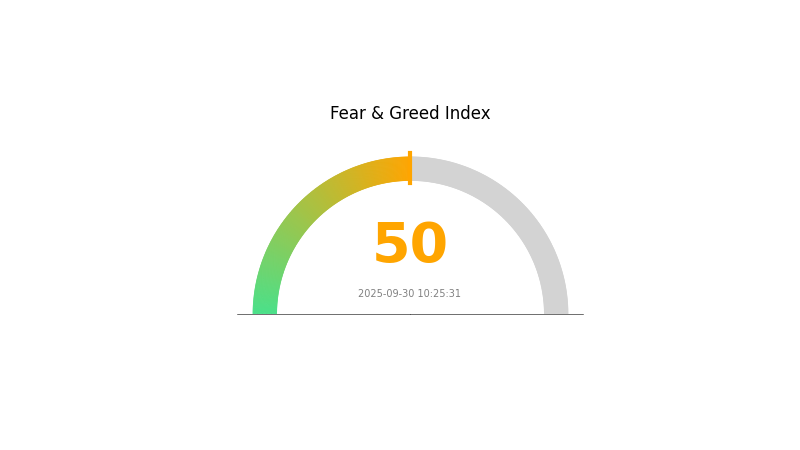

BANANAS31 Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment has stabilized, with the Fear and Greed Index reaching a neutral 50. This balanced state suggests investors are neither overly fearful nor excessively greedy. While the market appears stable, traders should remain vigilant as neutral sentiment can quickly shift. Consider diversifying your portfolio and staying informed about market trends. Gate.com offers a range of tools to help you navigate these market conditions effectively.

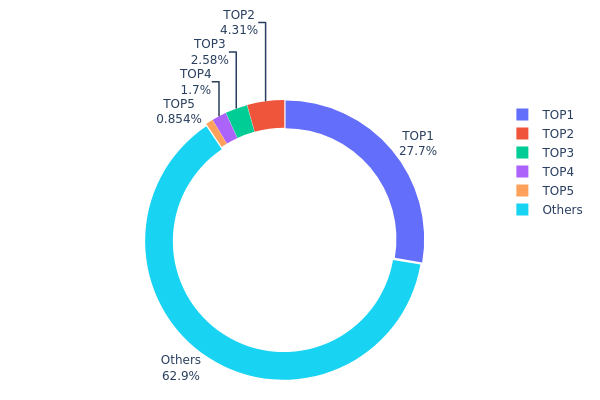

BANANAS31 Holdings Distribution

The address holdings distribution data for BANANAS31 reveals a moderate level of concentration. The top address holds 27.70% of the total supply, which is significant but not overwhelmingly dominant. The next four largest holders collectively account for 9.42% of the supply, indicating a degree of decentralization among major stakeholders.

Notably, 62.88% of BANANAS31 tokens are distributed among numerous smaller holders, suggesting a fairly wide distribution beyond the top addresses. This distribution pattern implies a balance between large stakeholders and a broader community of holders, which could contribute to market stability and reduce the risk of price manipulation by any single entity.

However, the presence of a single address holding over a quarter of the supply warrants attention, as it could potentially influence market dynamics if large transactions were to occur. Overall, the current distribution reflects a moderately decentralized structure, which may support long-term market health and resistance to extreme volatility.

Click to view current BANANAS31 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 2770000.00K | 27.70% |

| 2 | 0x7f51...32041d | 431091.25K | 4.31% |

| 3 | 0x77b2...cfda43 | 257927.14K | 2.57% |

| 4 | 0xc882...84f071 | 169668.71K | 1.69% |

| 5 | 0x8894...e2d4e3 | 85371.56K | 0.85% |

| - | Others | 6285941.33K | 62.88% |

II. Key Factors Affecting BANANAS31's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions' holdings have a significant impact on BANANAS31's price.

- Corporate Adoption: The adoption of BANANAS31 by well-known enterprises could potentially influence its market value.

- National Policies: Regulatory attitudes towards meme coins globally may affect BANANAS31's development and price.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions and overall monetary policy stance could influence BANANAS31's price movements.

- Geopolitical Factors: International situations and policy changes may impact the broader crypto market, including BANANAS31.

Technological Development and Ecosystem Building

- Ecosystem Applications: The potential integration of NFTs and DeFi into the BANANAS31 ecosystem could drive long-term growth and price appreciation.

- User Activity: The level of user engagement and activity within the BANANAS31 network significantly affects its price.

