2025 ANDYETH Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ANDYETH's Market Position and Investment Value

Andy (ANDYETH) is a memecoin that positions itself as Pepe's lifelong best friend, aiming to join Pepe as one of the top memecoins and dominate the crypto memecoin market. Since its launch in March 2024, Andy has established itself within the memecoin ecosystem. As of December 22, 2025, Andy's market capitalization stands at approximately $8.95 million, with a circulating supply of 1 trillion tokens at a price of $0.000008949. This distinctive asset has gained recognition among cryptocurrency enthusiasts and memecoin investors.

This article will provide a comprehensive analysis of ANDYETH's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors interested in this emerging memecoin asset.

ANDYETH Price History Review and Current Market Status

ANDYETH Historical Price Evolution

-

December 2024: Launch phase, ANDYETH reached its all-time high of $0.00036813 on December 12, 2024, marking the peak of initial market enthusiasm.

-

December 2025: Correction period, price declined significantly from the all-time high to the current level, with a year-to-date decline of -95.99%.

ANDYETH Current Market Situation

As of December 22, 2025, ANDYETH is trading at $0.000008949 with a market capitalization of $8,949,000. The token has experienced notable volatility recently:

-

Short-term performance: In the last 24 hours, ANDYETH has gained 2.65%, rising from $0.000008521 to a 24-hour high of $0.000009022. The 1-hour change shows a 2.1% increase.

-

Medium-term trend: Over the 7-day period, the token has declined 18.56%, reflecting ongoing downward pressure in the market.

-

Longer-term perspective: The 30-day performance shows a -25.11% decrease, while the yearly performance demonstrates a substantial -95.99% decline from its all-time high.

-

Market metrics: The token maintains a fully diluted valuation equal to its market cap at $8,949,000, with 100% of the 1 trillion total supply in circulation across 25,246 token holders. The 24-hour trading volume stands at $21,214.45.

-

Market positioning: ANDYETH ranks 1,226 by market capitalization with a market dominance of 0.00027%.

Click to view current ANDYETH market price

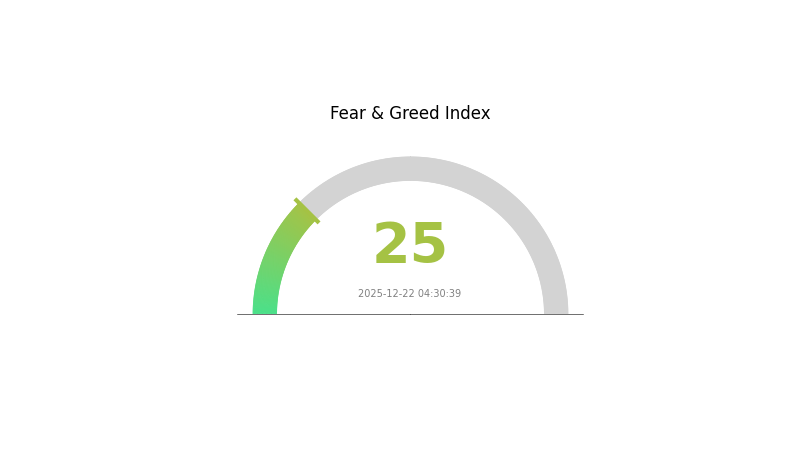

ANDYETH Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This exceptionally low reading indicates intense market pessimism and widespread risk aversion among investors. During such periods, market volatility tends to be elevated, and sentiment-driven selling pressure dominates. However, extreme fear often presents contrarian trading opportunities for experienced investors. Monitor key support levels closely and consider your risk tolerance before making any trading decisions. Stay informed through Gate.com's comprehensive market analysis tools.

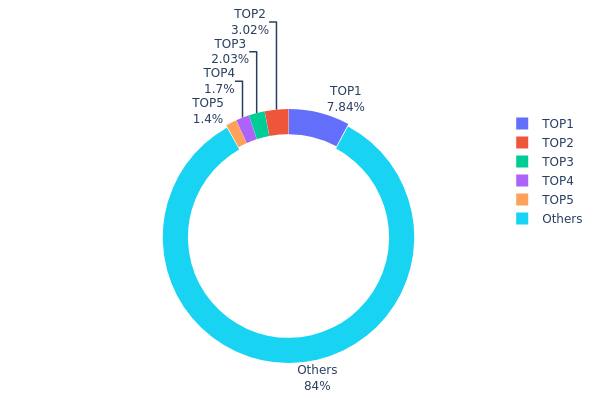

ANDYETH Holdings Distribution

The holdings distribution chart illustrates how ANDYETH tokens are allocated across different blockchain addresses, serving as a critical metric for assessing token concentration risk and market structure health. By analyzing the proportion of tokens held by major addresses versus retail holders, this distribution reveals the degree of decentralization and the potential for market manipulation or price volatility driven by whale activity.

