2025 BADGER Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of BADGER

BADGER (BADGER) serves as the ERC-20 governance token of Badger DAO, a decentralized autonomous organization dedicated to bridging Bitcoin and decentralized finance (DeFi). Since its inception in 2020, BADGER has established itself as a key infrastructure token within the Bitcoin-focused DeFi ecosystem. As of December 2025, BADGER maintains a market capitalization of approximately $11.06 million, with a circulating supply of around 19.93 million tokens out of a total supply of 21 million, trading at $0.5265 per token. This governance token, recognized for its multi-functional utility in the DeFi landscape, continues to play an increasingly important role in enabling decentralized decision-making, liquidity mining incentives, and Bitcoin-native yield strategies.

This article provides a comprehensive analysis of BADGER's price trajectory and market dynamics, integrating historical performance patterns, supply-demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the 2025-2030 period.

I. BADGER Price Historical Review and Current Market Status

BADGER Historical Price Evolution

- February 2021: BADGER reached its all-time high (ATH) of $89.08, marking the peak of its initial bull run following the protocol's launch.

- December 2025: BADGER hit its all-time low (ATL) of $0.512985 on December 19, 2025, reflecting significant long-term depreciation.

- One-Year Performance: Over the past year, BADGER has experienced a substantial decline of -84.67%, demonstrating severe downward pressure on the token's valuation.

BADGER Current Market Status

As of December 22, 2025, BADGER is trading at $0.5265, with a 24-hour trading volume of $28,832.41. The token exhibits minimal price movement over the last 24 hours with a -0.07% change. Over the 1-hour timeframe, BADGER shows a slight decline of -0.15%, while the 7-day period reflects a -4.27% decrease and the 30-day performance stands at -3.96%.

The fully diluted market capitalization (FDV) is valued at $11,056,500, with a circulating market cap of $10,493,497.71. The token's circulating supply represents 94.91% of its total supply, with 19,930,669.91 BADGER in circulation out of a maximum supply cap of 21,000,000 tokens. BADGER maintains a market dominance of 0.00034%, ranking 1,143st by market capitalization. The token is held by 31,286 unique addresses and is actively traded on 9 exchanges.

Market sentiment indicators suggest extreme fear conditions (VIX reading of 20 as of December 21, 2025), indicating heightened market anxiety and risk-averse sentiment among investors.

Check the current BADGER market price

BADGER Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market anxiety and significant selling pressure across digital assets. Investors are showing strong risk-averse behavior, creating potential opportunities for contrarian strategies. During periods of extreme fear, historically resilient projects like BADGER may present attractive entry points for long-term investors. However, caution is advised as market volatility remains elevated. Monitor key support levels and consider your risk tolerance before making investment decisions on Gate.com.

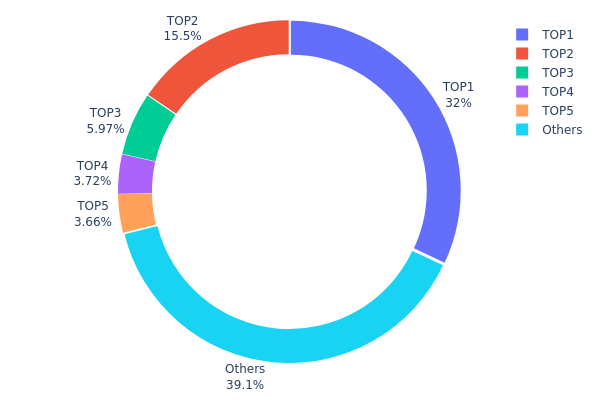

BADGER Holdings Distribution

The address holdings distribution map illustrates the concentration of BADGER tokens across the blockchain network by tracking the top wallet addresses and their respective token quantities. This metric serves as a critical indicator of the asset's decentralization level, market structure integrity, and vulnerability to potential price manipulation. By analyzing how token supply is distributed among different addresses, market participants can assess the degree of wealth concentration and evaluate the stability of the underlying network ecosystem.

BADGER exhibits notable concentration characteristics in its current holder distribution. The top five addresses collectively control approximately 60.83% of the circulating token supply, with the leading address alone accounting for 31.98% of all holdings. This concentration level represents a significant centralization point, particularly driven by the dominant position of the first address, which holds more than double the amount of the second-largest holder. While the remaining 39.17% of tokens distributed among other addresses provides some degree of decentralization, the pronounced weight of the top holders establishes a meaningful imbalance in token ownership structure.

The concentration pattern observed in BADGER's address distribution presents considerable implications for market dynamics. High ownership concentration among a limited number of addresses increases the potential for coordinated actions that could influence price volatility and market direction. The dependency on a few major holders creates scenarios where large token movements could trigger significant price fluctuations, as the market may lack sufficient liquidity to absorb substantial sell pressures from these dominant positions. Furthermore, such distribution patterns typically correlate with reduced governance decentralization and heightened counterparty risk, as decisions affecting the token's ecosystem become increasingly influenced by a concentrated holder base rather than distributed community consensus.