III. BANANAS31 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00472 - $0.00507

- Neutral prediction: $0.00507 - $0.00568

- Optimistic prediction: $0.00568 - $0.00629 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00473 - $0.00804

- 2028: $0.00539 - $0.00872

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00624 - $0.00948 (assuming steady market growth)

- Optimistic scenario: $0.00948 - $0.01107 (assuming strong market performance)

- Transformative scenario: $0.01107 - $0.0128 (assuming exceptional market conditions)

- 2030-12-31: BANANAS31 $0.00948 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00629 | 0.00507 | 0.00472 | 0 |

| 2026 | 0.00659 | 0.00568 | 0.00455 | 11 |

| 2027 | 0.00804 | 0.00614 | 0.00473 | 20 |

| 2028 | 0.00872 | 0.00709 | 0.00539 | 39 |

| 2029 | 0.01107 | 0.0079 | 0.00624 | 55 |

| 2030 | 0.0128 | 0.00948 | 0.00607 | 86 |

IV. BANANAS31 Professional Investment Strategies and Risk Management

BANANAS31 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for speculation

- Operation suggestions:

- Allocate only a small portion of your portfolio to meme tokens like BANANAS31

- Dollar-cost average into positions over time

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Track short-term and long-term trends

- Key points for swing trading:

- Monitor social media sentiment and meme trends

- Set strict stop-loss orders to manage downside risk

BANANAS31 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0-1%

- Aggressive investors: 1-3%

- Professional investors: 3-5%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for BANANAS31

BANANAS31 Market Risks

- High volatility: Meme tokens are subject to extreme price swings

- Liquidity risk: Trading volume may decrease suddenly, impacting ability to exit positions

- Sentiment-driven: Price heavily influenced by social media trends and community sentiment

BANANAS31 Regulatory Risks

- Increased scrutiny: Regulators may target meme tokens for investor protection

- Compliance issues: Potential for future regulatory actions against the project

- Exchange delisting: Risk of being removed from trading platforms due to regulatory concerns

BANANAS31 Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Blockchain congestion: High network fees or slow transactions during peak demand

- Wallet security: Risk of theft or loss if proper security measures are not followed

VI. Conclusion and Action Recommendations

BANANAS31 Investment Value Assessment

BANANAS31 is a high-risk, speculative investment with potential for significant short-term gains but limited long-term value proposition. Its price is largely driven by community engagement and meme trends rather than fundamental utility.

BANANAS31 Investment Recommendations

✅ Beginners: Avoid or limit exposure to a very small percentage of your portfolio ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with extreme caution, potentially as part of a diversified crypto portfolio

BANANAS31 Trading Participation Methods

- Spot trading: Buy and sell BANANAS31 tokens on Gate.com

- Limit orders: Set target entry and exit prices to manage risk

- Social trading: Follow experienced traders on Gate.com's copy trading platform

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will BANANAS31 go up again?

Yes, BANANAS31 is likely to continue its upward trend. With a recent 240% surge and strong bullish sentiment, further price increases are expected.

Is BANANAS31 meme coin?

Yes, BANANAS31 is a meme coin on the BNB Chain. It's inspired by the 'Banana for Scale' meme and uses AI technology.

How much is banana a31?

As of 2025-09-30, Banana A31 is priced at $0.0051458, trading between $0.004959 and $0.0051819 in the last 24 hours.

Is banana a good crypto?

Banana crypto shows potential but remains speculative. Its low market cap and limited trading activity suggest high risk and volatility. Investors should research thoroughly before considering it.

Is cheems (CHEEMS) a good investment?: Analyzing the potential and risks of the meme-inspired cryptocurrency

2025 LKY Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 BEFE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ANDYETH Price Prediction: Bullish Outlook Amid Blockchain Advancements and Market Expansion

Is Simons Cat (CAT) a good investment?: A Comprehensive Analysis of Price Trends, Market Potential, and Risk Factors

2025 TSTBSC Price Prediction: Expert Analysis and Future Market Outlook for Token Growth

What are the key differences between leading cryptocurrency exchange competitors in 2025?

What is SOPH token and how does Sophon's ZK Stack technology work for consumer applications?

How Active Is LITKEY Community and Ecosystem With 1.66 Million Wallets and 70+ DApps?

Unraveling the Origin of Bitcoin's Name: A Fascinating Journey

Guide to Investing in Feline-Themed Digital Assets