Current analysis of ANDYETH's address distribution demonstrates moderate concentration characteristics. The top five addresses collectively hold approximately 15.97% of total token supply, with the largest holder commanding 7.84% of all tokens in circulation. While this level of concentration is notable, it remains below the threshold typically associated with severe centralization risk. The dominant position of the leading address warrants monitoring, though the subsequent decline in holdings among addresses two through five suggests a relatively gradual distribution pattern rather than extreme concentration among a single entity.

The broader market structure reveals that 84.03% of ANDYETH tokens remain distributed among other addresses, indicating a substantially decentralized holder base. This distributed ownership structure enhances the resilience of the network against potential price manipulation attempts by individual large holders. However, the presence of several addresses holding stakes exceeding 1.40% introduces some sensitivity to coordinated whale movements or strategic liquidation events. The current distribution pattern suggests a healthy balance between institutional or strategic holders and the broader community, positioning ANDYETH with relatively strong on-chain structural stability compared to assets exhibiting extreme holder concentration.

Click to view current ANDYETH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa1bf...d1c2c0 | 78400384.87K | 7.84% |

| 2 | 0x126d...1e2ffa | 30177434.89K | 3.01% |

| 3 | 0x9642...2f5d4e | 20271237.59K | 2.02% |

| 4 | 0x52b7...507954 | 17028167.79K | 1.70% |

| 5 | 0x3cc9...aecf18 | 14002198.63K | 1.40% |

| - | Others | 840120576.22K | 84.03% |

II. Core Factors Affecting ANDYETH's Future Price

Market Volatility and Social Sentiment

-

Social Media Influence: As a meme coin, ANDYETH's price experiences significant volatility driven by social media trends and community sentiment. Investor attention and online discussions play a crucial role in price movements.

-

Community Dynamics: The strength and engagement of the ANDYETH community directly impacts market momentum. Positive community sentiment can drive price appreciation, while negative sentiment may trigger sell-offs.

Regulatory Environment

-

Regulatory Risk: The regulatory scrutiny on meme coins continues to intensify. Strengthened regulatory measures targeting meme coins may negatively impact ANDYETH's future development and price trajectory.

-

Policy Uncertainty: Changes in cryptocurrency regulations across different jurisdictions could create additional headwinds for the project.

Competitive Landscape

- Market Competition: ANDYETH faces competitive pressure from other meme coins in the cryptocurrency market. The ability to differentiate and maintain community interest is essential for sustainable growth.

Blockchain Innovation and Ecosystem Development

-

Blockchain Technology Advancement: Progress in blockchain technology and market expansion initiatives have the potential to drive upward price trends for ANDYETH.

-

Ecosystem Growth: Continued development of the project's ecosystem and adoption potential are key factors that could support future price appreciation.

III. 2025-2030 ANDYETH Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.00001

- Neutral Forecast: $0.00001

- Optimistic Forecast: $0.00001 (requires market stabilization and increased adoption)

2027-2028 Mid-term Outlook

- Market Stage Expectation: Potential consolidation phase with gradual accumulation as project fundamentals develop

- Price Range Forecast:

- 2027: $0.00001 - $0.00002 (24% projected growth)

- 2028: $0.00001 - $0.00002 (48% projected growth)

- Key Catalysts: Enhanced ecosystem development, strategic partnerships, increased trading volume on platforms like Gate.com, and growing community engagement

2029-2030 Long-term Outlook

- Base Case: $0.00001 - $0.00002 (assuming steady market conditions and consistent project progress)

- Optimistic Case: $0.00002 (assuming accelerated adoption and favorable market sentiment at 59% growth in 2029)

- Transformational Case: $0.00002 (assuming breakthrough developments and substantial institutional interest by 2030, with cumulative 77% growth potential)

Note: These projections are based on available forecast data and should be treated as analytical reference points. Cryptocurrency markets remain highly volatile, and actual prices may differ significantly from predictions. Investors should conduct independent research and consult financial advisors before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00001 | 0.00001 | 0.00001 | 0 |

| 2026 | 0.00001 | 0.00001 | 0.00001 | 5 |

| 2027 | 0.00002 | 0.00001 | 0.00001 | 24 |

| 2028 | 0.00002 | 0.00001 | 0.00001 | 48 |

| 2029 | 0.00002 | 0.00001 | 0.00001 | 59 |

| 2030 | 0.00002 | 0.00002 | 0.00001 | 77 |

ANDYETH Professional Investment Strategy and Risk Management Report

IV. ANDYETH Professional Investment Strategy and Risk Management

ANDYETH Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Retail investors with medium to long-term outlook, community supporters of meme coin culture, diversification-focused portfolio builders

- Operational recommendations:

- Accumulate during market downturns when price volatility creates entry opportunities

- Set clear profit-taking targets based on technical resistance levels and personal risk tolerance

- Maintain positions through market cycles while monitoring community sentiment and project developments

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Identify key price points (historical high of $0.00036813 and recent low of $0.000008521) to determine entry and exit points

- Volume analysis: Monitor trading volume trends (current 24h volume: $21,214.45) to confirm price movements and identify potential breakouts

- Wave trading key points:

- Capitalize on the 24-hour positive momentum (2.65% gain) while remaining cautious of the 7-day decline (-18.56%)