Click to view current BADGER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe15e...5da91b | 6717.53K | 31.98% |

| 2 | 0x36cc...f2ffc6 | 3259.94K | 15.52% |

| 3 | 0x5be2...412251 | 1254.54K | 5.97% |

| 4 | 0xa9d1...1d3e43 | 780.83K | 3.71% |

| 5 | 0xd0a7...158e9e | 768.53K | 3.65% |

| - | Others | 8218.63K | 39.17% |

II. Core Factors Affecting BADGER's Future Price

Macro Economic Environment

-

Market Sentiment Impact: Investor emotions and confidence directly influence BADGER price movements. Market sentiment serves as a primary driver of short-term price fluctuations in the crypto asset space.

-

Regulatory Policy Impact: Regulatory developments and policy changes significantly affect BADGER's valuation. Regulatory uncertainty and evolving compliance frameworks can create substantial price volatility as market participants reassess risk factors.

-

Market Volatility Characteristics: The cryptocurrency market exhibits high volatility by nature. BADGER's price can experience significant fluctuations driven by various external factors including market conditions, investor sentiment, and technological advancements.

Technology Development and Ecosystem Building

- Bitcoin Integration in DeFi: BADGER possesses potential to bring more Bitcoin liquidity into the DeFi ecosystem, helping unlock BTC trapped on the Ethereum network. This technological positioning could drive long-term value creation through ecosystem expansion and improved capital efficiency.

Note: The provided source materials contained limited specific information regarding BADGER's supply mechanisms, institutional holdings, enterprise adoption, national policies, and specific technical upgrades. Sections without substantive data from reliable sources have been excluded as per analysis requirements.

Three、2025-2030 BADGER Price Forecast

2025 Outlook

- Conservative Forecast: $0.4475 - $0.5265

- Base Case Forecast: $0.5265 - $0.6950

- Optimistic Forecast: $0.6950 (requiring sustained ecosystem adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth potential driven by ecosystem development and DeFi integration improvements.

- Price Range Forecast:

- 2026: $0.5313 - $0.7390 (16% upside potential)

- 2027: $0.5062 - $0.8841 (28% upside potential)

- 2028: $0.4989 - $1.1614 (48% upside potential)

- Key Catalysts: Protocol upgrades, governance participation expansion, strategic partnerships within the decentralized finance sector, and increased institutional interest in governance tokens.

2029-2030 Long-term Outlook

- Base Scenario: $0.5143 - $1.3780 by 2029, and $0.6928 - $1.6792 by 2030 (assuming stable market conditions and continuous protocol evolution)

- Optimistic Scenario: $1.3780 - $1.6792 (2029-2030, contingent upon mainstream DeFi adoption and significant expansion of tokenized assets)

- Transformative Scenario: $1.6792+ (assuming breakthrough developments in decentralized governance frameworks and exponential growth in protocol revenue streams)

- 2030-12-31: BADGER reaches $1.6792 as average price prediction (representing 123% cumulative gains from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.69498 | 0.5265 | 0.44753 | 0 |

| 2026 | 0.739 | 0.61074 | 0.53134 | 16 |

| 2027 | 0.88408 | 0.67487 | 0.50615 | 28 |

| 2028 | 1.16141 | 0.77947 | 0.49886 | 48 |

| 2029 | 1.37803 | 0.97044 | 0.51433 | 84 |

| 2030 | 1.67916 | 1.17424 | 0.6928 | 123 |

BADGER DAO Investment Strategy and Risk Management Report

IV. BADGER Professional Investment Strategy and Risk Management

BADGER Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: DeFi enthusiasts and Bitcoin ecosystem believers seeking yield optimization

- Operational Recommendations:

- Allocate BADGER tokens to Sett vaults for sustained yield farming rewards, with longer holding periods yielding higher reward coefficients

- Participate in protocol governance by holding BADGER to vote on marketing decisions, protocol parameters, and token supply adjustments

- Reinvest earned BADGER rewards to compound gains over extended timeframes (12+ months)

- Monitor Bitcoin ecosystem developments and DeFi protocol innovations that may impact Badger DAO's competitive position

(2) Active Trading Strategy

- Price Action Analysis:

- Track the 24-hour price range ($0.5262 - $0.6134) for intraday volatility opportunities

- Monitor historical price trends: current decline of -4.27% over 7 days and -3.96% over 30 days indicate downward momentum

- Note the significant year-over-year decline of -84.67%, reflecting broader market sentiment

BADGER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of cryptocurrency portfolio

- Active Investors: 5-8% of cryptocurrency portfolio

- Professional Investors: 10-15% of cryptocurrency portfolio (with additional hedging strategies)

(2) Risk Hedging Approaches

- Staking Diversification: Distribute holdings across multiple Badger DAO vault strategies rather than concentrating in single pools to reduce smart contract risk exposure

- Dollar-Cost Averaging (DCA): Execute periodic purchases at fixed intervals regardless of price movements to reduce entry point risk, particularly relevant given current price volatility

(3) Secure Storage Solutions

- Hot Wallet Management: Use Gate Web3 wallet for active trading and governance participation, enabling convenient access to Badger DAO protocols

- Cold Storage Option: Transfer long-term holdings to secure offline storage solutions for enhanced protection against exchange counterparty risks