- Implement strict stop-loss orders given the extreme 1-year decline of -95.99%

ANDYETH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% maximum allocation of total portfolio

- Active investors: 3-5% allocation for higher risk tolerance portfolios

- Professional investors: 5-10% allocation with comprehensive hedging strategies

(2) Risk Hedging Solutions

- Position sizing strategy: Limit individual trade size to preserve capital given meme coin volatility

- Diversification approach: Balance ANDYETH holdings with stable assets and established cryptocurrencies

(3) Secure Storage Solutions

- Hot wallet solution: Gate.com Web3 Wallet for frequent trading and liquidity management

- Cold storage approach: Use secure hardware-based solutions for long-term holdings

- Security precautions: Never share private keys, enable two-factor authentication on all accounts, verify contract addresses before transactions (ANDYETH contract: 0x68bbed6a47194eff1cf514b50ea91895597fc91e on Ethereum)

V. ANDYETH Potential Risks and Challenges

ANDYETH Market Risk

- Extreme price volatility: The coin has experienced a catastrophic -95.99% decline over one year, indicating severe market risk and speculative nature

- Low liquidity depth: With only 6 exchange listings and a relatively small 24-hour trading volume, the token faces liquidity constraints that could impact exit strategies

- Memecoin market saturation: The highly competitive meme coin landscape creates difficulty in maintaining long-term relevance and market share

ANDYETH Regulatory Risk

- Uncertain regulatory classification: Meme coins face unclear regulatory treatment across different jurisdictions, potentially exposing holders to future compliance issues

- Market manipulation concerns: Low-cap meme coins are susceptible to regulatory scrutiny regarding potential pump-and-dump schemes and market manipulation

- Exchange delisting risk: Regulatory crackdowns or compliance failures could result in exchange delistings, limiting trading opportunities

ANDYETH Technical Risk

- Smart contract vulnerabilities: As an ERC-20 token, potential security flaws in the contract code could lead to fund loss or token exploit

- Ethereum network dependency: ANDYETH relies entirely on Ethereum's network security and performance; network congestion or failures directly impact token functionality

- Limited project development: The absence of detailed whitepaper and technical documentation raises concerns about ongoing development and protocol improvements

VI. Conclusion and Action Recommendations

ANDYETH Investment Value Assessment

ANDYETH is a meme coin positioned as Pepe's companion, aiming to capture market share in the highly competitive meme coin segment. While it benefits from community interest and existing exchange listings, the token displays concerning fundamentals: a devastating 95.99% annual decline, relatively small market capitalization of $8.949 million, and concentrated holder base of 25,246 addresses. The recent -25.11% 30-day decline and -18.56% weekly decline suggest ongoing downward pressure. Investors should view ANDYETH as an extremely high-risk, speculative asset suitable only for experienced traders comfortable with potential total loss.

ANDYETH Investment Recommendations

✅ Beginners: Avoid direct investment; if interested in meme coins, allocate only 0.5-1% of portfolio as educational exposure; prioritize understanding market mechanics before committing capital

✅ Experienced traders: Consider tactical positions (1-3% allocation) using strict technical analysis and stop-loss orders; focus on short-term trading opportunities while maintaining disciplined risk management

✅ Institutional investors: Monitor as a market sentiment indicator rather than a core holding; any allocation should be minimal (under 1%) and part of broader meme coin research programs

ANDYETH Trading Participation Methods

- Gate.com platform: Access ANDYETH trading through Gate.com's spot trading markets with competitive liquidity

- Technical analysis approach: Utilize price action trading based on identified support levels ($0.000008521) and resistance levels ($0.00036813)

- Community engagement: Monitor social channels and project developments through official website (https://boysclubandy.com/), Twitter (@andycoinonerc), and Ethereum blockchain explorer tracking

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the value of an Andy coin?

The value of an Andy coin is $0.000157 as of December 22, 2025. It has experienced a 7.61% increase in the last 24 hours with a trading volume of $1,152.74.

What are the risks of investing in Andy Coin?

Andy Coin carries high volatility risk due to market sentiment fluctuations. Limited liquidity and regulatory uncertainty can amplify price swings. Technological changes and project developments may significantly impact token value. Always conduct thorough research before investing.

What factors influence ANDYETH price predictions?

ANDYETH price predictions are influenced by block reward changes, protocol updates, regulatory developments, and market adoption. Trading volume, market sentiment, and macroeconomic trends also significantly impact price movements and future predictions.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

How do exchange inflows and DOT holdings impact Polkadot's liquidity and fund flows in 2025?

What Are Cryptocurrency Compliance and Regulatory Risks: How Do SEC Regulations, Audit Transparency, and KYC/AML Policies Impact Your Crypto Investment in 2025?

How to Compare Cryptocurrency Competitors: Market Share, Performance, and User Adoption Analysis

What are the major security vulnerabilities and smart contract risks facing Hyperliquid (HYPE) in 2025?

What are the key security risks and smart contract vulnerabilities affecting ASTER crypto in 2025?