- Security Considerations: Enable multi-signature authentication, regularly audit smart contract interactions, verify all transactions on Etherscan before execution, and maintain backup recovery phrases in secure locations

V. BADGER Potential Risks and Challenges

BADGER Market Risks

- Extreme Price Volatility: The token has experienced an 84.67% year-over-year decline from approximately $2.43 to current $0.5265, demonstrating significant downside risk

- Low Trading Volume: Daily volume of $28,832 is relatively modest, which may limit liquidity for large position exits and increase slippage during trades

- Bitcoin Price Dependency: As a protocol focused on Bitcoin DeFi integration, BADGER is highly correlated with Bitcoin price movements; negative BTC sentiment directly impacts protocol adoption and token value

BADGER Regulatory Risks

- Evolving DeFi Regulations: Increasing global regulatory scrutiny on decentralized finance protocols may impose compliance requirements affecting Badger DAO's operations and token utility

- Governance Token Classification: Regulatory authorities may classify BADGER as a security in certain jurisdictions, restricting trading and holding activities for affected users

- Smart Contract Regulatory Exposure: Automated market operations and yield farming mechanisms may face regulatory challenges as governments establish clearer DeFi guidelines

BADGER Technology Risks

- Smart Contract Vulnerability: Complex vault strategies and automated yield optimization mechanisms introduce potential security vulnerabilities; any exploits could result in significant user fund losses

- Protocol Scalability Challenges: Badger DAO operates on Ethereum Layer 1, facing high transaction costs that may reduce yield attractiveness for smaller positions

- Competition from Emerging Alternatives: New Bitcoin DeFi protocols with superior user experience, lower fees, or enhanced security features could attract liquidity away from Badger DAO

VI. Conclusions and Action Recommendations

BADGER Investment Value Assessment

Badger DAO represents a specialized investment opportunity within the Bitcoin DeFi ecosystem, offering genuine utility through yield aggregation and governance participation. However, the 84.67% year-over-year decline, modest trading volume, and strong correlation with Bitcoin price movements present substantial risks. The protocol's focused positioning on Bitcoin integration is both a strength (clear market differentiation) and a constraint (limited addressable market during bear cycles). Current valuation reflects significant market pessimism, which could represent opportunity or validate fundamental concerns depending on Bitcoin ecosystem adoption trajectories.

BADGER Investment Recommendations

✅ Beginners: Start with small DCA allocations (0.5-1% of crypto portfolio) through Gate.com to understand protocol mechanics; do not engage in active trading until comfortable with Ethereum transaction costs and vault mechanics

✅ Experienced Investors: Consider 3-5% portfolio allocation with active Sett vault participation; implement stop-loss orders at 15-20% below entry points and rotate positions based on relative yield opportunities across vault strategies

✅ Institutional Investors: Evaluate 10-15% positions with comprehensive hedging strategies; conduct thorough smart contract audits, establish governance participation protocols, and maintain diversified entry points across multiple vault strategies

BADGER Trading Participation Methods

- Gate.com Direct Trading: Access BADGER trading pairs directly through Gate.com's spot trading interface for immediate market entry and exit with competitive spreads

- Vault Participation: Deposit BADGER, BADGER/WBTC LP, or related tokens into Badger DAO's Sett product to earn yield rewards and governance incentives

- Governance Staking: Lock BADGER tokens for governance voting rights on protocol parameter adjustments and strategic decisions affecting platform direction

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for BADGER coin in 2030?

Based on current market analysis, BADGER coin is predicted to reach approximately $0.000012 by 2030. However, price predictions vary depending on market conditions and should be verified with updated sources.

Is BADGER a meme coin?

Yes, BADGER is a meme coin inspired by the iconic "Badger Badger Badger" internet meme. It combines nostalgic internet culture with cryptocurrency technology, making it a community-driven meme token project.

What is Badger DAO and what does BADGER token do?

Badger DAO is a decentralized organization enabling Bitcoin to serve as collateral in DeFi applications. BADGER token provides governance rights and rewards to ecosystem participants.

What are the main risks and factors affecting BADGER price?

BADGER price is influenced by market volatility, regulatory changes, project development progress, investor sentiment, and broader cryptocurrency market trends. Trading volume and liquidity also significantly impact price fluctuations.

How does BADGER compare to other DeFi tokens?

BADGER stands out with its focus on yield farming and Bitcoin-backed assets. Unlike many DeFi tokens, BADGER offers unique exposure to decentralized finance through innovative tokenomics and governance, delivering stronger utility and community-driven value appreciation compared to competitors.

2025 TBCPrice Prediction: Analyzing Market Trends and Future Valuation of TBC in a Changing Crypto Landscape

2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

Is HTX DAO (HTX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

How Does WLFI's On-Chain Data Analysis Reveal Its Initial Circulating Supply?

2025 UMA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is DAO Maker (DAO) a Good Investment?: Analyzing the Potential and Risks in the Current Crypto Market

2025 GEAR Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 IDEX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 NBLU Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 JUV Price Prediction: Expert Analysis and Market Outlook for Juventus Fan Token

Anoma: A Blockchain Protocol Innovating Web3 Development